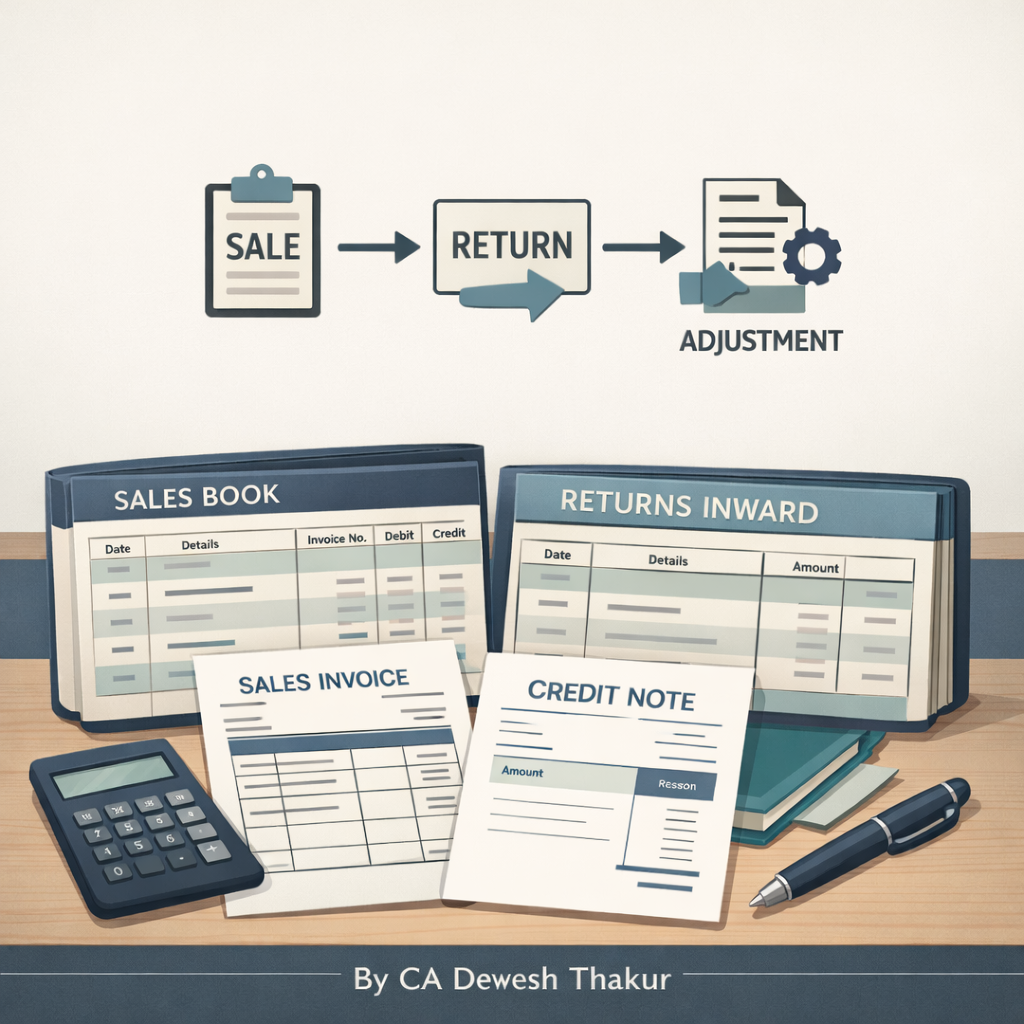

Sales Book, Sales Return & Credit Note Explained

Day 24 – 50 Days Accounting Challenge by CA Devesh Thakur

Accounting becomes easy when concepts are understood in a logical and practical manner.

In Day 24 of the 50 Days Accounting Challenge, we focus on the sales side of accounting, which is equally important as purchases.

This blog explains, in detail:

- Sales Book (Sales Journal)

- Difference between Sales Book and Sales Account

- Sales Return (Return Inward)

- Credit Note – concept and accounting treatment

- Practical illustrations with journal entries (December 2025)

This topic forms a core foundation for Class 11 accounting and is essential for understanding debtors, revenue, and GST-related accounting.

1. Sales Book (Sales Journal)

Meaning

A Sales Book, also known as the Sales Journal, is a subsidiary book used to record credit sales of goods only.

Here, goods mean items sold by the business as part of its normal trading activity.

What is Recorded in the Sales Book?

- Credit sales of goods

- Sales made to customers where payment is to be received later

What is Not Recorded?

- Cash sales

- Sale of assets such as machinery, furniture, or vehicles

- Sale of services (recorded in journal proper)

In simple terms, every time goods are sold on credit, the transaction is entered in the Sales Book.

Format of Sales Book

| Date | Customer Name | Invoice No. | Details | Amount (₹) |

Practical Illustration (December 2025)

On 6 December 2025, goods were sold on credit to Amit Stores for ₹50,000.

| Date | Customer Name | Invoice No. | Details | Amount |

| 06-12-2025 | Amit Stores | AS/210 | Goods sold | 50,000 |

Journal Entry (Posted from Sales Book)

Amit Stores A/c Dr. 50,000

To Sales A/c 50,000

Narration:

Being goods sold on credit to Amit Stores.

2. Difference Between Sales Book and Sales Account

Students often confuse these two, but both serve different purposes in accounting.

| Basis | Sales Book | Sales Account |

| Nature | Subsidiary book | Ledger account |

| Purpose | Records daily credit sales | Shows total sales |

| Entries | Customer-wise details | Consolidated amount |

| Balance | No balance | Appears in Trial Balance |

| Role | Book of original entry | Final account |

👉 Transactions are first recorded in the Sales Book and later posted to the Sales Account.

3. Sales Return (Return Inward)

Meaning

When goods sold to a customer are returned by the customer, the transaction is called Sales Return or Return Inward.

Sales returns reduce the amount receivable from the customer.

Common Reasons for Sales Return

- Goods damaged during delivery

- Wrong goods supplied

- Quality not as expected

- Delay in delivery

Format of Sales Return Book

| Date | Customer Name | Credit Note No. | Details | Amount (₹) |

Practical Illustration (December 2025)

On 12 December 2025, Amit Stores returned goods worth ₹8,000.

| Date | Customer Name | Credit Note No. | Details | Amount |

| 12-12-2025 | Amit Stores | CN/18 | Goods returned | 8,000 |

Journal Entry for Sales Return

Sales Return A/c Dr. 8,000

To Amit Stores A/c 8,000

Narration:

Being goods returned by Amit Stores.

4. Credit Note – Concept and Use

What is a Credit Note?

A Credit Note is a document issued by the seller to the customer when:

- Goods are returned by the customer

- Excess amount has been charged

- Post-sale discount is allowed

By issuing a Credit Note, the seller informs the customer that his account has been credited and the amount payable has been reduced.

Who Issues a Credit Note?

- Seller issues a Credit Note

- Buyer issues a Debit Note (in case of purchase return)

Simple Format of Credit Note

Credit Note No: CN/18

Date: 12-12-2025

| Particulars | Amount (₹) |

| Goods returned | 8,000 |

Accounting Effect of Credit Note

- Customer’s account is credited

- Sales Return account is debited

- Amount receivable decreases

5. Complete Accounting Flow (December 2025 Example)

- Credit sale recorded in the Sales Book

- Posting made to the Sales Account

- Sales return recorded in Sales Return Book

- Credit Note issued to the customer

- Journal entry passed with proper narration

This is the standard sales accounting cycle followed in real businesses.

6. Important Exam-Oriented Points

- Sales Book records credit sales of goods only

- Sales Account shows total sales

- Sales Return means goods returned by the customer

- Credit Note is issued by the seller

Conclusion

Sales Book, Sales Return, and Credit Note are fundamental concepts of accounting.

A clear understanding of these topics helps students manage debtors, revenue recognition, GST returns, and final accounts effectively.

This completes Day 24 of the 50 Days Accounting Challenge by CA Devesh Thakur, aimed at building a strong and practical accounting foundation for students and beginners.