Income from house property

This topic is governed by Sections 22 to 27 of the Income Tax Act.

Annual Value of Property (Section 22)

- The annual value of a property (consisting of buildings or lands appurtenant) is taxable under the head “Income from House Property.”

- The term “buildings” includes various structures like office buildings, warehouses, factories, and more, as long as they are not used for business or profession by the owner.

- Land appurtenant includes land adjoining or forming part of the building.

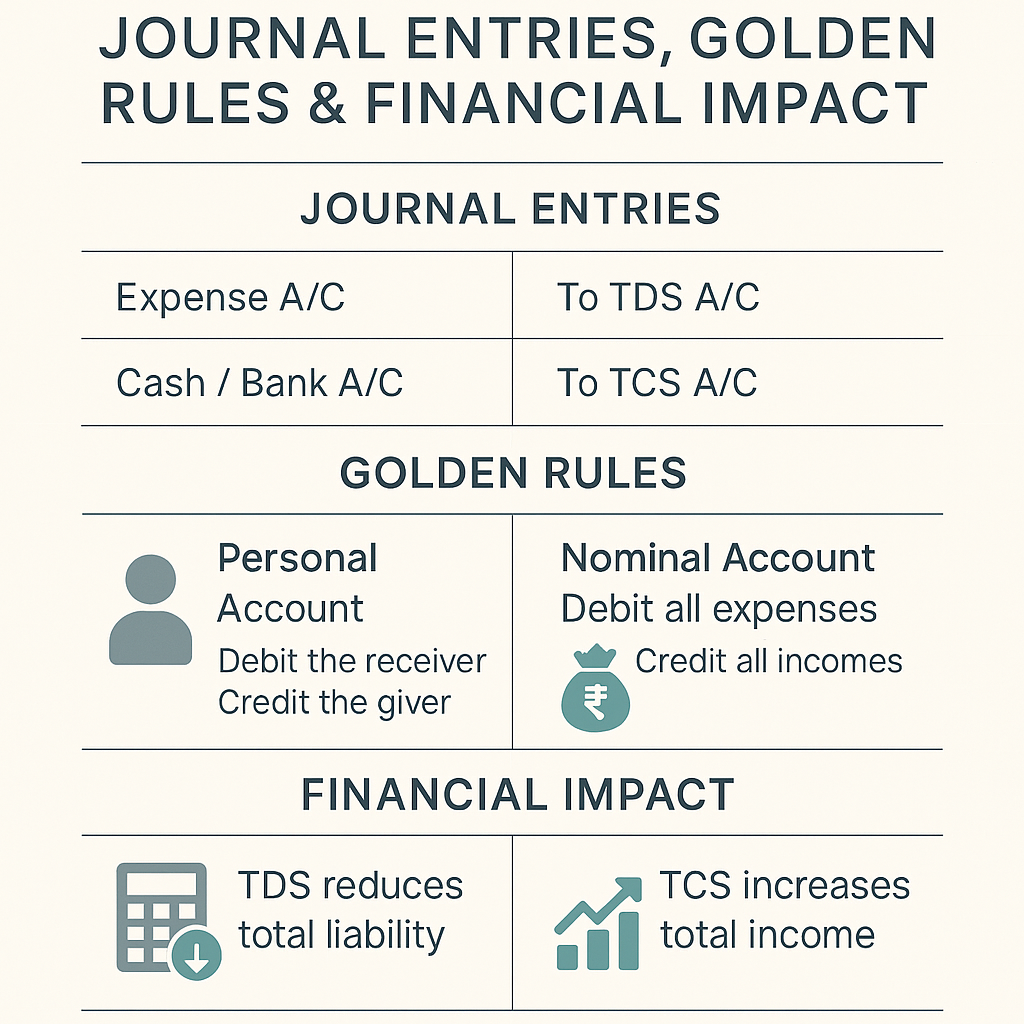

What is Form 16? Understand Form 16 (TDS Certificate)

Critical points:

- Tax is imposed on the annual value, irrespective of the tenant’s use of the property.

- Vacant land income is not covered under this section.

- Ownership can be by an individual, HUF, firm, or company.

- The owner must be a legal owner, and registration of the sale deed is not mandatory.

Determination of Annual Value (Section 23):

The annual value is calculated based on factors like municipal valuation, fair rent, and standard rent.

Deductions include municipal taxes paid by the owner.

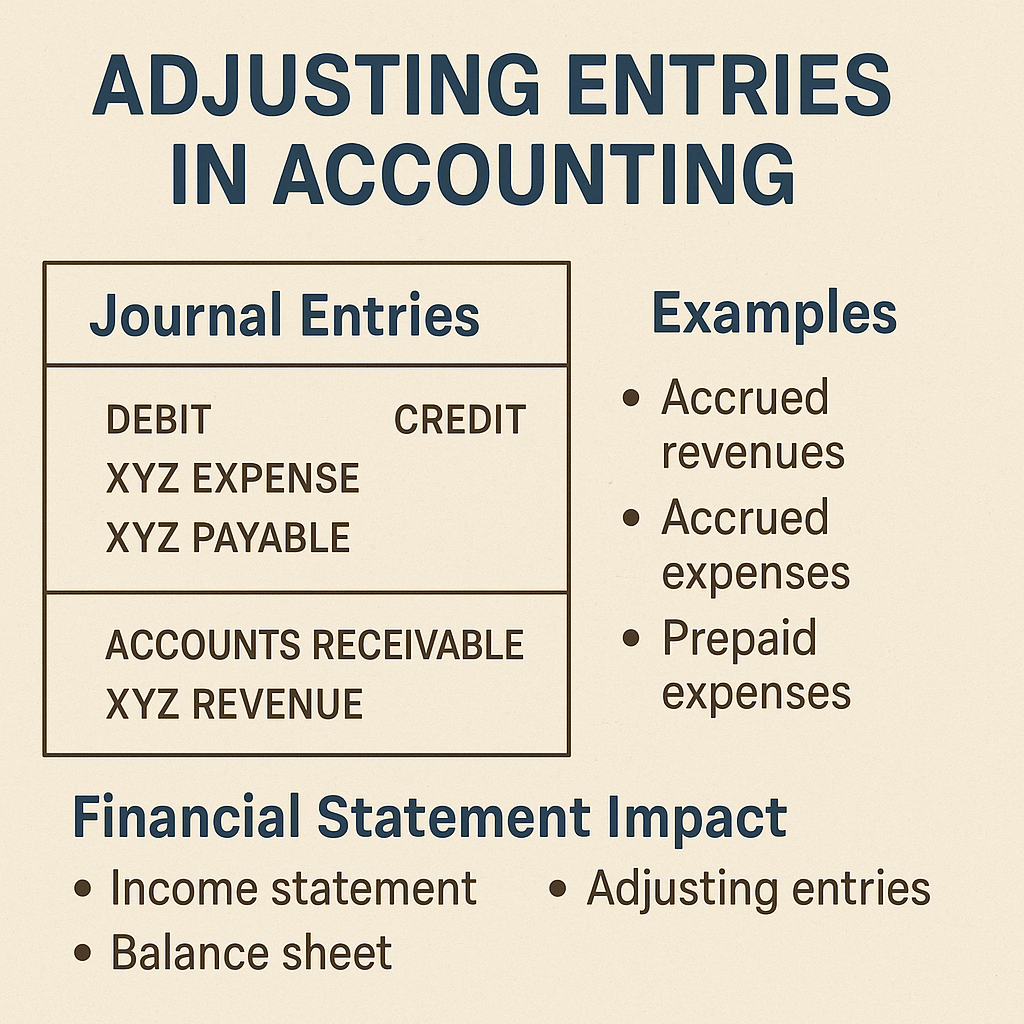

Allowable Deductions (Section 24):

Deductions allowed from income from house property:

- Standard deduction (30% of annual value).

- Interest on borrowed capital (up to ₹2 lakh for self-occupied property).

- Unrealized rent (subject to conditions).

Benefits of Home Loans in India

Illustrative Examples:

Example 1: Mr. A owns a residential property that he rents out. The annual rent received is ₹3,00,000. The municipal taxes paid are ₹20,000. Calculate the taxable income from house property.

Example 2: Ms. B has a self-occupied house. She took a home loan and pays interest of ₹2,50,000 annually. What is her taxable income from house property?

Example 3: Mr. C owns a commercial property. The annual rent received is ₹6,00,000, and municipal taxes paid are ₹40,000. Compute the taxable income.

Example 4: Mrs. D owns a vacant plot of land. She receives ground rent of ₹10,000 per year. Is this income taxable under house property?

Example 5: Dr. E owns a house used for his medical practice. The annual rent received is ₹4,80,000. Can he claim deductions for interest on the home loan?

Important Case Laws:

- Mysore Minerals Ltd. vs. CIT (1999):

- Significance: The Supreme Court held that even if a property is not let out, a notional income can be considered for taxation.

- CIT vs. Nawab Mir Barkat Ali Khan Bahadur (1972):

- Significance: The Supreme Court clarified that actual rent received or receivable is not decisive for determining the annual value of a property.

- S. Saravana Bhavan vs. DCIT (2019):

- Significance: The Madras High Court ruled that if the property is used for business purposes, the income from house property may be computed differently.

- Raghuvanshi Mills Ltd. vs. CIT (1971):

- Significance: The Supreme Court held that even if the property is not actually let out, it can be deemed to be let out if it is capable of being let out.

- CIT vs. Podar Cement Pvt. Ltd. (1997):

- Significance: The Bombay High Court clarified that rental income from a property held as stock-in-trade is taxed as business income.

- CIT vs. Mithlesh Kumari (2011):

- Significance: The Delhi High Court held that the entire interest on a housing loan is deductible, even if the loan is used for both self-occupied and let-out properties.

- CIT vs. Chetan Das Lachman Das (1972):

- Significance: The Supreme Court emphasized that municipal taxes paid by the owner are deductible while computing the income from house property.

- Durga Prasad vs. CIT (1971):

- Significance: The Supreme Court clarified that unrealized rent cannot be considered as income from house property.

- CIT vs. Shambhuram (1971):

- Significance: The Supreme Court held that repairs and collection charges are deductible while computing income from house property.

- CIT vs. Dr. H. H. Rana (2008):

- Significance: The Delhi High Court ruled that the annual value of a property cannot be negative, and loss from house property cannot be set off against other incomes.

Conclusion:

Understanding the nuances of income from house property is crucial for taxpayers. The type of property, its usage, and the ownership structure all play a significant role in determining the taxable income. Additionally, case laws provide insights into the interpretation and application of these provisions, ensuring compliance with the Income Tax Act.