Introduction

Maintaining accurate and organized ledger accounts is the backbone of any accounting system. Whether you’re a business owner, an accountant, or a Tally operator, setting up the right ledger structure in Tally is critical for smooth financial reporting, GST filing, and compliance. To help you get started, we’ve created a Basic Ledger List in Excel — covering all essential ledger heads required for day-to-day business accounting.

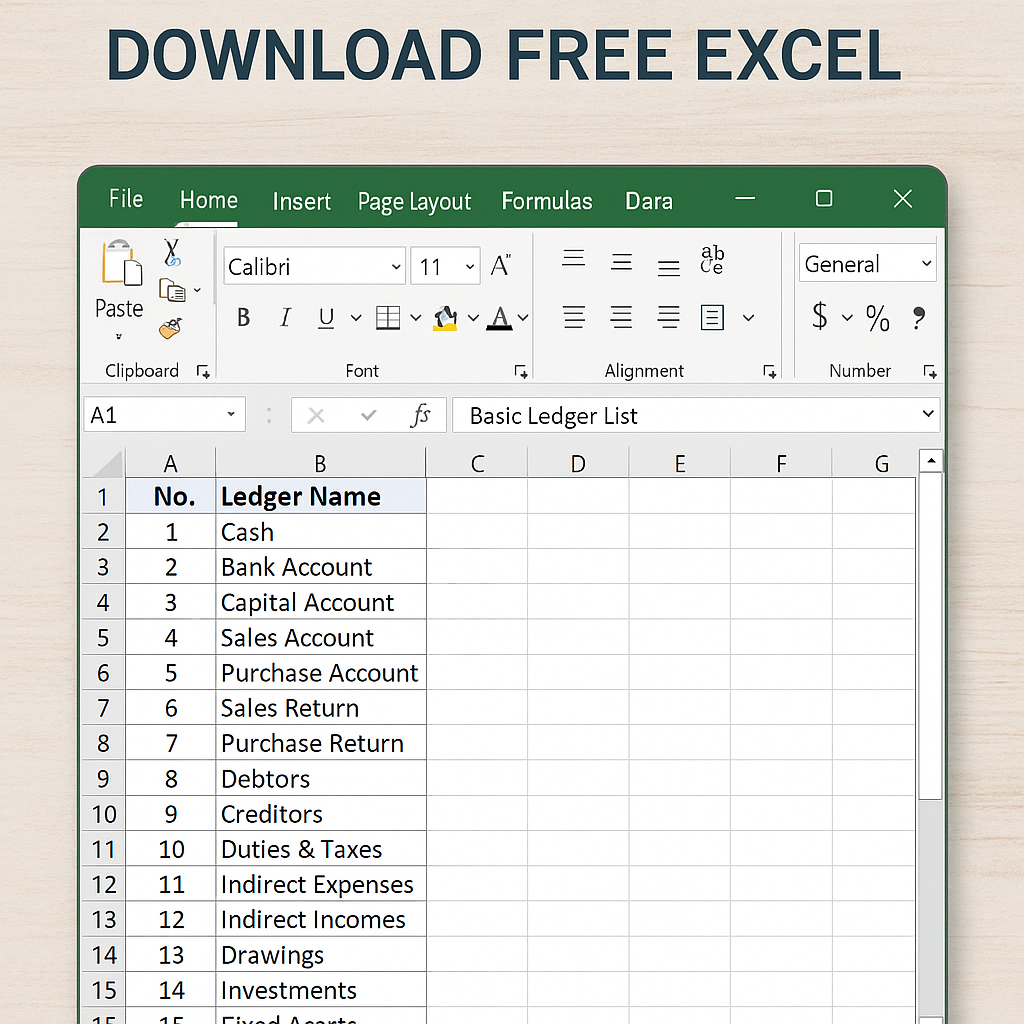

🔽 Click here to download the full Excel sheet – Basic Tally Ledger List

🧾 What is a Ledger in Tally?

A ledger in Tally is the actual account head used to identify transactions under specific categories such as Sales, Purchase, Bank, Capital, Sundry Debtors, and so on. Every financial entry in Tally needs to be routed through a ledger. Setting up accurate ledgers not only ensures compliance with statutory requirements but also makes financial tracking and GST reconciliation easier.

📂 Category-wise Ledger Heads Covered in the Excel File

Here’s a preview of the major ledger groups included in the Excel file:

1. Capital & Drawings

- Capital Account

- Drawings

- Partners Capital

- Proprietor’s Capital

2. Current Liabilities

- Salary Payable

- GST Payable

- TDS Payable

- Professional Tax Payable

- PF/ESI Payable

3. Bank Accounts

- HDFC Bank

- ICICI Bank

- State Bank of India

- Cash-in-hand

4. Loans (Liability)

- Secured Loan

- Unsecured Loan

- Loan from Bank

- Loan from Directors

5. Sundry Creditors & Debtors

- Party-wise Creditors

- Party-wise Debtors

- Grouped under “Sundry Creditors” or “Sundry Debtors”

6. Sales & Purchase Accounts

- Domestic Sales (Taxable & Exempted)

- Export Sales (with/without LUT)

- Purchase – Local & Interstate

- Purchase Returns

7. Indirect Income & Expenses

- Commission Income

- Interest Received

- Rent Income

- Office Expenses

- Telephone Expenses

- Conveyance

- Printing & Stationery

- Professional Fees

8. Direct Income & Expenses

- Manufacturing Wages

- Raw Material Consumption

- Power & Fuel

- Direct Freight Charges

9. Duties & Taxes

- GST Output CGST/SGST/IGST

- GST Input CGST/SGST/IGST

- Cess Ledger

- TDS Ledger

✅ Benefits of Using This Ledger Template

- ✅ Saves setup time for beginners and new businesses

- ✅ GST-ready ledger structure

- ✅ Works for trading, manufacturing, and service industries

- ✅ Simplified naming conventions

- ✅ Easy to import in Tally using Excel-to-XML converter

🛠 How to Use This Excel Ledger List?

- Download the Excel file from the link below

- Customize party names, bank accounts, or tax ledgers as per your business

- Import into Tally manually or via TDL/XML converter

- Start entering vouchers using the created ledgers

Tips for Best Results

- 🔄 Always reconcile your ledgers monthly with GST portal

- 🧾 Keep party-wise ledger GSTIN updated for GSTR-2A matching

- 💼 Use separate ledgers for taxable and exempt sales/purchases

- 💳 Group all expenses properly for accurate Profit & Loss statement

- 🧮 Regularly review your ledger balances to avoid errors

Need Help?

If you’re unsure how to import these ledgers into Tally or need guidance on setting up GST-compliant books of accounts, feel free to reach out to me or drop a comment below.

📧 YouTube: cadeveshthakur

📸 Instagram: @cadeveshthakur