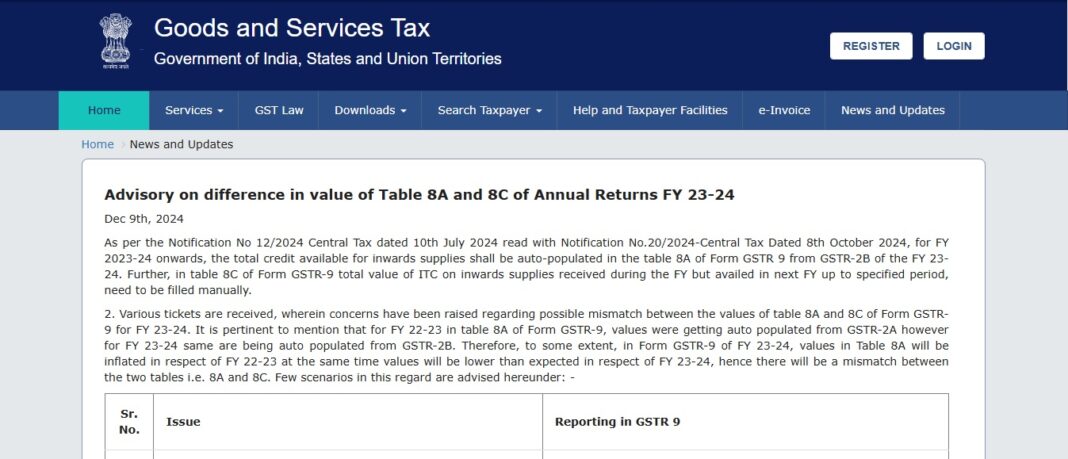

Advisory on Mismatch in Values Between Table 8A and Table 8C of Annual Return (GSTR-9) for FY 2023-24

Date: December 9, 2024

As per Notification No. 12/2024-Central Tax dated 10th July 2024, and Notification No. 20/2024-Central Tax dated 8th October 2024, the reporting of input tax credit (ITC) in the Annual Return (Form GSTR-9) for FY 2023-24 has been updated.

From FY 2023-24 onwards:

- The total credit available on inward supplies will be auto-populated in Table 8A of GSTR-9 using data from GSTR-2B for the corresponding financial year.

- The value of ITC on inward supplies pertaining to FY 2023-24 but availed in the next financial year (up to the specified time period) must be reported manually in Table 8C of GSTR-9.

This update has led to numerous queries regarding discrepancies between Table 8A and Table 8C of GSTR-9 for FY 2023-24.

Key Points of Mismatch

For FY 2022-23, Table 8A was auto-populated using GSTR-2A, but for FY 2023-24, it is based on GSTR-2B. As a result:

- Inflated values in Table 8A for invoices of FY 2022-23 reported late.

- Lower-than-expected values in Table 8A for FY 2023-24 due to invoices reported after March 2024.

Below are common scenarios and their reporting requirements in GSTR-9:

Scenario-Based Reporting Guide

| Sr. No. | Issue | Reporting in GSTR-9 |

|---|---|---|

| 1 | Invoice Date: FY 2023-24, Supplier Reporting After March 2024 | |

| Invoice date is in FY 2023-24, but the supplier reports it in GSTR-1 after the due date for March 2024. This invoice does not appear in Table 8A of GSTR-9 for FY 2023-24 as it is part of the subsequent year’s GSTR-2B. | Report such ITC in Table 8C and Table 13 of GSTR-9 as it pertains to FY 2023-24. This aligns with the instructions for these tables. |

| 2 | ITC Claimed in FY 2023-24 but Reversed Due to Non-Payment Within 180 Days

ITC was reversed in FY 2023-24 per Section 16(2) and reclaimed in FY 2024-25 after payment to the supplier. | The reclaimed ITC will be reported in Table 6H of GSTR-9 for FY 2024-25. Do not report this in Table 8C or Table 13 for FY 2023-24. This is per instructions for Table 13 and Rule 37A reporting. |

| 3 | ITC Reversed in FY 2023-24 Due to Non-Receipt of Goods

The invoice belongs to FY 2023-24, and ITC is claimed in Table 4A(5) and reversed in Table 4B(2) of GSTR-3B as per Circular 170/02/2022-GST. ITC is reclaimed in FY 2024-25. | Report the reclaimed ITC in Table 8C and Table 13 of GSTR-9 as it pertains to FY 2023-24. |

| 4 | Invoice for FY 2022-23 Appearing in Table 8A of FY 2023-24

This invoice appears in Table 8A of GSTR-9 for FY 2023-24 as the supplier filed late in GSTR-1 for FY 2022-23. | Do not report this ITC in Table 8C or Table 13 of GSTR-9 for FY 2023-24. This ITC pertains to FY 2022-23 and should have been reported there. Instruction 2A of the notified GSTR-9 form specifies that Tables 4, 5, 6, and 7 must only contain details for the current financial year. |

| 5 | ITC Claimed, Reversed, and Reclaimed in FY 2023-24

An invoice belongs to FY 2023-24, and ITC was claimed, reversed, and reclaimed within the same year. | Per the CBIC press release dated 3rd July 2019, ITC claimed and reclaimed within the same financial year should be reported in one row of Table 6B or Table 6H, but not both. Such ITC should not be shown as a reversal in Table 7. |

Key Takeaways

- Ensure ITC reporting aligns with the financial year it pertains to and follows the instructions for Table 8C and Table 13 in GSTR-9.

- Distinguish between ITC for the current and previous financial years to avoid discrepancies.

- Familiarize yourself with notifications and circulars governing ITC reporting to ensure accurate filing.