GSTR-3B is a summary return under the Goods and Services Tax (GST) regime in India. Every regular GST-registered taxpayer is required to file this return monthly or quarterly (under QRMP scheme), which contains consolidated details of outward supplies, inward supplies liable to reverse charge, eligible Input Tax Credit (ITC), tax liability, and payment of taxes.

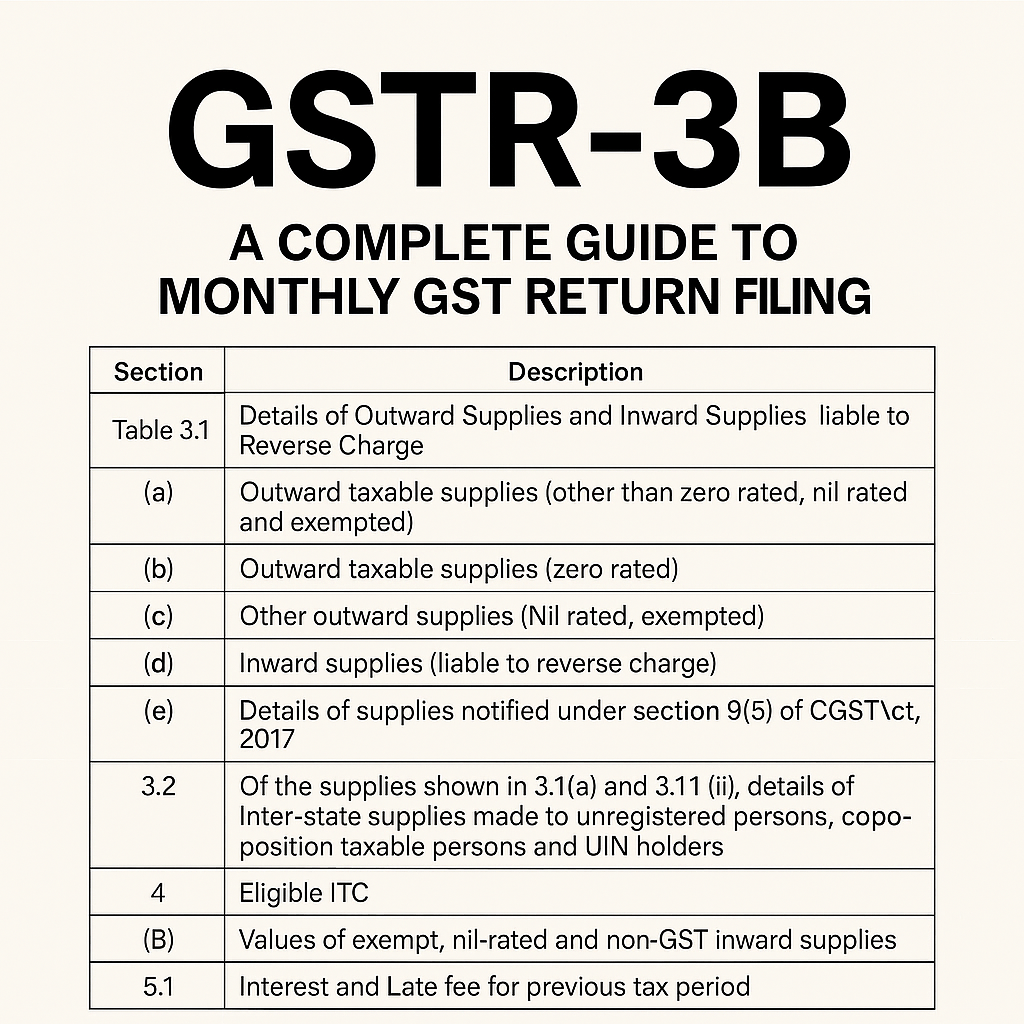

🔹 Table 3.1 – Details of Outward Supplies and Inward Supplies Liable to Reverse Charge

| Sl. | Sub-section | Description | Reference to GSTR-1 | Notes |

| (a) | Outward taxable supplies (other than zero rated, nil rated and exempted) | Regular taxable supplies within India. Includes B2B, B2C large, and B2C small | GSTR-1 Table 4, 5, 7 | Net of credit notes/debit notes |

| (b) | Outward taxable supplies (zero rated) | Export and SEZ supplies without payment of tax (under LUT) or with payment of IGST | GSTR-1 Table 6A & 6B | Must match shipping bill/Bill of Export |

| (c) | Other outward supplies (Nil rated, exempted) | Supplies on which tax rate is 0% or fully exempt u/s 11 | GSTR-1 Table 8 | Do not include here if included in (a) or (b) |

| (d) | Inward supplies (liable to reverse charge) | Purchases where recipient pays GST (e.g., GTA, advocate services) | Not reported in GSTR-1 | Payable under RCM; eligible for ITC |

| (e) | Non-GST outward supplies | Alcohol, petroleum products etc., not under GST | GSTR-1 Table 8 | Disclosed for disclosure purposes |

🔹 Table 3.1.1 – Supplies under Section 9(5)

| Sl. | Description | Explanation | Examples | GSTR-1 Reference |

| (i) | Supplies notified under Section 9(5) | E-commerce operator liable to pay tax on behalf of supplier | Passenger transport (Ola, Uber), accommodation (Oyo) | GSTR-1 Table 4A or 4C if reported by ECO |

🔹 Table 3.2 – Inter-State Supplies to Special Categories

| Sl. | Sub-section | Description | GSTR-1 Reference | Notes |

| (a) | To Unregistered Persons | Inter-State B2C (small) transactions > ₹2.5 lakh | GSTR-1 Table 5 | Declare state-wise breakup |

| (b) | To Composition Taxable Persons | Inter-State B2B to composition dealers | GSTR-1 Table 4A | GSTIN-wise breakup needed |

| (c) | To UIN Holders | Supplies to embassies, UN bodies etc. | GSTR-1 Table 6C | UIN must be mentioned correctly |

🔹 Table 4 – Eligible Input Tax Credit (ITC)

(A) ITC Available (Auto-drafted from GSTR-2B)

| Sl. | Source | Description | GSTR-2B Reference | ITC Eligibility |

| (1) | Import of goods | IGST paid on imports incl. SEZ units | GSTR-2B Part A (Import section) | ITC claimable on bill of entry |

| (2) | Import of services | IGST on cross-border services | GSTR-2B Part A | Self-assessed on RCM basis |

| (3) | Inward supplies (RCM) | Domestic purchases under RCM | GSTR-2B Part A | Includes GTA, advocate, etc. |

| (4) | From ISD | Credit distributed by Input Service Distributor | GSTR-2B Part A (ISD) | Based on ISD invoice |

| (5) | All other ITC | Normal B2B supplies | GSTR-2B Part A | Must be valid tax invoice |

(B) ITC Reversed

| Sl. | Basis | Explanation | Applicable Rules |

| (1) | As per Rules 38, 42, 43 & Section 17(5) | Blocked credits, proportionate reversal for exempt supplies or personal use | Rule 42: InputsRule 43: Capital goodsSec 17(5): Blocked ITC |

| (2) | Others | Voluntary reversal or credit note reversal | Business adjustment |

(C) Net ITC Available

| Description | Formula | Notes |

| Net Available ITC | Table 4(A) – Table 4(B) | Eligible credit that can be used to pay output liability |

(D) Other Details

| Sl. | Description | Explanation |

| (1) | ITC reclaimed (from earlier reversals) | ITC reversed in earlier period now eligible for reclaim |

| (2) | Ineligible ITC under Sec 16(4) & POS rules | Credit ineligible due to late invoice beyond time limit or wrong POS |

🔹 Table 5 – Values of Exempt, Nil-Rated, and Non-GST Inward Supplies

| Sl. | Category | Description | Intra-State | Inter-State | GSTR-2B Reference |

| (a) | From Composition Dealers, Exempt, Nil-rated | Includes purchases from composition dealers or exempted products/services | ₹… | ₹… | GSTR-2B (non-credit section) |

| (b) | Non-GST supply | Alcohol, petroleum, electricity purchases | ₹… | ₹… | Not shown in 2B, disclosed manually |

🔹 Table 5.1 – Interest and Late Fee for Previous Period

| Component | Description | Calculation Formula | Notes |

| Interest | On delay in payment of GST | Based on rate (usually 18% p.a.) on tax amount for days delayed | Auto-populated or manual |

| Late Fee | Delay in filing GSTR-3B | ₹25/day per Act (₹50 total) for returns with liability₹10/day per Act (₹20 total) for Nil returns | Max cap: ₹5,000 per Act (CGST + SGST) |