Input Tax Credit (ITC) under GST: Conditions to Claim and Key Concepts Explained with Examples

Author: CA Devesh Thakur

Category: GST Basics | 30 Days GST Challenge – Day 12

Introduction

Under the Goods and Services Tax (GST) regime, one of the biggest benefits for registered taxpayers is the ability to claim Input Tax Credit (ITC). ITC helps businesses reduce their tax liability by offsetting the tax paid on purchases against tax collected on sales.

But to claim ITC, you must follow certain rules and conditions laid out in the GST law. In this blog, we will break down all such conditions in a student-friendly and easy-to-understand manner, along with relevant examples and illustrations.

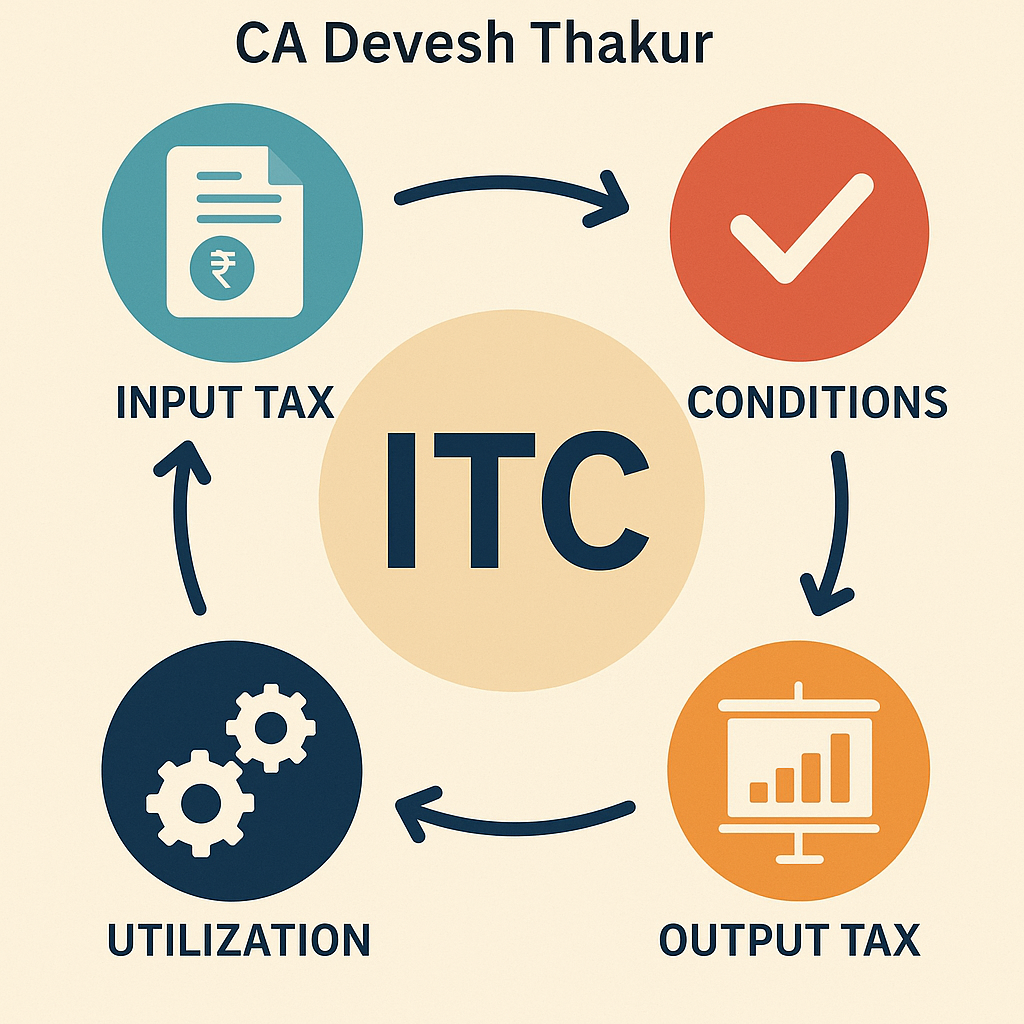

What is Input Tax Credit (ITC)?

Input Tax Credit means reducing the tax you’ve already paid on purchases (inputs) from the tax you have to pay on sales (outputs).

In simple terms:

Output Tax – Input Tax = Tax Payable

Conditions to Claim ITC (Section 16 & Related Rules)

1. You Must Be a Registered Person

Only a registered person under GST is allowed to take ITC. Also, the goods/services must be used for business purposes, not personal use.

Example:

Mr. A runs a stationery shop and buys printing paper and pens for business. GST paid on these purchases can be claimed as ITC.

2. You Must Have a Valid Tax Document

ITC can be claimed only if you have one of the following:

- Tax Invoice from supplier

- Invoice under Reverse Charge Mechanism

- Debit Note

- Bill of Entry (for imports)

- Input Service Distributor (ISD) invoice or credit note

3. Goods or Services Must Be Received

The taxpayer must receive the goods/services.

It is also considered received if:

- Delivered to your agent

- Delivered to another person on your direction

Example:

If goods are delivered to your warehouse or any branch office, it’s considered as received by you.

4. Supplier Must Upload Invoice in GSTR-1 & Reflect in GSTR-2B

After October 9, 2019, a major change was introduced via Rule 36(4).

You can claim ITC only if the invoice is uploaded by your supplier in GSTR-1, and it appears in your GSTR-2B (auto-generated ITC statement).

Understanding Rule 36(4) – Matching Concept

Earlier:

You could claim ITC based on invoice alone.

Now:

You must match ITC with GSTR-2B. No reflection in GSTR-2B means no ITC.

ITC Limits Over Time:

| Period | Maximum ITC allowed |

| Oct 9, 2019 – Dec 31, 2019 | 120% of matched invoices |

| Jan 1, 2020 – Dec 31, 2020 | 110% |

| Jan 1, 2021 – Dec 31, 2021 | 105% |

| From Jan 1, 2022 onwards | 100% only |

Illustration: X Ltd. (Practical Case)

Let’s say X Ltd. has:

- Outward tax liability: ₹54,90,000

- Total eligible ITC as per books: ₹46,20,000

- Ineligible ITC (blocked): ₹7,80,000 (for car purchase)

Here’s the ITC as per GSTR-2B:

| Situation | Reflected ITC | ITC Allowed (100%) | Blocked ITC |

| 1 | ₹36,00,000 | ₹36,00,000 | ₹10,20,000 |

| 2 | ₹44,00,000 | ₹44,00,000 | ₹2,20,000 |

| 3 | ₹45,00,000 | ₹45,00,000 | ₹1,20,000 |

| 4 | ₹46,00,000 | ₹46,00,000 | ₹20,000 |

Conclusion: ITC cannot exceed the amount reflected in GSTR-2B, and blocked credits (like for personal vehicles) are not allowed even if they appear.

What is Blocked ITC? (Section 17(5))

Some ITC is not allowed under any condition. Examples include:

- Motor vehicles for personal use

- Food, beverages, health services

- Membership of clubs, health clubs

- Goods given as free samples

- Works contracts for own construction

Time Limit to Claim ITC

Claim ITC before the earlier of:

- 30th November of the next financial year, or

- Filing of Annual Return

Example:

Invoice Date: 10 October 2024

Claim ITC by:

30 November 2025 or

Date of filing annual return for FY 2024–25 – whichever is earlier

180-Day Rule – Payment to Supplier

If you don’t pay your supplier within 180 days from the invoice date:

- You must reverse ITC

- Also, pay interest

- Reclaim ITC once payment is made

Example:

Invoice Date: 20 July 2023 | Payment made: 18 May 2024

- Reverse ITC and pay interest in February 2024

- Reclaim ITC in May 2024

Capital Goods & Depreciation Rule

If GST paid on capital goods is claimed as depreciation under the Income Tax Act:

- ITC on that GST amount is not allowed

Reversal If Supplier Fails to File GSTR-3B

If your supplier doesn’t file GSTR-3B by 30th September (after the financial year), and you’ve claimed ITC:

- You must reverse ITC by 30 November

- You can reclaim ITC once the supplier files return

Goods Received in Installments

If goods are received in parts (or lots), ITC can be claimed only when the last lot is received.

Final Summary – When Can You Claim ITC?

- You are a registered person

- Goods/services used for business

- You have a valid invoice

- Goods/services received

- Supplier has uploaded invoice in GSTR-1

- Invoice appears in GSTR-2B

- You have paid the supplier within 180 days

- ITC is not blocked under section 17(5)

- You claim ITC within time limits