Adjusting Entries in Accounting: Concepts, Journal Entries, and Financial Impact

Introduction

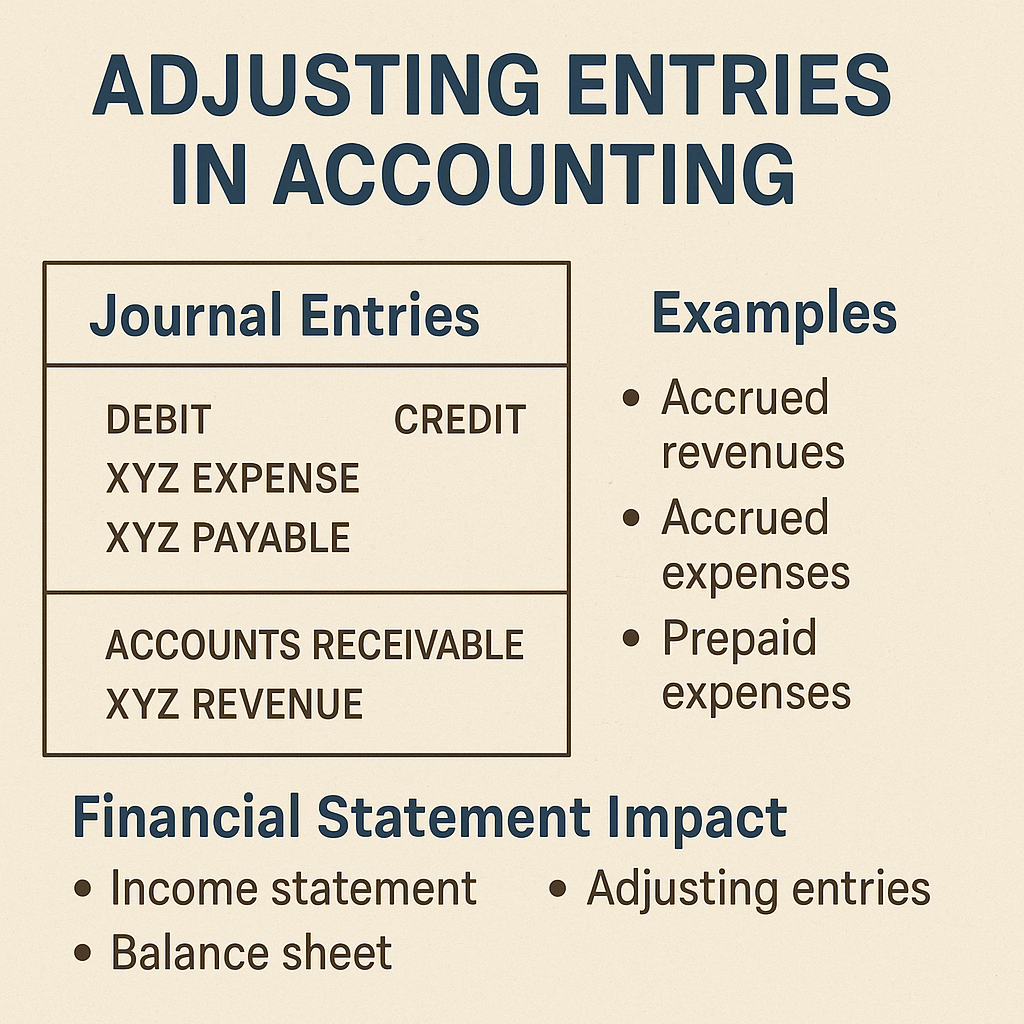

In accounting, adjusting entries are essential at the end of every accounting period. They help ensure that the financial statements reflect the actual financial position and performance of a business as per the accrual basis of accounting.

These adjustments align income and expenses with the correct accounting period. Below is a detailed explanation of each major year-end adjustment, along with journal entries, examples, effects on financial statements, and references to the Golden Rules of Accounting.

Key Adjusting Entries

1. Closing Stock

- Concept: Closing stock refers to the value of unsold goods remaining at the end of the financial year.

- Example: Purchases = ₹10,00,000, Sales = ₹15,00,000, Closing stock = ₹2,00,000

- Journal Entry:

- Closing Stock A/c Dr. 2,00,000

- To Trading A/c 2,00,000

- Effect on Financial Statements:

- Profit & Loss Account: Shown in the Trading Account, reducing the cost of goods sold.

- Balance Sheet: Shown under Current Assets.

- Golden Rule: Real Account – “Debit what comes in”

2. Outstanding Expense

- Concept: These are expenses incurred but not yet paid at the end of the accounting period.

- Example: March salary of ₹30,000 remains unpaid.

- Journal Entry:

- Salary A/c Dr. 30,000

- To Outstanding Salary A/c 30,000

- Effect on Financial Statements:

- Profit & Loss Account: Full salary is charged as expense.

- Balance Sheet: Shown as Current Liability.

- Golden Rule:

- Nominal Account – “Debit all expenses”

- Personal Account – “Credit the giver” (the liability)

3. Prepaid Expense

- Concept: These are payments made in advance for benefits to be received in future periods.

- Example: Insurance of ₹12,000 paid in January for a full year. Only 3 months (₹3,000) are for the current year; ₹9,000 is prepaid.

- Journal Entry:

- Prepaid Insurance A/c Dr. 9,000

- To Insurance A/c 9,000

- Effect on Financial Statements:

- Profit & Loss Account: Only ₹3,000 is charged.

- Balance Sheet: ₹9,000 shown as Current Asset.

- Golden Rule:

- Real Account – “Debit what comes in” (future benefit)

- Nominal Account – “Credit what is not expense for this year”

4. Accrued Income

- Concept: Income that is earned but not yet received as of the end of the period.

- Example: Interest of ₹5,000 earned in March but received in April.

- Journal Entry:

- Accrued Interest A/c Dr. 5,000

- To Interest Income A/c 5,000

- Effect on Financial Statements:

- Profit & Loss Account: ₹5,000 added to income.

- Balance Sheet: ₹5,000 shown as Current Asset.

- Golden Rule:

- Real Account – “Debit what comes in”

- Nominal Account – “Credit all incomes”

5. Interest Accrued and Due

- Concept: Interest expense that has been incurred and is also due for payment.

- Example: ₹15,000 interest on loan is due on 31st March and unpaid.

- Journal Entry:

- Interest A/c Dr. 15,000

- To Interest Accrued and Due A/c 15,000

- Effect on Financial Statements:

- Profit & Loss Account: ₹15,000 shown under Finance Costs.

- Balance Sheet: Shown as Current Liability.

- Golden Rule:

- Nominal Account – “Debit all expenses”

- Personal Account – “Credit the giver”

6. Income Received in Advance

- Concept: Income received for services yet to be rendered in future periods.

- Example: ₹24,000 rent received on 1st March for 12 months. ₹22,000 relates to the next financial year.

- Journal Entry:

- Rent Income A/c Dr. 22,000

- To Rent Received in Advance A/c 22,000

- Effect on Financial Statements:

- Profit & Loss Account: ₹2,000 shown as income.

- Balance Sheet: ₹22,000 shown as Current Liability.

- Golden Rule:

- Nominal Account – “Debit income not earned”

- Personal Account – “Credit the obligation”

7. Depreciation

- Concept: Systematic allocation of the cost of a tangible asset over its useful life.

- Example: Machinery costing ₹5,00,000 with 10% depreciation = ₹50,000

- Journal Entry:

- Depreciation A/c Dr. 50,000

- To Machinery A/c 50,000

- Effect on Financial Statements:

- Profit & Loss Account: Depreciation charged as expense.

- Balance Sheet: Reduces the value of Machinery (Net Book Value).

- Golden Rule:

- Nominal Account – “Debit all expenses”

- Real Account – “Credit what goes out” (asset value)

8. Amortization

- Concept: Similar to depreciation, but for intangible assets.

- Example: Software purchased for ₹1,00,000 amortized over 5 years = ₹20,000 per year.

- Journal Entry:

- Amortization A/c Dr. 20,000

- To Software A/c 20,000

- Effect on Financial Statements:

- Profit & Loss Account: Amortization shown as expense.

- Balance Sheet: Reduces the intangible asset.

- Golden Rule:

- Nominal Account – “Debit all expenses”

- Real Account – “Credit asset reduced”

Summary Table

| Adjustment | Journal Entry | P&L Impact | Balance Sheet Impact |

| Closing Stock | Closing Stock A/c Dr. To Trading A/c | Reduces COGS | Current Asset |

| Outstanding Expense | Expense A/c Dr. To Outstanding Expense A/c | Expense increases | Current Liability |

| Prepaid Expense | Prepaid Expense A/c Dr. To Expense A/c | Expense decreases | Current Asset |

| Accrued Income | Accrued Income A/c Dr. To Income A/c | Income increases | Current Asset |

| Interest Accrued & Due | Interest A/c Dr. To Interest Accrued and Due A/c | Expense increases | Current Liability |

| Income Received in Advance | Income A/c Dr. To Income Received in Advance A/c | Income decreases | Current Liability |

| Depreciation | Depreciation A/c Dr. To Asset A/c | Expense increases | Asset value decreases |

| Amortization | Amortization A/c Dr. To Intangible Asset A/c | Expense increases | Intangible Asset value decreases |

Quiz: Test Your Knowledge

1. What is the journal entry for prepaid rent of ₹5,000?

A. Rent A/c Dr. To Prepaid Rent A/c

B. Prepaid Rent A/c Dr. To Rent A/c

C. Rent A/c Dr. To Cash A/c

D. Prepaid Rent A/c Dr. To Cash A/c

Answer: B

Explanation: Prepaid expense is an asset. We reduce the rent expense by debiting Prepaid Rent and crediting Rent.

2. Depreciation is an example of:

A. Provision

B. Accrued Expense

C. Deferred Income

D. Non-cash Expense

Answer: D

Explanation: Depreciation is a non-cash expense charged to allocate the cost of a tangible asset over its life.

3. Which of the following affects both Trading A/c and Balance Sheet?

A. Depreciation

B. Closing Stock

C. Outstanding Rent

D. Prepaid Insurance

Answer: B

Explanation: Closing stock is credited in Trading A/c and appears under Current Assets in the Balance Sheet.

4. Rent received in advance is shown as:

A. Income in P&L

B. Asset in Balance Sheet

C. Liability in Balance Sheet

D. None of the above

Answer: C

Explanation: Income received in advance is unearned, hence a liability until service is rendered.

5. Accrued income is recorded using which type of account?

A. Personal

B. Real

C. Nominal

D. Mixed

Answer: B

Explanation: Accrued income is a receivable, so it’s treated as a Real account – an asset to the business.

Conclusion

Adjusting entries form the backbone of accurate financial reporting. Understanding these adjustments helps maintain compliance with accounting principles and prepares a business for audits, tax filing, and decision-making. Each entry aligns with the Golden Rules of Accounting, ensuring clarity, consistency, and correctness.