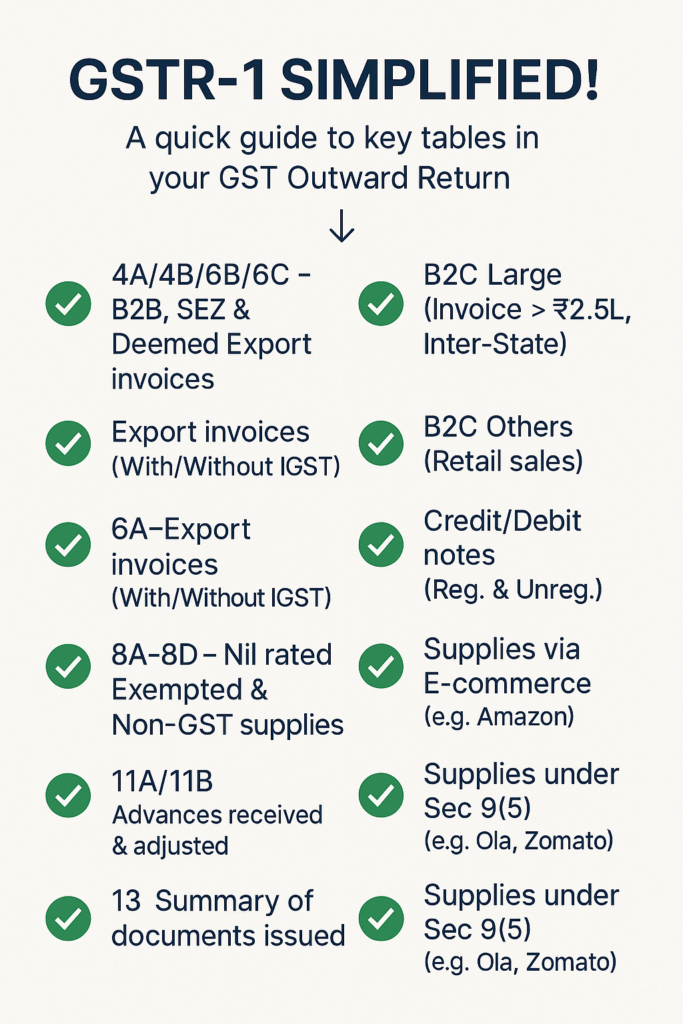

| Table No. | Description | Details / Purpose |

| 4A, 4B, 6B, 6C | B2B, SEZ, Deemed Exports | Outward supplies to registered persons, including: • B2B invoices (normal supplies) • Supplies to SEZ (with or without payment of tax) • Deemed Exports like supply to EOU or advance authorization holders |

| 5 | B2C (Large) Invoices | Supplies made to unregistered persons where: • Invoice value > ₹2.5 lakh • Inter-State transactions |

| 6A | Exports Invoices | Reporting of exports: • With or without payment of IGST • Includes details like Shipping Bill, Port Code, etc. |

| 7 | B2C (Others) | Supplies to unregistered persons: • Intra-State supplies • Inter-State where invoice value ≤ ₹2.5 lakh |

| 8A, 8B, 8C, 8D | Nil Rated, Exempted & Non-GST Supplies | Supplies that are: • Nil rated (e.g., foodgrains) • Exempt (as per GST Act) • Non-GST (e.g., petroleum, alcohol) Reported by supply type (inter/intra-state) |

| 9B | Credit / Debit Notes (Registered & Unregistered) | Details of credit/debit notes issued against earlier invoices: • Separate reporting for Registered (B2B) and Unregistered (B2C) recipients |

| 11A(1), 11A(2) | Tax Liability – Advances Received | Advance payments received for supplies where invoice not yet issued: • 11A(1) – Advance received • 11A(2) – Adjusted against future invoice |

| 11B(1), 11B(2) | Adjustment of Advances | Adjustment made against previously received advances reported in earlier periods |

| 12 | HSN-wise Summary of Outward Supplies | Details of outward supplies by HSN/SAC Code: • Description, UQC, quantity, value, taxable value, tax rate |

| 13 | Documents Issued During the Tax Period | Summary of all documents issued like: • Invoices (B2B, B2C) • Credit/Debit Notes • Delivery Challans, etc. |

| 14 | Supplies through E-Commerce Operators | Supplies made via platforms like Amazon, Flipkart, etc. Details of the E-Commerce Operator’s GSTIN |

| 15 | Supplies U/s 9(5) | Applicable for services like cab aggregators, hotel booking platforms: • Liability to pay GST lies with E-commerce operator, not supplier |

The GSTR-1 is a monthly or quarterly return that every registered GST taxpayer (except for a few exempt categories) must file to report outward supplies (sales) of goods or services. It plays a crucial role in the auto-population of GSTR-2A/2B for recipients and for determining tax liability.

Here’s what each table in GSTR-1 signifies:

- Table 4A, 4B, 6B, 6C – B2B, SEZ, and Deemed Export Invoices:

These sections capture invoices issued to registered persons (B2B), supplies made to Special Economic Zones (SEZs), and deemed exports (like supplies to Export Oriented Units). These are subject to either IGST or CGST/SGST depending on the nature of supply. - Table 5 – B2C (Large) Invoices:

This covers inter-State supplies made to unregistered persons where the invoice value exceeds ₹2.5 lakh. These high-value transactions are shown invoice-wise. - Table 6A – Export Invoices:

This is used for reporting all export transactions, whether made with or without the payment of IGST. It includes key shipping details and must align with data reported in ICEGATE. - Table 7 – B2C (Others):

It includes intra-State supplies to unregistered persons, and inter-State B2C transactions where the invoice