Introduction

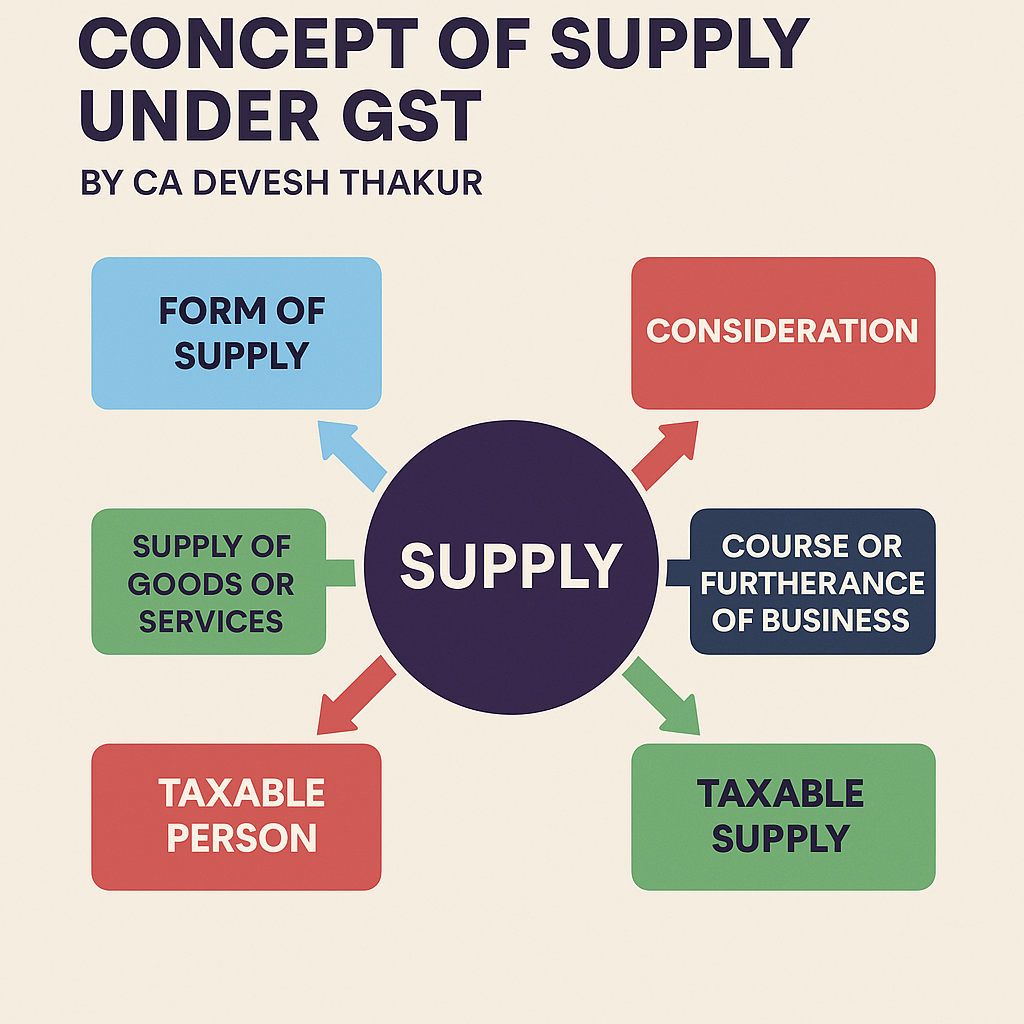

The taxable event under GST is the “Supply” of goods or services or both. This marks a major shift from the earlier indirect tax regime where events like sale, manufacture, or provision of service triggered taxation. Under GST, the concept of supply is broad, inclusive, and well-defined in Section 7 of the CGST Act, 2017.

Let’s break it down in simple terms using legal references, practical examples, and visual concepts.

Legal Reference: Section 7 of CGST Act, 2017

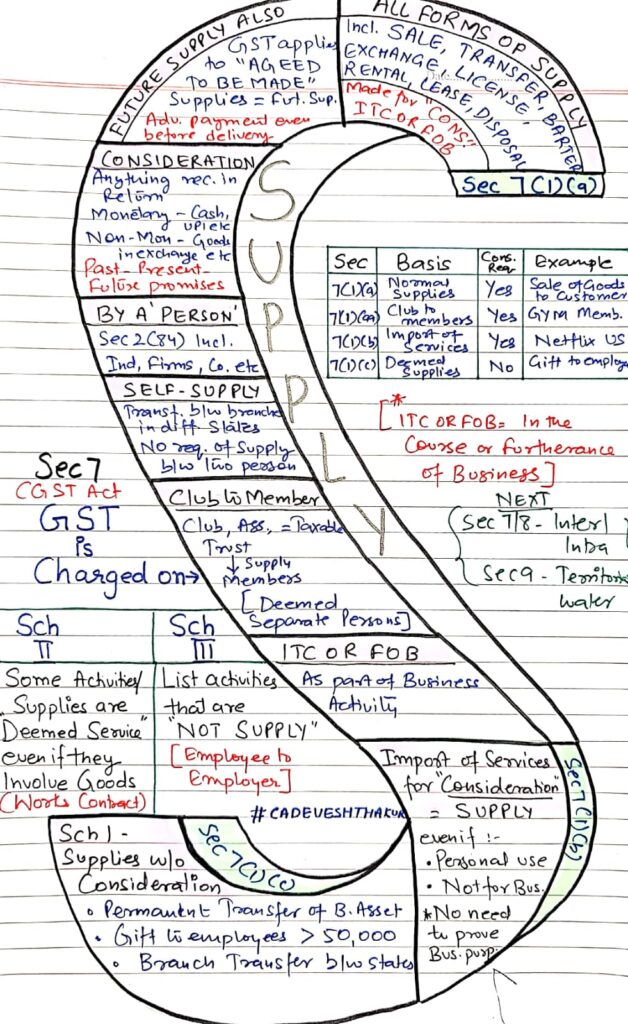

Section 7 defines supply and includes:

- All forms of supply for consideration in the course or furtherance of business

- Import of services for consideration (even if not for business)

- Certain activities specified in Schedule I even if made without consideration

Effective from 01.07.2017 via Notification No. 09/2017-CT dated 28.06.2017

What is Included in “Supply”?

🔹 1. Normal Supply – Section 7(1)(a)

Includes:

- Sale, Transfer, Barter, Exchange

- License, Lease, Rental, Disposal

Conditions:

- For consideration

- By a person

- In the course or furtherance of business

Example:

- Sale of mobile phones to customers

- Renting office space

🔹 2. Future Supplies Also Covered

GST applies to agreed-to-be-made supplies too.

Advance received for a future supply = Taxable

Example:

Advance ₹10,000 for service to be delivered next month → GST payable on receipt.

🔹 3. Consideration Must Be Present (Sec 2(31))

Can be:

- Monetary: Cash, UPI, Card

- Non-monetary: Exchange of goods/services

- Past, Present, or Future promises

Example:

- Barter of laptops for printers

- Promise to deliver goods in exchange for services

🔹 4. Supply by a Person – Section 2(84)

“Person” includes:

- Individual

- HUF

- Company

- Partnership

- Trusts, Govt. bodies, etc.

Example:

Supply made by a registered LLP to another business unit

🔹 5. Self-Supply is Taxable

Distinct persons under GST = Separate GSTINs

Transfer between branches in different states = Supply

Example:

Stock transferred from Delhi Head Office to Bangalore branch → GST applicable

🔹 6. Club/Association to Members – Section 7(1)(aa)

Inserted via Finance Act, 2021 (retrospective effect from 01.07.2017)

- Supplies by clubs, associations, trusts to members are taxable

- Mutuality principle doesn’t apply

Example:

Gym membership fees collected by an association → Supply

🔹 7. Import of Services – Section 7(1)(b)

- Import for consideration is supply

- Even if used for personal or non-business purpose

Example:

Netflix US subscription for personal entertainment = Supply

🔹 8. Deemed Supply Without Consideration – Section 7(1)(c)

As per Schedule I, following are deemed as supply even without consideration:

Examples:

- Permanent transfer of business assets

- Gift > ₹50,000 to employees

- Supply between related/distinct persons (e.g., inter-state branch transfer)

Classification Based on Schedule

| Schedule | Nature | Example |

| Schedule I | Supply without consideration | Branch transfer, Gift to employee > ₹50,000 |

| Schedule II | Deemed service even if goods used | Renting immovable property, Works contract |

| Schedule III | Not a supply | Employee service to employer, Sale of land/building |

Intra-State vs Inter-State Supply

| Supply Type | Law Applicable | Tax Components |

| Intra-State | CGST + SGST Acts | CGST + SGST |

| Inter-State | IGST Act | IGST |

| Territorial | Sec 9, IGST Act | IGST on marine/water-based |

Reference:

- Sec 7 & 8, IGST Act for classification

- Sec 9, IGST Act for territorial supplies

Section-Wise Summary Table

| Section | Type of Supply | Consideration Needed | Example |

| 7(1)(a) | Normal supply | ✅ Yes | Sale of goods |

| 7(1)(aa) | Club/Association to member | ✅ Yes | GYM membership |

| 7(1)(b) | Import of services | ✅ Yes | Netflix subscription |

| 7(1)(c) | Deemed supplies (Sch I) | ❌ No | Gift > ₹50,000 to employee |

Key Takeaways

- GST is a destination-based consumption tax.

- Supply is the triggering event under GST.

- Future supplies, self-supplies, and imports for personal use are all covered.

- Some activities are taxable even without consideration (Schedule I).

- Others are not treated as supply at all (Schedule III).

FAQs

Q. Is barter considered supply?

Yes, barter is included under Section 7(1)(a).

Q. Are gifts taxable?

Yes, if gifts > ₹50,000 are given by employer to employee (Schedule I).

Q. Are inter-branch transfers taxable?

Yes, if branches are in different states.

Author: CA Devesh Thakur

Category: GST Basics | 30 Days GST Challenge – Day 3

Learn More

Day 2: GST Explained with Simplicity | Threshold, Supply, Types, Valuation & Key Terms