Looking for a safe and steady source of monthly income? The Post Office Monthly Income Scheme (MIS) is a reliable investment option backed by the Government of India, offering attractive interest rates and capital security. In this blog, we break down the latest features of MIS as of January 1, 2024—including updated interest rates, eligibility criteria, deposit limits, maturity rules, tax implications, and pre-mature closure terms. Whether you’re a senior citizen, salaried individual, or guardian investing for a minor, this comprehensive guide will help you understand how to make the most of your MIS investment.

Get all the essential details in an easy-to-read tabular format to make informed financial decisions. Don’t miss out on this low-risk, income-generating opportunity!

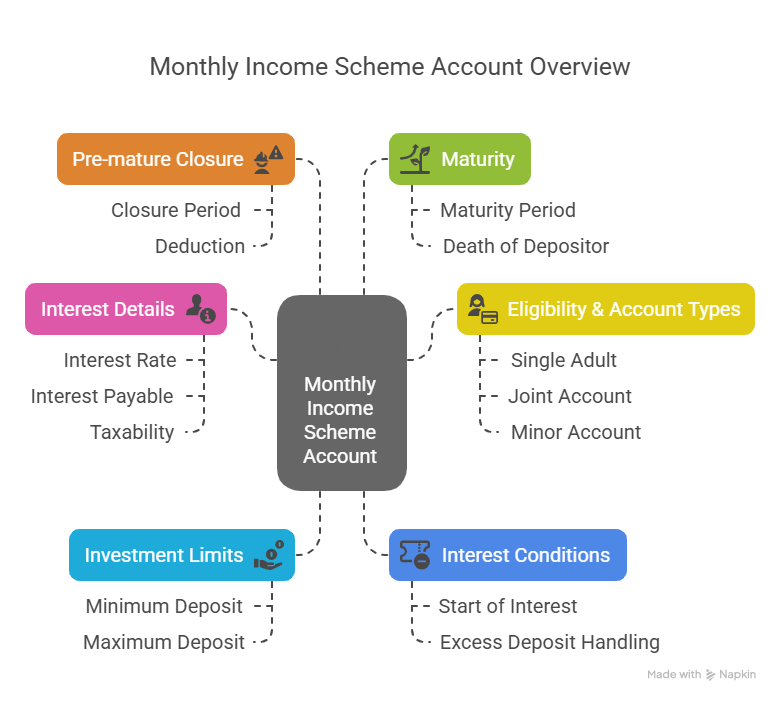

📌 Interest Details

| Particulars | Details |

| Interest Rate | 7.4% per annum |

| Interest Payable | Monthly |

| Effective From | 01.01.2024 |

| Interest Earnings | Taxable in hands of depositor |

| Interest Mode of Payment | Auto credit to PO Savings Account / ECS |

| Interest on Unclaimed Amount | No additional interest |

💰 Investment Limits

| Particulars | Details |

| Minimum Deposit | ₹1,000 (in multiples of ₹1,000) |

| Maximum Deposit (Single Account) | ₹9 lakh |

| Maximum Deposit (Joint Account) | ₹15 lakh (₹7.5 lakh each if 2 holders) |

| Limit for Minor Account (by Guardian) | Separate from guardian’s individual limit |

| Individual Limit Including Joint Share | ₹9 lakh (total including joint accounts) |

👤 Eligibility & Account Types

| Who Can Open | Type of Account |

| Single Adult | Single Account |

| Up to 3 Adults | Joint Account (Joint A or B) |

| Guardian | On behalf of minor / person of unsound mind |

| Minor (above 10 years) | In own name |

🧾 Interest Conditions

| Condition | Details |

| Start of Interest | After completion of 1 month from deposit |

| Excess Deposit Handling | Refunded; PO Savings interest applies |

❌ Pre-mature Closure

| Closure Period | Deduction |

| Before 1 year | Not allowed |

| 1–3 years | 2% of principal amount deducted |

| 3–5 years | 1% of principal amount deducted |

| Required Documents | Prescribed application + passbook |

⏳ Maturity

| Condition | Details |

| Maturity Period | 5 years from account opening |

| On Maturity | Submit form + passbook to PO |

| In case of Death of Depositor | Amount refunded to nominee/legal heir |

| Interest on Death Refund | Paid up to preceding month of refund |