Financial Journal Entries Briefing Document

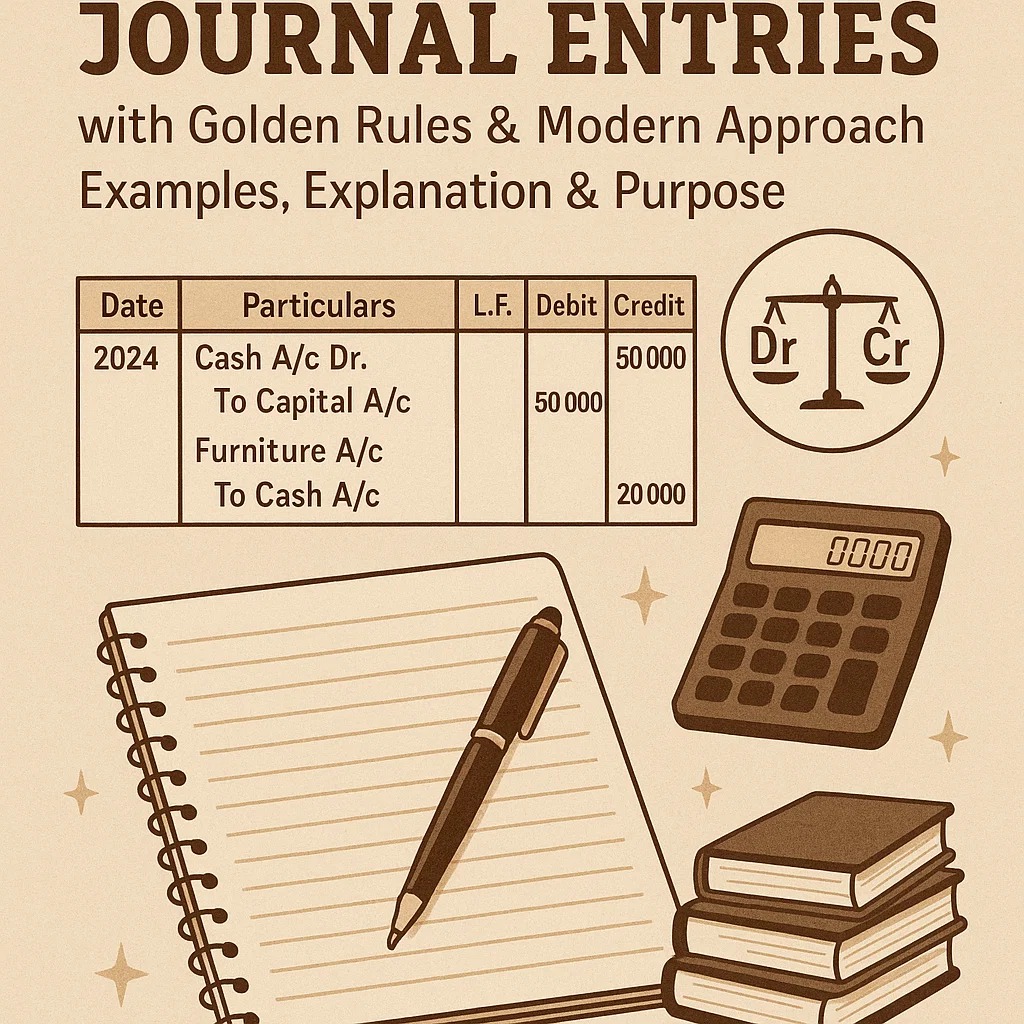

This document provides a detailed overview of common financial journal entries, categorizing them by transaction type and illustrating each with an example.

Download 30 Journal Entries with Examples, Explanation and Purpose

Main Themes and Key Concepts

The core concept is the double-entry bookkeeping system, where every financial transaction affects at least two accounts, with one account being debited (Dr.) and another credited (Cr.). This ensures the accounting equation (Assets = Liabilities + Equity) remains balanced. The document systematically outlines various scenarios a business encounters, from initial setup to year-end adjustments, demonstrating the appropriate journal entry for each.

I. Basic Business Operations

These entries cover the fundamental transactions a business performs regularly.

- Business Commencement: The initial investment by the owner is recorded. “Dr. Cash/Bank A/c Cr. Capital A/c ₹5,00,000 invested by owner.” (Entry 1)

- Purchases: Cash Purchase: “Dr. Purchase A/c Cr. Cash A/c Purchased goods worth ₹10,000.” (Entry 2)

- Credit Purchase: “Dr. Purchase A/c Cr. Creditors A/c (Vendor) Purchased from Ramesh & Co.” (Entry 3)

- Sales: Cash Sales: “Dr. Cash A/c Cr. Sales A/c Sold goods for ₹15,000 cash.” (Entry 4)

- Credit Sales: “Dr. Debtors A/c (Customer) Cr. Sales A/c Sold goods to Shyam on credit.” (Entry 5)

- Payments & Receipts: Paid to Creditor: “Dr. Creditors A/c Cr. Cash/Bank A/c Paid ₹5,000 to Ramesh & Co.” (Entry 6)

- Received from Debtor: “Dr. Cash/Bank A/c Cr. Debtors A/c Received ₹8,000 from Shyam.” (Entry 7)

II. Expenses & Income Recognition

This section details how various operational expenses and incomes are recorded.

- Expenses Paid: Direct expenses like “Rent Paid Dr. Rent A/c Cr. Cash/Bank A/c Paid rent ₹10,000” (Entry 8) and “Salary Paid Dr. Salary A/c Cr. Cash/Bank A/c Paid salary ₹20,000” (Entry 9), as well as utility costs such as “Electricity Bill Dr. Electricity Expenses A/c Cr. Bank A/c Paid ₹3,000 for electricity” (Entry 11) are expensed.

- Income Received: Various forms of income are accounted for, such as “Commission Received Dr. Bank A/c Cr. Commission Received A/c ₹2,000 commission received” (Entry 10) and “Interest Income Dr. Bank A/c Cr. Interest Income A/c Interest ₹1,500 credited by bank.” (Entry 12)

III. Bank Transactions

These entries specify how cash movements involving the bank are recorded.

- Cash Deposits: “Dr. Bank A/c Cr. Cash A/c Deposited ₹10,000.” (Entry 13)

- Cash Withdrawals: “Dr. Cash A/c Cr. Bank A/c Withdrew ₹5,000” for office use. (Entry 14)

- Bank Charges: “Dr. Bank Charges A/c Cr. Bank A/c ₹200 charges deducted.” (Entry 15)

- Cheque Receipts: “Dr. Bank A/c Cr. Debtors A/c Received ₹7,000 cheque from customer.” (Entry 16)

IV. Assets, Depreciation & Drawings

This category covers entries related to fixed assets, their value reduction over time, and owner withdrawals.

- Asset Purchase: “Dr. Furniture A/c Cr. Cash/Bank A/c Bought furniture for ₹25,000.” (Entry 17)

- Depreciation: The systematic reduction in an asset’s value is recorded: “Dr. Depreciation A/c Cr. Furniture A/c Depreciated ₹2,500 on furniture.” (Entry 18)

- Owner Drawings:Cash Withdrawal: “Dr. Drawings A/c Cr. Cash/Bank A/c Owner withdrew ₹3,000.” (Entry 19)

- Goods for Personal Use: “Dr. Drawings A/c Cr. Purchase A/c Goods worth ₹1,000 used by owner.” (Entry 20)

V. Loan & Interest Entries

These entries deal with borrowing funds and the associated interest costs.

- Loan Taken: “Dr. Bank A/c Cr. Loan A/c ₹50,000 loan taken from SBI.” (Entry 21)

- Interest Paid on Loan: “Dr. Interest A/c Cr. Bank A/c Paid ₹5,000 interest on loan.” (Entry 22)

VI. Stock/Inventory Adjustments

These are crucial for accurately reflecting inventory values at specific points in time.

- Closing Stock: Recorded at year-end: “Dr. Closing Stock A/c Cr. Trading A/c ₹30,000 stock at year-end.” (Entry 23)

- Opening Stock: Recorded at the beginning of the year: “Dr. Trading A/c Cr. Opening Stock A/c Opening stock ₹40,000.” (Entry 24)

VII. Adjustment & Provisions

These entries ensure that financial statements accurately reflect revenues and expenses in the period they are incurred, regardless of when cash is exchanged.

- Outstanding Expenses: Expenses incurred but not yet paid: “Dr. Expense A/c Cr. Outstanding Expenses A/c Salary outstanding ₹5,000.” (Entry 25)

- Prepaid Expenses: Expenses paid in advance: “Dr. Prepaid Expenses A/c Cr. Expense A/c ₹2,000 prepaid insurance.” (Entry 26)

- Accrued Income: Income earned but not yet received: “Dr. Accrued Income A/c Cr. Income A/c ₹1,000 interest accrued.” (Entry 27)

- Provision for Bad Debts: An estimate for uncollectible accounts receivable: “Dr. P&L A/c Cr. Provision for Bad Debts A/c ₹3,000 provision created.” (Entry 28)

VIII. Year-End & Transfer Entries

These are closing entries made at the end of an accounting period to prepare for the next period and transfer balances to relevant accounts.

- Transferring Net Profit: “Dr. P&L A/c Cr. Capital A/c Transferred profit ₹10,000.” (Entry 29)

- Transferring Drawings: “Dr. Capital A/c Cr. Drawings A/c Adjusted drawings of ₹3,000.” (Entry 30)

Conclusion

The provided source offers a comprehensive practical guide to fundamental journal entries in accounting. It highlights the pervasive application of the double-entry system across diverse business scenarios, from routine transactions to year-end adjustments. Understanding these entries is crucial for accurate financial record-keeping, statement preparation, and overall financial management.

What is a journal entry in accounting?

A journal entry is a record of a financial transaction in an accounting system. It typically follows the double-entry bookkeeping system, meaning each entry affects at least two accounts, with debits equaling credits. The examples provided illustrate various types of common business transactions and their corresponding journal entries.

How are business starting and operational purchases/sales recorded?

When a business starts, the owner’s investment is recorded by debiting Cash/Bank A/c and crediting Capital A/c. For purchases, if cash is used, Purchase A/c is debited and Cash A/c is credited. If purchased on credit, Purchase A/c is debited and Creditors A/c is credited. Conversely, for sales, if cash is received, Cash A/c is debited and Sales A/c is credited. If sold on credit, Debtors A/c is debited and Sales A/c is credited.

How are payments to creditors and receipts from debtors recorded?

When a payment is made to a creditor, the Creditors A/c is debited (reducing the liability) and Cash/Bank A/c is credited (reducing the asset). When cash or a cheque is received from a debtor, the Cash/Bank A/c is debited (increasing the asset) and Debtors A/c is credited (reducing the asset owed).

What are common ways to record expenses and income?

Expenses like rent and salary are recorded by debiting the specific Expense A/c (e.g., Rent A/c, Salary A/c) and crediting Cash/Bank A/c. Similarly, electricity bills involve debiting Electricity Expenses A/c and crediting Bank A/c. For income, such as commission or interest, the Bank A/c is debited and the relevant Income A/c is credited (e.g., Commission Received A/c, Interest Income A/c).

How are bank transactions like deposits, withdrawals, and charges recorded?

Depositing cash into the bank involves debiting Bank A/c and crediting Cash A/c. Withdrawing cash from the bank for office use is the reverse: debiting Cash A/c and crediting Bank A/c. Bank charges are recorded by debiting Bank Charges A/c and crediting Bank A/c. If a cheque is received from a customer, Bank A/c is debited and Debtors A/c is credited.

How are assets, depreciation, and owner’s drawings recorded?

When an asset like furniture is purchased, the Asset A/c (e.g., Furniture A/c) is debited and Cash/Bank A/c is credited. Depreciation, which is the expense of an asset’s wear and tear, is recorded by debiting Depreciation A/c and crediting the specific Asset A/c. If the owner withdraws cash for personal use, Drawings A/c is debited and Cash/Bank A/c is credited. If goods are used for personal use, Drawings A/c is debited and Purchase A/c is credited.

What are common loan, stock, and adjustment entries?

Taking a loan is recorded by debiting Bank A/c and crediting Loan A/c. Interest paid on a loan is an expense, so Interest A/c is debited and Bank A/c is credited. Closing stock at year-end is debited to Closing Stock A/c and credited to Trading A/c, while opening stock is debited to Trading A/c and credited to Opening Stock A/c. Adjustment entries include: outstanding expenses (debit Expense A/c, credit Outstanding Expenses A/c), prepaid expenses (debit Prepaid Expenses A/c, credit Expense A/c), accrued income (debit Accrued Income A/c, credit Income A/c), and provision for bad debts (debit P&L A/c, credit Provision for Bad Debts A/c).

How are year-end profit and drawings transferred in accounting?

At year-end, the net profit is transferred from the Profit & Loss (P&L) account to the owner’s capital. This is done by debiting P&L A/c and crediting Capital A/c. Similarly, the owner’s drawings, which reduce their capital, are transferred by debiting Capital A/c and crediting Drawings A/c.

Journal Entry Mastery: A Comprehensive Study Guide

This study guide is designed to help you review and solidify your understanding of basic journal entries in accounting. It covers various types of transactions, from business operations to year-end adjustments, providing examples for each.

Quiz

Answer the following questions in 2-3 sentences each.

- What is the purpose of a journal entry for “Business Started,” and what accounts are typically debited and credited?

- Explain the difference in journal entries for a cash purchase versus a credit purchase of goods.

- When a business receives cash from a debtor, which accounts are affected and how (debit/credit)?

- Describe the journal entry for “Rent Paid.” What type of account is Rent, and how does it decrease cash/bank?

- If an owner withdraws cash from the business for personal use, what is the specific journal entry used to record this?

- How does a “Cash Deposited to Bank” entry differ from a “Withdrawn from Bank for Office Use” entry in terms of the accounts debited and credited?

- What is depreciation, and how is it recorded in a journal entry for an asset like furniture?

- Explain the concept of “Outstanding Expenses” and provide the journal entry example.

- What is the journal entry for “Accrued Income,” and what does it signify?

- Describe the purpose of “Transferring Net Profit” and the accounts involved in its journal entry.

Quiz Answer Key

- The purpose of a “Business Started” journal entry is to record the initial investment by the owner into the business. Typically, the Cash/Bank A/c is debited to show an increase in assets, and the Capital A/c is credited to reflect the owner’s equity.

- For a cash purchase, “Purchase A/c” is debited and “Cash A/c” is credited, as cash leaves the business immediately. For a credit purchase, “Purchase A/c” is debited, but “Creditors A/c” is credited, indicating that the payment is owed to a vendor.

- When cash is received from a debtor, the “Cash/Bank A/c” is debited to increase the liquid assets of the business. Concurrently, the “Debtors A/c” is credited, as the amount owed by that specific customer has decreased.

- The journal entry for “Rent Paid” involves debiting “Rent A/c,” which is an expense account, to recognize the cost incurred. “Cash/Bank A/c” is credited, reflecting the outflow of funds used to pay the rent.

- If an owner withdraws cash from the business for personal use, this is recorded as “Drawings.” The journal entry involves debiting “Drawings A/c” to track the owner’s personal withdrawals and crediting “Cash/Bank A/c” to show the decrease in business funds.

- “Cash Deposited to Bank” involves debiting “Bank A/c” and crediting “Cash A/c,” moving funds from physical cash to the bank. “Withdrawn from Bank for Office Use” is the reverse, debiting “Cash A/c” and crediting “Bank A/c,” moving funds from the bank into physical cash for office use.

- Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It is recorded by debiting “Depreciation A/c” to recognize the expense and crediting the specific asset account (e.g., “Furniture A/c”) to reduce its book value.

- “Outstanding Expenses” are expenses incurred but not yet paid at the end of an accounting period. The journal entry debits the specific “Expense A/c” to recognize the cost and credits “Outstanding Expenses A/c,” which is a liability account, showing the amount owed.

- The journal entry for “Accrued Income” is Dr. Accrued Income A/c Cr. Income A/c. It signifies income that has been earned during an accounting period but has not yet been received in cash. This entry recognizes the revenue even without cash receipt.

- “Transferring Net Profit” is a year-end entry to move the calculated net profit from the Profit & Loss (P&L) A/c to the owner’s equity. The journal entry debits “P&L A/c” to close it out for the profit amount and credits “Capital A/c,” thereby increasing the owner’s investment in the business.

Essay Format Questions

- Discuss the fundamental principles of double-entry accounting as illustrated by the provided journal entries. How do debits and credits maintain the accounting equation (Assets = Liabilities + Equity) across different transaction types?

- Categorize the provided journal entries into relevant accounting elements (Assets, Liabilities, Equity, Revenue, Expenses). Choose one entry from each category and explain how it impacts the financial position or performance of a business.

- Analyze the importance of adjustment entries (e.g., Outstanding Expenses, Prepaid Expenses, Accrued Income, Depreciation, Provision for Bad Debts) in accurately reflecting a business’s financial position at the end of an accounting period. Provide specific examples from the source material to support your explanation.

- Compare and contrast the recording of cash-based transactions (e.g., Cash Purchase, Cash Sales) with credit-based transactions (e.g., Credit Purchase, Credit Sales). Explain how these differences affect the current assets and liabilities on a balance sheet.

- Explain the concept of “Drawings” in accounting and how it relates to the owner’s equity. Discuss the two different methods of recording drawings shown in the source material (cash vs. goods used for personal use) and their respective impacts on the business’s accounts.

Glossary of Key Terms

- Account (A/c): A record in an accounting system that summarizes increases and decreases in a specific asset, liability, equity, revenue, or expense.

- Accrued Income: Income that has been earned but not yet received in cash.

- Assets: Economic resources controlled by the business that are expected to provide future economic benefits (e.g., Cash, Bank, Furniture).

- Bank Charges: Fees imposed by a bank for services rendered to an account holder.

- Capital A/c: The owner’s equity account, representing the owner’s investment in the business.

- Cash A/c: An asset account representing physical cash held by the business.

- Closing Stock: The value of unsold goods at the end of an accounting period.

- Commission Received: Income earned by the business for services provided, often as a percentage of a transaction.

- Creditors A/c (Vendor): A liability account representing amounts owed by the business to suppliers for goods or services purchased on credit.

- Credit Purchase: The acquisition of goods or services on credit, meaning payment is deferred to a later date.

- Credit Sales: The sale of goods or services on credit, meaning the customer will pay at a later date.

- Debtors A/c (Customer): An asset account representing amounts owed to the business by customers for goods or services sold on credit.

- Depreciation: The systematic allocation of the cost of a tangible asset over its useful life, reflecting its decline in value.

- Drawings: Withdrawals of cash or goods from the business by the owner for personal use.

- Expenses: Costs incurred in the process of generating revenue (e.g., Rent, Salary, Electricity Expenses).

- Interest Income: Revenue earned from lending money or holding interest-bearing assets.

- Interest Paid: Expense incurred for borrowing money.

- Journal Entry: The initial record of a financial transaction in the accounting system, showing which accounts are debited and credited.

- Loan A/c: A liability account representing money borrowed by the business that must be repaid.

- Opening Stock: The value of unsold goods at the beginning of an accounting period.

- Outstanding Expenses: Expenses that have been incurred but not yet paid.

- P&L A/c (Profit & Loss Account): An account used to summarize revenues and expenses to determine the net profit or loss for an accounting period.

- Prepaid Expenses: Expenses that have been paid in advance for a future period.

- Provision for Bad Debts: An estimate of the amount of accounts receivable that may not be collected.

- Purchase A/c: An expense account used to record the cost of goods bought for resale or for use in the business.

- Revenue/Income: Amounts earned by the business from its primary operations (e.g., Sales, Commission Received, Interest Income).

- Sales A/c: A revenue account used to record the income generated from selling goods or services.

- Trading A/c: An account used to calculate the gross profit or loss of a business by matching the cost of goods sold against sales revenue.

CA Devesh Thakur

(Author)

Author can be reached at: cadeveshthakur@gmail.com