-

📌Income Tax Slab FY 2024-25| Income Tax Calculator FY 2024-25| #shorts #incometax #youtubeshorts

-

📌Income Tax Slab FY 2024-25| Salary Calculator FY 24-25| #shorts #incometax #youtubeshorts #trending

-

📌Senior Citizen Income Tax Slab ITR FY24-25#trending #viralvideo #short #shorts #shortvideo #youtube

-

📌Due Dates for Filing ITR for FY 2024-25 (AY 2025-26) #shorts #incometax #youtubeshorts #trending

-

Income under the head "Salary| Income Tax Computation|proforma showing valuation of “salary” #shorts

-

📌Income Tax Slab FY 2024-25| Old vs New Tax Regime FY 2024-25| #shorts #incometax #youtubeshorts

-

📌Income Tax Calculation FY 24-25| Income Tax Calculator| #shorts #incometax #youtubeshorts #trending

-

📌Income Tax Slab FY 2024-25| Old Tax Regime FY 2024-25| #shorts #incometax #youtubeshorts #short

-

📌Income Tax Slab FY 2024-25|Income Tax Calculator FY 2024-25#shorts #incometax #youtubeshorts #short

-

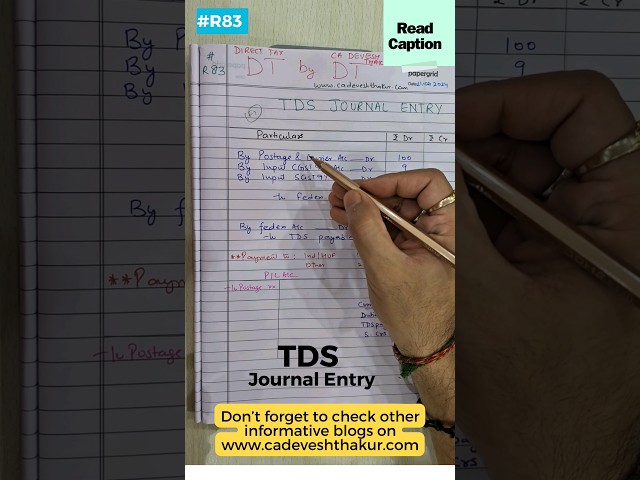

📌How to pass TDS Journal Entry in Books of Accounts/TDS entry with GST in Tally #shorts #shortsfeed

-

How to file Rectification u/s154 online| How to file ITR after receiving Intimation u/s 143(1)

-

📌Deductions under Old vs New Tax Regime #shorts #youtubeshorts #trending #viralvideo #shortvideo

Home Direct Tax