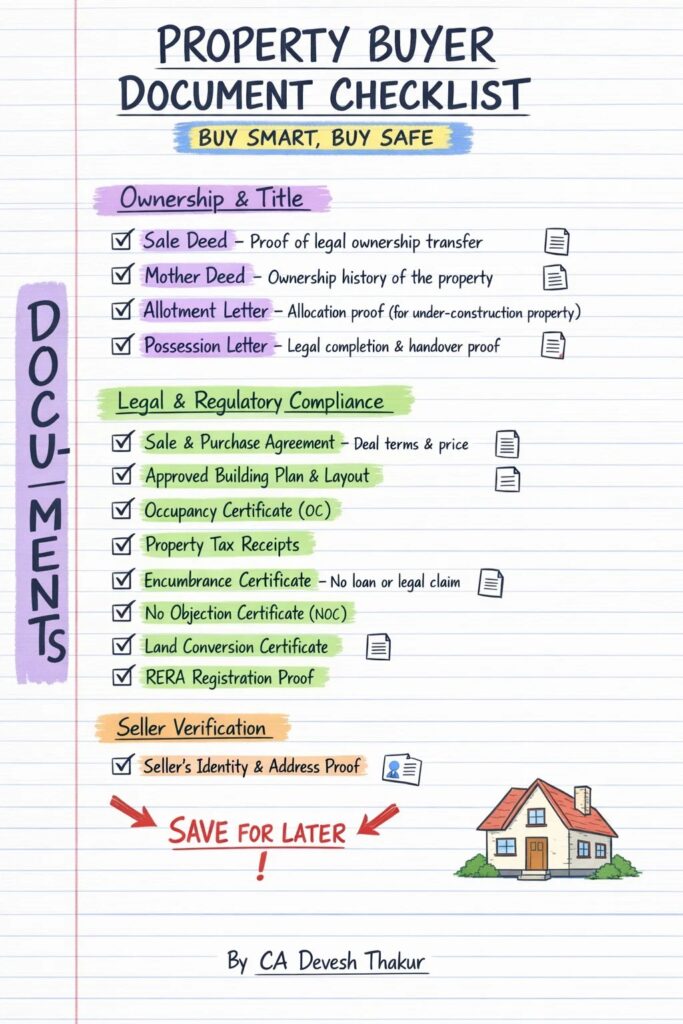

Property Buyer Document Checklist – Buy Smart, Buy Safe

Buying a property is one of the biggest financial decisions of your life. Whether you are purchasing a flat, plot, or an under-construction property, document verification is more important than price negotiation. A single missing or incorrect document can lead to legal disputes, loan rejection, or even loss of ownership.

This SEO-optimized guide explains the complete Property Buyer Document Checklist that every buyer in India must verify before finalising a property deal.

Why Document Verification Is Crucial Before Buying Property

Many buyers focus only on location, amenities, and budget. However, property documents establish legal ownership, compliance with laws, and freedom from disputes. Proper verification ensures:

- Clear and marketable title

- No pending loans or legal claims

- Approval from government authorities

- Eligibility for home loans

- Long-term safety of your investment

1. Ownership & Title Documents

1. Sale Deed

The Sale Deed is the most important legal document. It proves the lawful transfer of ownership from seller to buyer and must be registered with the Sub-Registrar.

Key check: Names, property description, consideration amount, registration details.

2. Mother Deed

The Mother Deed shows the history of ownership of the property. It helps verify how the current seller acquired the property.

Key check: Continuous ownership without breaks or disputes.

3. Allotment Letter (For Under-Construction Property)

Issued by the builder or authority, this document confirms allocation of a specific unit to the buyer.

Key check: Flat number, area, price, and payment terms.

4. Possession Letter

This confirms that the buyer has received legal possession of the property from the builder or seller.

Key check: Date of possession and signatures of both parties.

2. Legal & Regulatory Compliance Documents

5. Agreement to Sell / Sale Agreement

This document records the terms and conditions of the property deal before execution of the Sale Deed.

Key check: Payment schedule, possession timeline, penalties, and exit clauses.

6. Building Plan Approval & Layout Sanction

The construction must be approved by the local development authority.

Key check: Sanctioned plan matches the actual construction.

7. Occupancy Certificate (OC)

Issued by the local authority, the Occupancy Certificate confirms that the building is legally complete and fit for occupation.

Key check: Mandatory for utilities and resale in many states.

8. Property Tax Receipts

Latest property tax receipts prove that all municipal taxes have been paid.

Key check: No pending dues in municipal records.

9. Encumbrance Certificate (EC)

The Encumbrance Certificate confirms that the property is free from loans, mortgages, or legal claims.

Key check: EC should reflect “Nil Encumbrance”.

10. No Objection Certificate (NOC)

NOCs may be required from various authorities such as housing society, local authority, or pollution board.

Key check: Property-specific and valid at the time of sale.

11. Land Conversion Certificate

If agricultural land is converted to non-agricultural or residential use, a Conversion Certificate is mandatory.

Key check: Land-use permission as per local laws.

12. RERA Registration Certificate

For projects covered under RERA, registration with the Real Estate Regulatory Authority is compulsory.

Key check: Verify project details on the official RERA website.

3. Seller Verification Documents

Seller Identity & Address Proof

Always verify the seller’s identity using valid documents such as Aadhaar, PAN, or Passport.

Key check: Seller name must match ownership documents.

Common Mistakes Property Buyers Must Avoid

- Buying without checking Encumbrance Certificate

- Ignoring RERA registration

- Not verifying ownership history

- Relying only on builder assurances

- Skipping legal review by a professional

Final Words: Buy Smart, Buy Safe

Property buying should be a secure and stress-free experience. Proper document verification protects your money, your peace of mind, and your future. Always consult a qualified professional before signing or registering any property document.

📌 This checklist is applicable for flats, plots, under-construction, and resale properties across India.

Author: CA Devesh Thakur