ITR Form 4 Filing Guide: Comprehensive Review

This study guide is designed to help you review and consolidate your understanding of filing ITR Form 4 for FY 2024-25 (Assessment Year 2025-26) online in India.

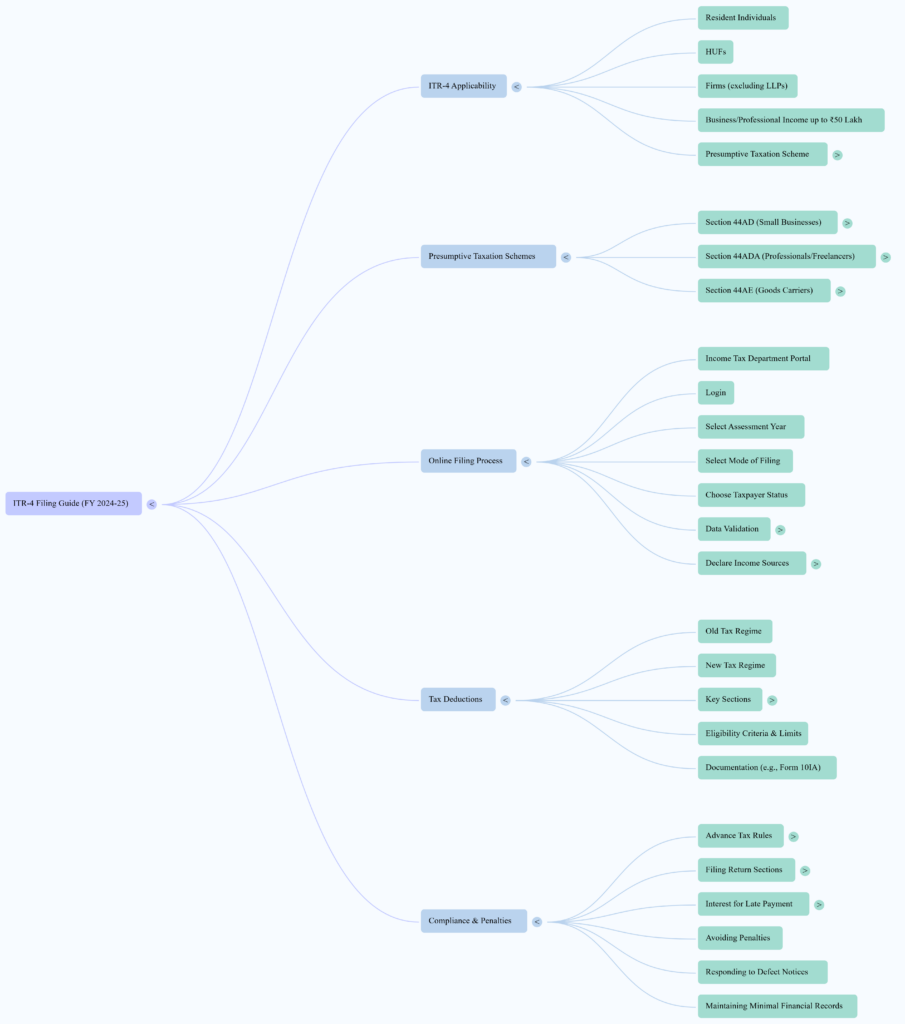

Section 1: Applicability and Presumptive Taxation Schemes

- ITR-4 Applicability: Who is eligible to file ITR-4? What are the income and turnover limits for applicability?

- Presumptive Taxation Explained:What is the core principle of presumptive taxation?

- How does it simplify compliance for small taxpayers?

- What is the purpose of not requiring detailed books of accounts under these schemes?

- Sections 44AD, 44ADA, and 44AE:Section 44AD (Small Businesses):What is the presumed income percentage for general turnover?

- How does digital transaction usage affect the presumed income percentage?

- What are the turnover limits for this section (including extensions)?

- Section 44ADA (Professionals/Freelancers):What is the presumed income percentage for gross receipts?

- What are the turnover limits for this section (including extensions)?

- How does digital transaction usage affect the turnover limit?

- Section 44AE (Goods Carriers): How is income determined under this section?

- Advance Tax for Presumptive Taxpayers: What are the specific rules for advance tax payment for those under presumptive taxation?

Section 2: Online Filing Process and Data Verification

- Step-by-Step Filing Process: Outline the general steps involved in filing ITR-4 online through the Income Tax Department’s portal.

- Data Verification Importance:Why is it crucial to verify and validate pre-filled data?

- Which specific forms/sources should taxpayers use for cross-checking pre-filled information?

- What action should be taken if discrepancies are found in pre-filled data?

- Income Declaration: Identify the various sources of income that need to be declared in ITR-4.

- Reconciliation: Why is reconciling books of accounts with turnover figures from the GST portal essential?

Section 3: Tax Deductions and Regimes

- Old vs. New Tax Regimes:What are the key differences between the old and new tax regimes regarding deductions?

- What form allows taxpayers to switch between regimes?

- What factors should a taxpayer consider when deciding on a tax regime?

- Common Deductions (Old Regime): For each of the following sections, understand its purpose, general eligibility, and what it covers:

- Section 80C

- Section 24B

- Section 80D, 80DD, 80DDB (focus on health/disability)

- Section 80E

- Section 80G

- Section 80GG

- Sections 80TTA/80TTB

- Documentation Requirements: Why is maintaining correct documentation important for claiming deductions? Provide examples of necessary documents for health/disability-related deductions.

Section 4: Return Types, Penalties, and Compliance

- Types of Returns: Explain the purpose and applicability of the following filing sections:

- Section 139(1)

- Section 139(4)

- Section 139(5)

- Section 139(9)

- Consequences of Non-Compliance:What are the implications of late payment of advance tax?

- Identify the sections related to interest for late tax payments.

- How can taxpayers avoid penalties?

- Defect Notices: How should taxpayers respond to defect notices?

- Maintaining Records: Why is it advisable to maintain minimal financial records even when exempt from detailed bookkeeping under presumptive schemes?

Quiz

Answer each question in 2-3 sentences.

- For whom is ITR Form 4 primarily applicable, and what is the general income limit for its use?

- Explain the primary benefit of the presumptive taxation scheme for small businesses and professionals.

- Under Section 44AD, what is the presumed income percentage if a business receives more than 95% of its payments digitally?

- What is the main difference in advance tax payment rules for presumptive taxpayers compared to others?

- Why is it crucial to cross-verify pre-filled data in the online ITR-4 form with sources like Form 26AS, AIS, and TIS?

- List two significant tax deductions available under the old tax regime that are generally not available under the new tax regime.

- What specific documentation is highlighted as important for claiming health and disability-related deductions under Sections 80D, 80DD, and 80DDB?

- Briefly explain the purpose of filing a return under Section 139(4) and how it differs from Section 139(1).

- Identify two specific sections related to interest levied for late payment of advance tax.

- Why is reconciling business turnover figures between books of accounts and GST data important for ITR-4 filing?

Quiz Answer Key

- ITR Form 4 is primarily applicable for resident Individuals, HUFs, and Firms (excluding LLPs) with business or professional income up to ₹50 lakh. Their income must be computed under the presumptive taxation scheme.

- The primary benefit of the presumptive taxation scheme is that it simplifies compliance by allowing taxpayers to declare income on a presumed basis, thereby reducing the burden of maintaining detailed books of accounts. This saves time and effort for small taxpayers.

- Under Section 44AD, if a business receives more than 95% of its turnover or gross receipts through digital transactions, the presumed income is lowered to 6% of the turnover. This encourages the adoption of digital payment methods.

- Presumptive taxpayers are subject to a simplified advance tax rule where they only need to pay one installment by March 15 of the financial year. This differs from other taxpayers who typically pay in four installments throughout the year.

- It is crucial to cross-verify pre-filled data to ensure accuracy and prevent discrepancies, which could lead to notices from the Income Tax Department. This validation helps in reporting correct income and deductions, avoiding future complications.

- Two significant tax deductions available under the old tax regime but limited or unavailable in the new regime are Section 80C (for investments, life insurance, PPF, etc.) and Section 24B (for interest on housing loans). The new regime offers lower slab rates but fewer deductions.

- For claiming health and disability-related deductions under Sections 80D, 80DD, and 80DDB, correct documentation such as prescriptions from doctors and approved certificates from medical authorities is highlighted as important. This ensures eligibility and proper claim.

- Section 139(4) is for filing a belated return, meaning a return filed after the original due date but before December 31st of the assessment year. Section 139(1) refers to filing an on-time return, which is submitted by the original due date.

- The two specific sections related to interest levied for late payment of advance tax are Section 234B (for default in paying advance tax or paying less than 90% of the assessed tax) and Section 234C (for deferment of advance tax installments).

- Reconciling business turnover figures between books of accounts and GST data is important to ensure consistency and accuracy in reported income. This cross-verification helps prevent discrepancies that could lead to notices or tax adjustments from the Income Tax Department.

Essay Format Questions

- Compare and contrast the Old Tax Regime and the New Tax Regime in India, specifically focusing on their approach to tax deductions and how a taxpayer might decide which regime is more suitable for their financial profile.

- Analyze the role of presumptive taxation schemes (Sections 44AD, 44ADA, and 44AE) in simplifying tax compliance for small businesses and professionals in India. Discuss both the advantages and potential limitations or considerations for taxpayers utilizing these schemes.

- Describe the comprehensive online filing process for ITR-4, emphasizing the critical steps involving data verification and reconciliation with external sources like Form 26AS, AIS, TIS, and GST portal data. Explain why each of these verification steps is crucial for accurate filing.

- Discuss the various types of income tax returns (e.g., on-time, belated, revised, defective) and the implications of filing under each section. Furthermore, elaborate on the financial consequences, such as interest under Sections 234A, 234B, and 234C, for non-compliance with tax payment and filing timelines.

- Beyond the primary purpose of filing a tax return, explain why maintaining even minimal financial records is advised for taxpayers under presumptive schemes, despite not being required to keep detailed books of accounts. Consider the broader implications for financial management and future needs.

Glossary of Key Terms

- Assessment Year (AY): The year immediately following the Financial Year, in which the income earned in the Financial Year is assessed for tax. For FY 2024-25, the AY is 2025-26.

- Advance Tax: Income tax paid in advance, in installments, rather than in a lump sum at the end of the financial year. Presumptive taxpayers have specific rules for this.

- Annual Information Statement (AIS): A comprehensive statement of financial transactions made by a taxpayer in a financial year, provided by the Income Tax Department.

- Belated Return (Section 139(4)): An income tax return filed after the original due date but within the timeline specified (currently up to December 31st of the assessment year).

- Defect Notice (Section 139(9)): A notice issued by the Income Tax Department when a filed return is incomplete or contains errors, requiring the taxpayer to rectify the defects.

- Financial Year (FY): The period from April 1st to March 31st during which income is earned.

- Form 10IA: A form required for claiming certain deductions, specifically related to the New Tax Regime or switching between regimes.

- Form 26AS: An annual consolidated statement summarizing tax deducted at source (TDS), tax collected at source (TCS), advance tax paid, and self-assessment tax paid by a taxpayer.

- Hindu Undivided Family (HUF): A separate entity for tax purposes in India, consisting of all persons lineally descended from a common ancestor.

- Income Tax Return (ITR): A form that taxpayers use to declare their total income, deductions, and taxes paid to the Income Tax Department.

- Limited Liability Partnership (LLP): A hybrid business entity that offers the benefits of both a partnership and a corporation. LLPs are excluded from filing ITR-4.

- New Tax Regime: An optional tax regime introduced in India offering lower tax slab rates but with limited or no deductions and exemptions.

- Old Tax Regime: The traditional tax regime in India that allows taxpayers to claim various deductions and exemptions (e.g., under Section 80C, 80D, 24B) to reduce their taxable income.

- Presumptive Taxation Scheme: A simplified tax scheme under specific sections (e.g., 44AD, 44ADA, 44AE) that allows eligible taxpayers to declare income at a presumed rate, based on turnover or gross receipts, without maintaining detailed books of accounts.

- Revised Return (Section 139(5)): An income tax return filed to correct mistakes or omissions in an already submitted original or belated return.

- Tax Information Summary (TIS): A summary of information related to a taxpayer’s financial transactions available on the Income Tax portal, often more comprehensive than AIS.

- Turnover: The total sales or gross receipts of a business during a specific period.

- Section 24B: Allows deduction for interest paid on housing loans.

- Section 44AD: Presumptive taxation scheme for small businesses with turnover up to specified limits, allowing income declaration at 8% or 6% of turnover.

- Section 44ADA: Presumptive taxation scheme for specified professionals with gross receipts up to specified limits, allowing income declaration at 50% of gross receipts.

- Section 44AE: Presumptive taxation scheme for businesses involved in goods carriage, based on per tonnage rates.

- Section 80C: Allows deduction for various investments and expenses like life insurance premiums, provident fund contributions, principal repayment of housing loans, etc.

- Section 80D: Allows deduction for health insurance premiums.

- Section 80DD: Allows deduction for medical treatment/maintenance expenses for a disabled dependent.

- Section 80DDB: Allows deduction for medical treatment expenses for specified diseases or ailments.

- Section 80E: Allows deduction for interest paid on education loans.

- Section 80G: Allows deduction for donations made to certain charitable institutions.

- Section 80GG: Allows deduction for rent paid by individuals not receiving House Rent Allowance (HRA).

- Section 80TTA/80TTB: Allow deduction for interest income from savings accounts (80TTA for individuals/HUFs, 80TTB for senior citizens).

- Section 234A: Interest charged for default in furnishing the return of income on time.

- Section 234B: Interest charged for default in payment of advance tax or paying less than 90% of the assessed tax.

- Section 234C: Interest charged for deferment of advance tax installments.

This briefing document summarizes the key themes, important ideas, and facts presented in the provided source regarding the online filing of Income Tax Return (ITR) Form 4 in India for the Financial Year 2024-25 (Assessment Year 2025-26).

1. Applicability and Core Principle: Presumptive Taxation

The ITR Form 4 is specifically designed for resident Individuals, Hindu Undivided Families (HUFs), and Firms (excluding LLPs) whose business or professional income does not exceed ₹50 lakh. The fundamental principle underpinning ITR-4 is the presumptive taxation scheme, which significantly simplifies income reporting by allowing taxpayers to declare income on a presumed basis, thereby eliminating the need to maintain detailed books of accounts.

Key Sections for Presumptive Taxation:

- Section 44AD (for small businesses): Presumes income at 8% of turnover or receipts. This rate is reduced to 6% if “digital transactions exceed 95%.” Turnover limits are ₹2 crores, extendable to ₹3 crores based on digital payments.

- Section 44ADA (for professionals/freelancers): Presumes income at 50% of gross receipts. This applies if turnover is under ₹50 lakh, extendable to ₹75 lakh if digital payments are above 95%.

- Section 44AE (for goods carriers): Income is computed based on per tonnage rates.

Key Insight: “Simplified Compliance Through Presumptive Taxation: Sections 44AD, 44ADA, and 44AE provide a relief mechanism for small taxpayers by allowing income declaration on a presumed basis linked to turnover or receipts, reducing the burden of maintaining detailed accounts.” This simplification, however, “requires precise turnover limits and digital payment thresholds,” highlighting “the growing importance of digital payments in taxation compliance.”

2. Online Filing Process and Data Verification

The online filing process for ITR-4 is designed to be user-friendly through the Income Tax Department’s portal. It involves logging in, selecting the relevant assessment year and mode of filing, choosing the taxpayer status, and filling in the required fields.

Critical Steps:

- Verification of Pre-filled Data: Taxpayers are strongly advised to “verif[y] and validat[e] pre-filled data from Form 26AS, AIS, and TIS, and modify where necessary.”

- Income Declaration: Detailed guidance is provided on declaring various income sources, including business income under presumptive taxation, salary, house property, and other income (e.g., dividends, interest).

- Reconciliation: It emphasizes “the importance of reconciling books of accounts with turnover figures from the GST portal.” The source notes that “Reconciliation Between Books and GST [is] Critical for Accuracy,” as “effective cross-verification prevents notices and tax adjustments down the line.”

Key Insight: “User-Friendly Online Filing with Verification: The online portal not only pre-fills data from multiple sources like Form 26AS, AIS, and TIS but also allows manual correction and validation, balancing automation with taxpayer control. Taxpayers should thoroughly cross-check these auto-filled figures against their records, especially reconciled GST data, to avoid discrepancies and notices.”

3. Tax Deductions: Old vs. New Regimes

The video “extensively covers tax deductions under both old and new tax regimes,” outlining eligibility, limits, and documentation requirements.

Common Deductions Highlighted:

- Section 80C: Investments (e.g., PPF, ELSS) and principal repayment on housing loans.

- Section 24B: Interest on housing loans.

- Sections 80D, 80DD, 80DDB: Health insurance premiums, treatment expenses for disabled dependents, and expenses for specified diseases. “Health and Disability-related Deductions Provide Significant Relief,” though “easy compliance requires correct documentation like prescriptions and approved certificates.”

- Section 80E: Interest on education loans.

- Section 80G: Donations to charitable institutions.

- Section 80GG: Rent paid deduction.

- Sections 80TTA/80TTB: Interest income from savings accounts.

Key Insight: “Nuanced Tax Deduction Rules Impact Filing Decisions: The video highlights the contrasting deduction benefits between old and new tax regimes. New tax regime offers lower slab rates but limited deductions; old tax regime allows multiple deductions… Taxpayers must evaluate their profile to decide on the regime, further supported by the option to switch regimes using Form 10IE.”

4. Filing Timelines, Penalties, and Compliance

The document stresses the importance of timely filing and highlights the consequences of non-compliance.

Important Filing Sections and Situations:

- 139(1): On-time return.

- 139(4): Belated return.

- 139(5): Revised return.

- 139(9): Response to defect notices.

Advance Tax for Presumptive Taxpayers:

- Presumptive taxpayers have a simplified advance tax rule: “only one installment by March 15.”

Consequences of Non-Compliance:

- “Penalties and interest for late tax payments under 234A, 234B, and 234C” are explained.

- 234A: Interest for late filing of return.

- 234B: Interest for default in payment of advance tax or short payment.

- 234C: Interest for deferment of advance tax.

Key Insight: “Timely Tax Payments and Filing Curtail Penalties: The advance tax regime for presumptive taxpayers—single installment by March 15—is less cumbersome but strict. Failure leads to interest under 234B and 234C. Awareness of timelines and calculating exact dues avoid unnecessary extra tax costs.” Additionally, “Different Filing Sections Accommodate Diverse Situations… providing a legal framework that balances compliance and flexibility while safeguarding revenue interests.”

5. Record Keeping and General Advice

Even under presumptive schemes, where detailed books are not mandatory, maintaining some minimal financial records is advised for “loan and compliance purposes.” The video encourages taxpayers to “validate all details, complete their ITR filing timely, and seek help if needed.”

Overall takeaway: The source provides a “comprehensive” guide that “demystifies ITR-4 filing under presumptive taxation, helping taxpayers and professionals navigate compliance with clarity and confidence for FY 2024-25. It equips the viewer with both conceptual understanding and practical steps to correctly file returns and optimize deductions, avoiding penalties and ensuring legal adherence.”

What is ITR-4 and who is it applicable for in India?

ITR-4, also known as Sugam, is an Income Tax Return form designed for resident Individuals, Hindu Undivided Families (HUFs), and Firms (excluding Limited Liability Partnerships – LLPs) in India. It is specifically intended for those whose total income includes business or professional income computed under the presumptive taxation scheme, provided their income does not exceed ₹50 lakh. This threshold can extend to ₹75 lakh in certain cases, particularly for professionals using digital payment methods.

How do the presumptive taxation schemes (Sections 44AD, 44ADA, 44AE) simplify income reporting?

These sections simplify income reporting by allowing eligible taxpayers to declare income on a presumed basis without maintaining detailed books of accounts.

- Section 44AD (for small businesses): Presumes income at 8% of turnover or gross receipts (reduced to 6% if digital transactions exceed 95%). This applies to businesses with turnover up to ₹2 crores (extendable to ₹3 crores with high digital payments).

- Section 44ADA (for professionals/freelancers): Presumes income at 50% of gross receipts if turnover is under ₹50 lakh (extendable to ₹75 lakh if digital payments are above 95%).

- Section 44AE (for goods carriers): Income is presumed based on per tonnage rates of goods carried. This reduces the compliance burden, but taxpayers must monitor turnover limits and digital transaction percentages to remain eligible.

What are the key steps for filing ITR-4 online through the Income Tax Department’s portal?

The online filing process involves several steps:

- Logging in: Access the Income Tax Department’s e-filing portal.

- Selecting Assessment Year and Mode: Choose the relevant assessment year (e.g., 2025-26 for FY 2024-25) and online filing mode.

- Choosing Taxpayer Status: Select your status (Individual or HUF).

- Filling Details: Accurately fill in personal information and income details from various sources like business income under presumptive taxation, salary, house property, and other income (e.g., dividends, interest).

- Verifying Pre-filled Data: Thoroughly check and validate pre-filled data from Form 26AS, Annual Information Statement (AIS), and Taxpayer Information Summary (TIS). Make any necessary modifications to ensure accuracy.

- Reconciliation: Reconcile your books of accounts with turnover figures from the GST portal to avoid discrepancies.

- Deductions: Claim eligible tax deductions under the chosen tax regime (old or new).

- Submission: Validate all details and submit the return.

What are the main types of tax deductions available, and how do the old and new tax regimes differ in this regard?

Both old and new tax regimes offer different approaches to deductions:

- Old Tax Regime: Allows for extensive deductions, including:

- Section 80C: Investments (e.g., PPF, ELSS, NPS) and principal repayment on housing loans.

- Section 24B: Interest on housing loans.

- Sections 80D, 80DD, 80DDB: Health insurance premiums, treatment expenses for disabled dependents, and expenses for specified diseases, respectively.

- Section 80E: Interest on education loans.

- Section 80G: Donations to charitable institutions.

- Section 80GG: Rent paid for housing where HRA is not received.

- Sections 80TTA/80TTB: Interest income from savings accounts.

- New Tax Regime: Offers lower slab rates but limits most of these deductions. Taxpayers must evaluate their financial profile to decide which regime is more beneficial, with the option to switch regimes using Form 10IE.

Why is it crucial to reconcile books of accounts with GST data before filing ITR-4?

Reconciliation between books of accounts and GST data is critical for ensuring accuracy and preventing discrepancies that could lead to notices or tax adjustments. GST treats inter-branch transactions differently, and accounting entries may vary, making cross-verification essential. This process helps ensure that business turnover figures reported in your income tax return are consistent and correct, reflecting the true financial picture of your business.

What are the advance tax payment rules for presumptive taxpayers, and what are the consequences of late payment?

For taxpayers opting for the presumptive taxation scheme, advance tax rules are simplified: they are required to pay their entire advance tax liability in a single installment by March 15th of the financial year. Failure to adhere to this timeline or underpayment of advance tax can lead to significant penalties and interest charges under the Income Tax Act:

- Section 234B: Interest for default in payment of advance tax or underpayment.

- Section 234C: Interest for deferment of advance tax (i.e., not paying in prescribed installments or paying less than due). Timely calculation and payment of tax dues are crucial to avoid these additional costs.

What are the different types of ITR filing sections mentioned, and what do they signify?

The video discusses various sections under which Income Tax Returns can be filed or modified, accommodating different taxpayer situations:

- Section 139(1): For filing the original return on or before the due date.

- Section 139(4): For filing a belated return after the original due date but before the end of the assessment year or completion of assessment, whichever is earlier.

- Section 139(5): For filing a revised return to correct any mistakes or omissions in a previously filed original or belated return.

- Section 139(9): Relates to defective returns, where the Income Tax Department identifies errors or omissions and issues a notice requiring correction. These sections provide a legal framework for taxpayers to comply with filing requirements, offering flexibility while ensuring revenue interests are safeguarded.

What minimal financial records should a taxpayer maintain even if exempt from detailed bookkeeping under presumptive schemes?

Even when exempt from maintaining detailed books of accounts under presumptive schemes, it is advisable for taxpayers to maintain certain minimal financial records. This practice is crucial for several reasons, including:

- Loan Purposes: Banks and financial institutions often require some form of financial documentation to assess creditworthiness for loans.

- Compliance: To justify income declarations if questioned by tax authorities, or to provide proof for any deductions claimed.

- Personal Financial Management: To track business performance, expenses, and income for personal financial planning. Such records might include bank statements, digital transaction records, invoices for major expenditures, and proof of income receipts.