-

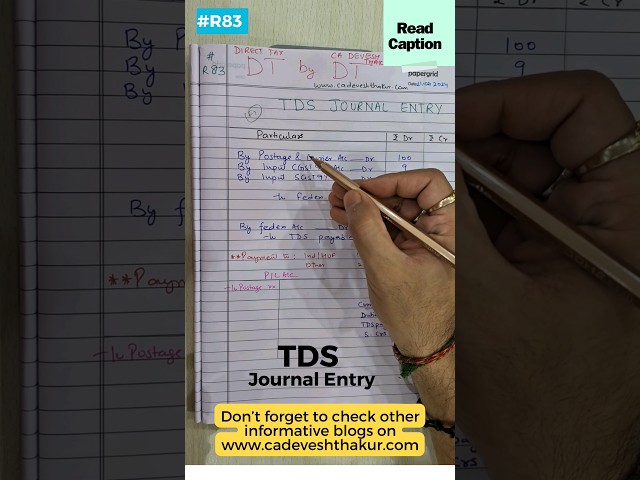

📌How to pass TDS Journal Entry in Books of Accounts/TDS entry with GST in Tally #shorts #shortsfeed

-

📌Credit Note under GST| Treatment of Credit Note in GST #gst #shorts #shortsfeed #short #shortvideo

-

AD Code Registration on New ICEGATE 2.0 Portal| How to apply DSC on Pdf| Documents required|

-

📌Physical verification under GST| #shorts #viral #shortvideo #gst #physicalverification #gstupdates

-

📌Late fees for filing GSTR-3B/ GSTR-1 #gst #shorts #short #shortsfeed #youtubeshorts #youtube

-

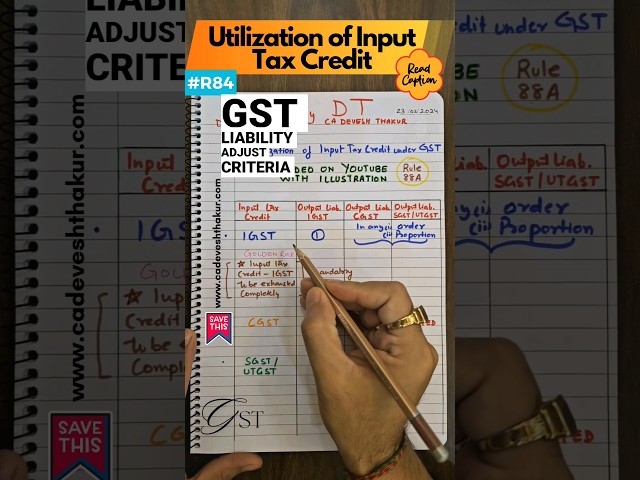

📌How to Set off of Input Tax Credit under GST|Utilization of Input Tax Credit under #gst #shorts #yt

-

📌First Time TDS Return filers? How to file First TDS Return #shorts #shortsfeed #short #shortvideo

-

📌Avail ITC max.99% of electronic credit ledger a/c Rule86B #shorts #short #shortsfeed #youtubeshorts

-

How to register on ICEGATE New Portal| ICEGATE registration process| ICEGATE DSC Registration|

-

GSTR-9 Annual Return? GSTR-9 Annual Return under GST| Pre conditions/Exemption/Due Date #shorts #yt

-

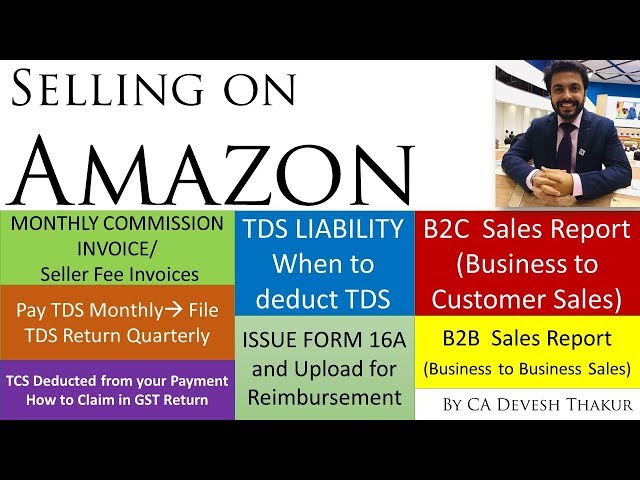

Selling on Amazon|Download Commission Invoice,Sales Return,B2C & B2B sales report|TDS Reimbursement|

-

📌Refund of IGST paid on Export of Goods| GSTR-3B| GSTR-1| #shorts #viral #youtubeshorts #shortvideo

Home E-Commerce Sellers