-

GST Registration|SCN Issued|Query raised on New Registration|Partnership Firm GST Registration Query

-

📌unlock The Secrets Of Rcm Journal Entries With Reverse Charge Mechanism #shorts #shortfeed #short

-

AD Code Registration on New ICEGATE 2.0 Portal| How to apply DSC on Pdf| Documents required|

-

How to rectify GST JSON Errors| Generate, Download, and Modify JSON Error Report in Offline Utility

-

📌Credit Note under GST| Treatment of Credit Note in GST #gst #shorts #shortsfeed #short #shortvideo

-

Reasons for Non-Transmission of Export Invoices to ICEGATE| Invoices not transmitted to ICEGATE

-

📌GSTR-9 Annual Return | पूरी जानकारी एक ही वीडियो में | How to File GSTR-9| #shorts #youtubeshorts

-

📌Late fees for filing GSTR-3B/ GSTR-1 #gst #shorts #short #shortsfeed #youtubeshorts #youtube

-

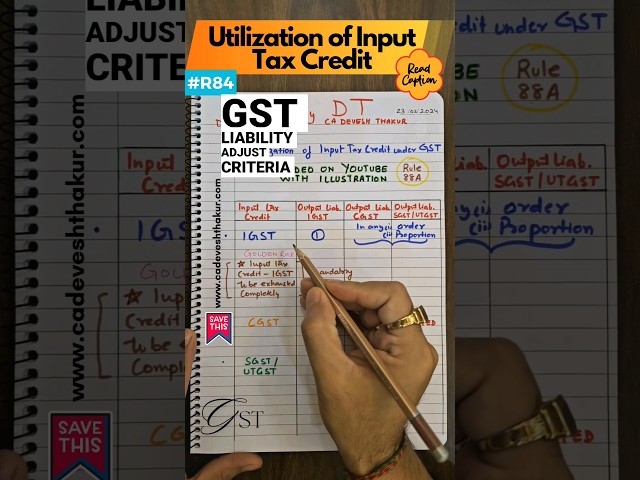

📌How to Set off of Input Tax Credit under GST| Utilization of Input Tax Credit under #gst #shorts

-

📌Avail ITC max.99% of electronic credit ledger a/c Rule86B #shorts #short #shortsfeed #youtubeshorts

-

GST Liability and Input Tax Credit Reconciliation| Tax Liability and ITC statement Summary & Reports

-

How to File GSTR-3B for Amazon Sellers|File GSTR3B using PIVOT Table in Excel|Credit Note|TCS Credit

Home GST