In the world of Goods and Services Tax (GST) compliance, one document has become indispensable for the movement of goods across India — the e-Way Bill. Introduced under the GST regime to ensure transparency, reduce tax evasion, and track the movement of goods in real-time, the e-Way Bill is a legal requirement for specific transactions.

This detailed guide will walk you through:

- What an e-Way Bill is and when it is required.

- Legal provisions under GST for e-Way Bills.

- Step-by-step explanation of the e-Way Bill entry form.

- Example case with fictional data.

- Common mistakes and compliance tips.

- FAQs and practical insights.

1. What is an e-Way Bill?

An e-Way Bill (Electronic Way Bill) is an electronically generated document required for the movement of goods valued at more than ₹50,000 under GST. It contains details of the goods, the consignor (seller), the consignee (buyer), and the transporter.

It ensures that goods being transported comply with GST laws and that tax liabilities are correctly accounted for.

2. Legal Provisions for e-Way Bill

- Governing Law: Section 68 of the CGST Act, 2017 read with Rule 138 of the CGST Rules, 2017.

- Applicability: Required for movement of goods:

- In relation to a supply.

- For reasons other than supply (job work, own use, etc.).

- Due to inward supply from an unregistered person.

- Threshold: Mandatory if the consignment value exceeds ₹50,000.

- Distance Rule: Part-B (vehicle details) must be updated before commencement of movement.

- Validity:

- Up to 100 km – 1 day from the date & time of generation.

- Additional 1 day for every 100 km or part thereof.

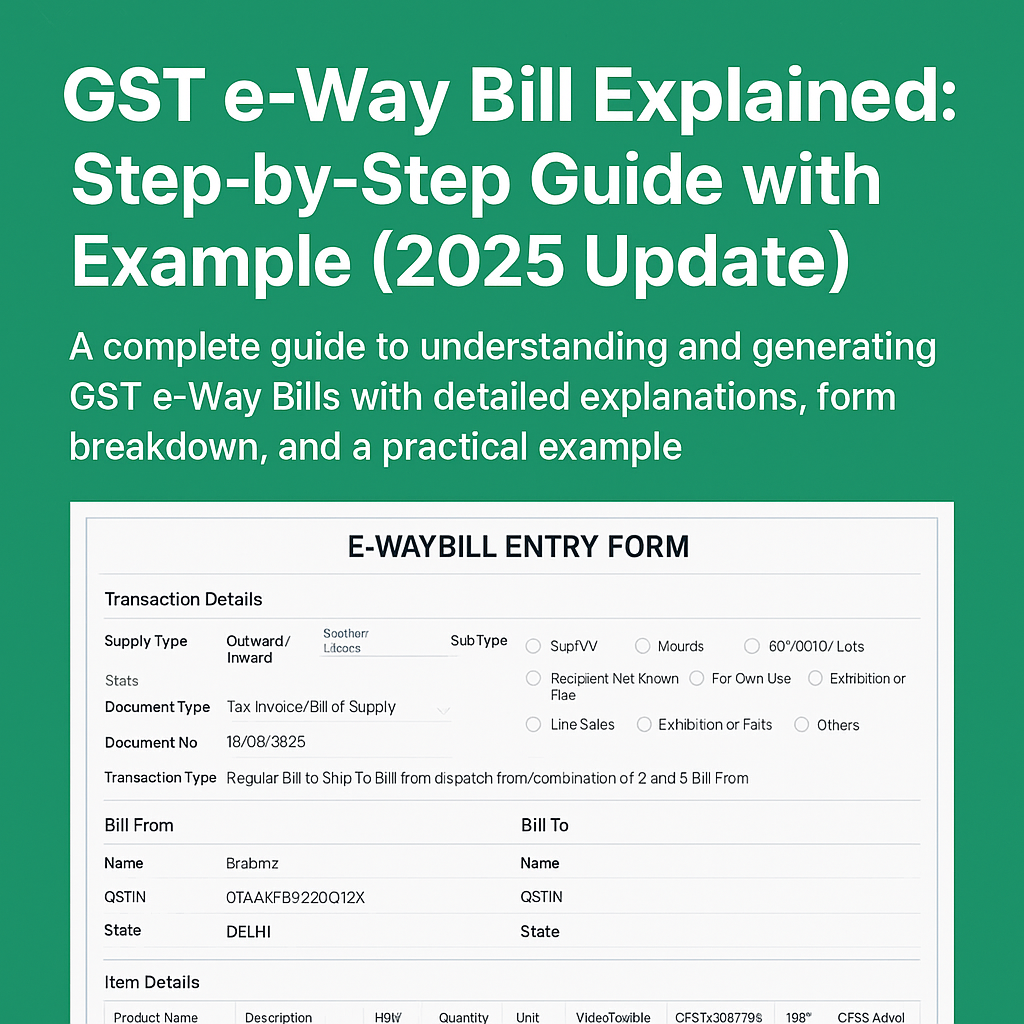

3. e-Way Bill Entry Form – Section-by-Section Explanation

Let us understand the e-Way Bill system using a fictional example of a transaction.

Example Scenario

Seller: Alpha Traders

GSTIN: 07ABCDE1234F1Z5

State: Delhi

Buyer: Star Enterprises

GSTIN: 09PQRSX5678H1Z8

State: Uttar Pradesh

Transaction Type: Regular sale of electrical goods worth ₹1,25,000.

Transport Mode: Road transport by a registered transporter.

A. Transaction Details Section

This section captures the nature of the transaction.

- Supply Type:

- Outward: Goods are moving out from the seller to the buyer.

- Inward: Goods are being received.

In our example, we select Outward.

- Sub Type:

Options include:- Supply

- Export

- Job Work

- SKD/CKD/Lots

- Recipient Not Known

- For Own Use

- Exhibition or Fairs

- Line Sales

- Others

For our example, we choose Supply.

- Document Type:

- Tax Invoice

- Bill of Supply

- Delivery Challan

For a regular sale, Tax Invoice is selected.

- Document No. and Date:

- Document No.: INV-2025/145

- Date: 15/08/2025.

- Transaction Type:

- Regular

- Bill to Ship To

- Bill from Dispatch From

- Combination

In our case, it’s Regular.

B. Bill From Section (Consignor Details)

This captures the seller’s details.

- Name: Alpha Traders

- GSTIN: 07ABCDE1234F1Z5

- State: Delhi

C. Dispatch From Section

Where the goods are physically dispatched from.

- Address: Warehouse No. 12, Industrial Area Phase 2

- Place: West Delhi

- Pincode: 110041

- State: Delhi

D. Bill To Section (Consignee Details)

Details of the buyer.

- Name: Star Enterprises

- GSTIN: 09PQRSX5678H1Z8

- State: Uttar Pradesh

E. Ship To Section

If the goods are shipped to a different location than the “Bill To” party.

Example:

- Address: Plot No. 45, Transport Nagar

- Place: Kanpur

- Pincode: 208023

- State: Uttar Pradesh

F. Item Details Section

Details of the goods being transported.

| Product Name | Description | HSN | Qty | Unit | Value (₹) | CGST (%) | SGST (%) | IGST (%) |

| Electrical Cable | 3-core Copper Cable | 8544 | 50 | Mtr | 1,25,000 | 0 | 0 | 18 |

Here, since the transaction is inter-state, IGST @ 18% applies.

G. Totals Section

- Total Taxable Amount: ₹1,25,000

- IGST Amount: ₹22,500

- Total Invoice Amount: ₹1,47,500

H. Transportation Details Section

- Transporter ID & Name:

- Transporter ID: 27TPT1234GHZ8

- Transporter Name: SafeTrans Logistics Pvt. Ltd.

- Distance: Auto-calculated PIN-to-PIN distance, e.g., 480 km (Delhi to Kanpur).

I. Part-B (Vehicle Details)

- Mode: Road

- Vehicle No.: UP78AB1234

- Vehicle Type: Regular

- Transporter Doc. No. & Date: LR-4598, 15/08/2025

J. Action Buttons in Portal

- Preview: Check details before submission.

- Submit: Generate e-Way Bill number (12-digit unique number).

- Exit: Cancel without saving.

4. Step-by-Step Process to Generate e-Way Bill

- Login to the GST e-Way Bill portal with your credentials.

- Select Generate New.

- Fill in Transaction Details (Outward/Inward, Supply type, etc.).

- Enter Document Details (Invoice No. & Date).

- Fill in Consignor & Consignee details.

- Enter Item details with HSN, quantity, value, and tax rates.

- Fill Transporter & Vehicle details in Part-B.

- Click Submit to generate the e-Way Bill number and print a copy.

5. Common Mistakes to Avoid

- Wrong GSTIN of buyer/seller – leads to rejection.

- Incorrect HSN code – may cause compliance issues.

- Not updating Part-B before vehicle movement.

- Mismatch in invoice and e-Way Bill values.

- Exceeding validity period without extension.

6. Compliance Tips

- Keep your GST registration and transporter ID ready before dispatch.

- Use the auto distance calculator to avoid errors.

- Always match e-Way Bill details with your GST return (GSTR-1).

- Train your staff on e-Way Bill portal usage.

7. Penalties for Non-Compliance

- If e-Way Bill is not generated: Penalty of ₹10,000 or the tax sought to be evaded, whichever is higher.

- Goods may be detained or seized by the authorities.

8. FAQs on e-Way Bill

Q. Is e-Way Bill required for goods below ₹50,000?

No, but voluntary generation is allowed.

Q. Can I cancel an e-Way Bill?

Yes, within 24 hours if the goods are not moved.

Q. Is e-Way Bill required for non-GST goods?

Not generally, except for specific notified items like petroleum products in certain states.

Conclusion

The GST e-Way Bill is more than just a compliance requirement — it’s a vital tool to ensure transparency and smooth interstate and intrastate goods movement. By understanding each section of the e-Way Bill entry form, businesses can avoid penalties and ensure hassle-free transportation of goods.

When in doubt, always double-check your entries, keep records ready, and align your e-Way Bill with GST returns. A small error in an HSN code or vehicle number can delay your shipment and invite unwanted scrutiny.

Mastering the e-Way Bill process is not just good compliance — it’s smart business.