Definition:

Capital gains arise when a depreciable asset is sold at a price higher than its written down value. Depreciable assets include tangible assets like machinery, buildings, furniture, etc. The capital gain is the difference between the selling price and the written down value of the asset.

Calculation of Capital Gain:

The capital gain on the sale of depreciable assets is calculated as follows:

Capital Gain=Selling Price−Written Down Value (WDV)

Block of Assets Concept:

The Income Tax Act uses the concept of a block of assets for calculating depreciation. Instead of calculating depreciation for each asset individually, assets of similar nature and use are grouped into blocks. The written down value is calculated for the entire block, and when a part of the block is sold, capital gains or losses are determined.

Example:

Let’s assume a machinery block with the following details:

- Opening WDV of the Block: ₹10,00,000

- Additions during the year: ₹2,00,000

- Depreciation during the year: ₹2,50,000

- Selling price of machinery sold: ₹3,50,000

Calculation:

Closing WDV=Opening WDV+Additions during the year−Depreciation during the year

Closing WDV=₹10,00,000+₹2,00,000−₹2,50,000=₹9,50,000

Capital Gain=Selling Price−Closing WDV

Capital Gain=₹3,50,000−₹9,50,000=−₹6,00,000

In this case, there is a capital loss of ₹6,00,000.

Deductions under Section 80C to 80U

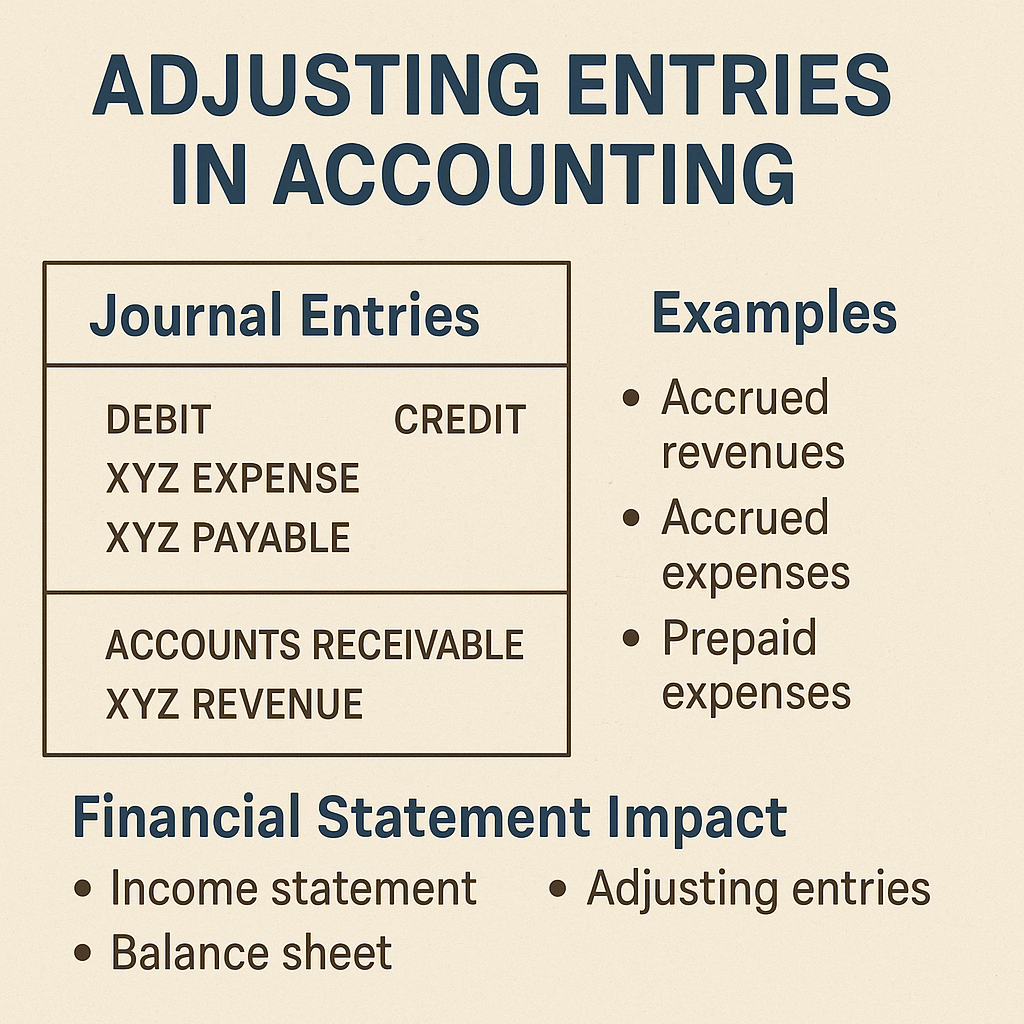

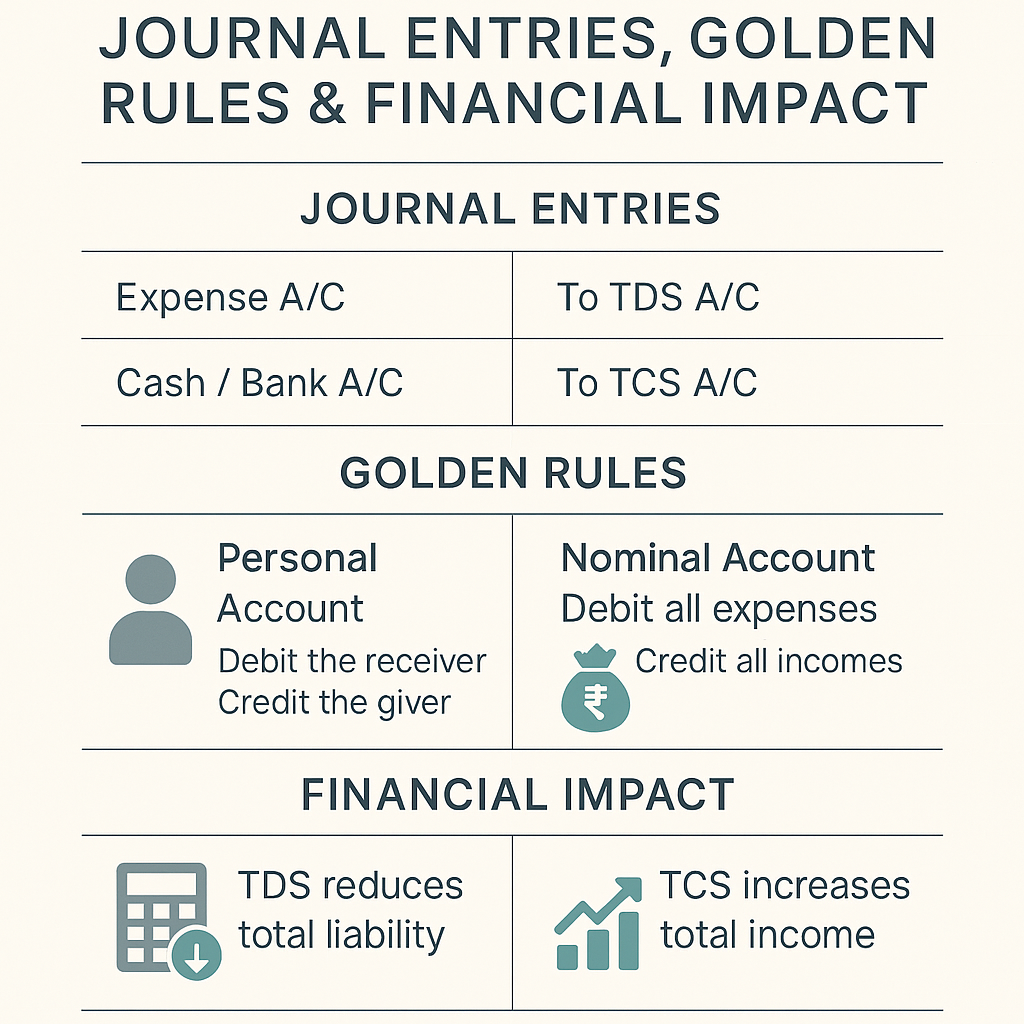

Journal Entry:

- For Depreciation:

- Debit: Depreciation Expense

- Credit: Accumulated Depreciation (Block)

- For Sale of Machinery:

- Debit: Bank (or Cash)

- Credit: Machinery (Block)

- Debit/Credit: Capital Gain (or Loss)

Treatment in Books of Accounts:

- Balance Sheet:

- The closing WDV is deducted from the machinery block to show the net book value.

- Income Statement:

- Capital gain or loss is recorded in the income statement.

Concept of Depreciation and Accumulated Depreciation?

Important Case Laws:

- CIT vs. Motors & General Stores (P.) Ltd. (1972):

- The Supreme Court clarified the treatment of balancing charge in the case of a depreciable asset.

- CIT vs. Velsicol Chemical Corporation (1971):

- The Madras High Court ruled on the treatment of insurance compensation in the calculation of capital gains.

- CIT vs. Bharat Earth Movers Ltd. (2000):

- The Karnataka High Court discussed the treatment of government grants received on depreciable assets.

- Mysore Minerals Ltd. vs. CIT (1999):

- The Supreme Court ruled on the computation of capital gains when assets are transferred to a government company.

- CIT vs. Metal Box Co. of India Ltd. (1979):

- The Supreme Court emphasized the need for consistency in the treatment of revaluation reserves in the calculation of capital gains.

- CIT vs. Associated Industrial Development Co. Pvt. Ltd. (1983):

- The Supreme Court clarified the treatment of compensation received for loss of depreciable assets.

- DCIT vs. Rallis India Ltd. (2009):

- The ITAT discussed the treatment of scrap sale in the calculation of capital gains on depreciable assets.

- CIT vs. Saurashtra Cement & Chemical Industries Ltd. (1994):

- The Supreme Court ruled on the treatment of voluntary retirement compensation in the computation of capital gains.

- CIT vs. Hindustan Lever Ltd. (2004):

- The Supreme Court discussed the treatment of restructuring expenses in the computation of capital gains.

- CIT vs. State Bank of India (2010):

- The Supreme Court emphasized the importance of fair market value in the determination of capital gains.

Conclusion:

Understanding the calculation and treatment of capital gains on the sale of depreciable assets is essential for accurate financial reporting and tax compliance. It involves the application of the block of assets concept and adherence to relevant provisions of the Income Tax Act. Seeking professional advice is recommended to ensure proper accounting and compliance with tax regulations.

Top of Form