Introduction:

Exporters in India often utilize various logistics channels to ship goods outside the country. While air and sea shipments are common, many small and medium exporters use India Post for their international deliveries. For such postal exports, the Postal Bill of Export-II (PBE-II) plays a crucial role. This form acts as a declaration and proof of export and is essential for compliance under the Customs Act and GST laws.

What is the Postal Bill of Export – II?

The Postal Bill of Export – II is a legally recognized document used by exporters who ship goods through foreign post offices (FPOs) in India. It serves as a simplified version of the standard shipping bill used for air or sea exports and is specifically designed for exports via post.

Who Should File PBE-II?

Exporters who:

- Send goods through India Post.

- Are located inland and not near air/sea ports.

- Deal in e-commerce, handicrafts, garments, books, etc.

- Intend to claim export benefits such as IGST refund, duty drawback, or RoDTEP.

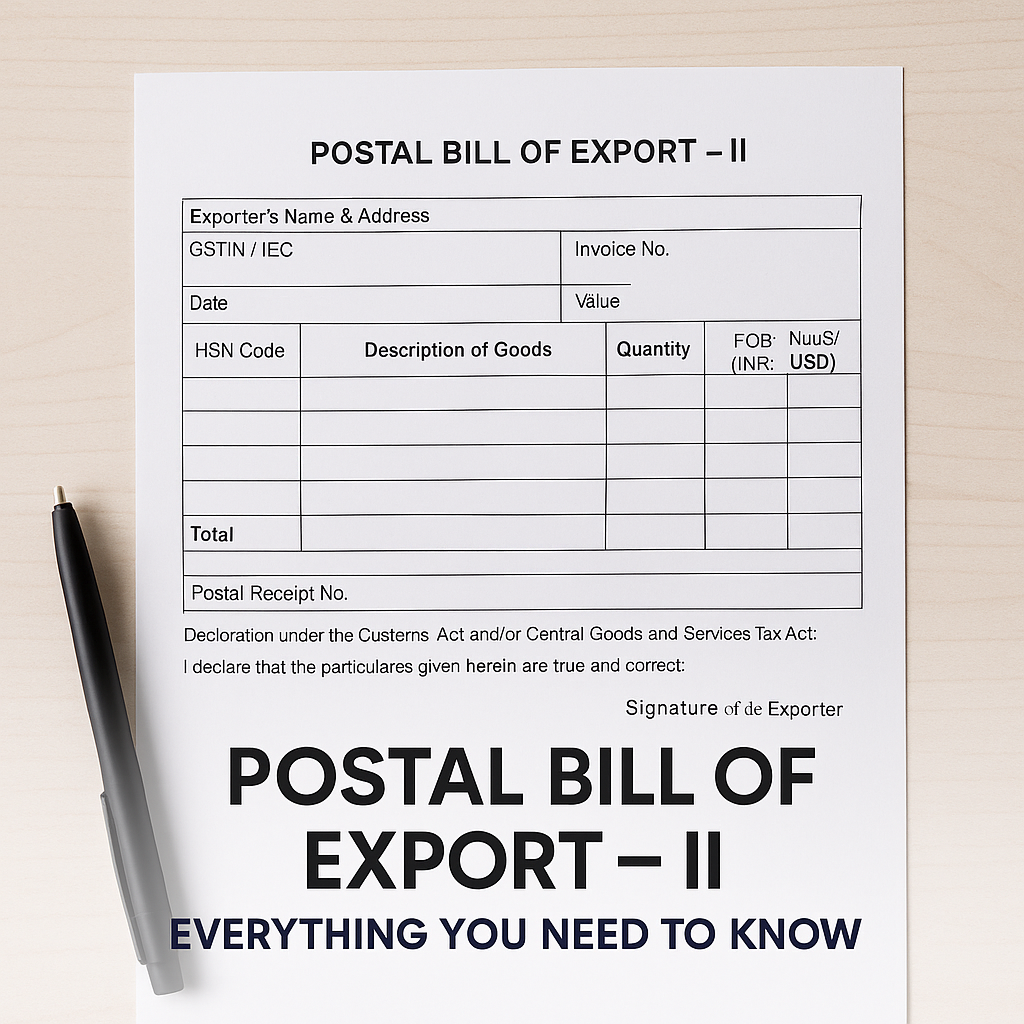

Key Fields in the Postal Bill of Export-II Format:

| Field | Description |

| Exporter’s Name & Address | Details of the entity/individual exporting the goods. |

| GSTIN/IEC | Mandatory identification for GST and customs purposes. |

| Invoice Details | Invoice number, date, and currency. |

| Description of Goods | HSN code, product name, quantity, unit, and value. |

| FOB Value | Free on Board value in INR/USD. |

| Postal Receipt Number | Reference number from the post office. |

| Declaration & Signature | Exporter’s declaration under applicable customs and GST laws. |

How to File Postal Bill of Export – II: Step-by-Step

- Prepare Export Invoice:

Include details such as buyer name, HSN, GST rate (if applicable), and value. - Fill the PBE-II Form:

Complete all sections as per the format including your IEC, GSTIN, and goods particulars. - Visit the Foreign Post Office (FPO):

Submit the goods along with PBE-II, invoice, and any necessary declarations. - Customs Clearance:

Customs officers at the FPO will verify and endorse the Postal Bill of Export. - Tracking & Export Proof:

The India Post tracking ID along with the endorsed PBE-II becomes the official proof of export.

Importance of Postal Bill of Export-II:

- Proof of Export for GST Refund: Required to claim IGST refund on zero-rated exports.

- Mandatory under Customs Rules: Especially for exports through post without electronic filing.

- Small Exporters’ Gateway: Ideal for low-volume or high-value goods not requiring containerization.

Digitalization & PBE-II:

With increased digitization, some post offices are enabling online submission and e-tracking for better compliance and ease of business. However, many FPOs still require physical submission of this form.

Common Errors to Avoid:

- Incomplete GSTIN or IEC.

- Incorrect HSN or goods description.

- Missing FOB or Invoice value.

- Illegible handwriting or missing signature.

PBE-II vs Other Shipping Bills:

| Aspect | PBE-II | Standard Shipping Bill |

| Channel | India Post | Air/Sea Cargo |

| Format | Manual | Electronic (ICEGATE) |

| Volume | Small/Moderate | High |

| Suitable For | MSMEs, e-commerce | Large-scale exporters |

Conclusion:

The Postal Bill of Export – II is a vital tool for exporters using the postal route. It ensures customs compliance, enables benefits like GST refunds, and facilitates smooth cross-border trade for small-scale businesses. Whether you’re an emerging exporter or a seasoned trader using India Post, understanding and correctly filing the PBE-II is crucial for successful export documentation.

Suggested Download:

📥 [Download Sample Postal Bill of Export – II Format in PDF]

📧 YouTube: cadeveshthakur

📸 Instagram: @cadeveshthakur