GST Notes for Students – Simplified [Day 1]

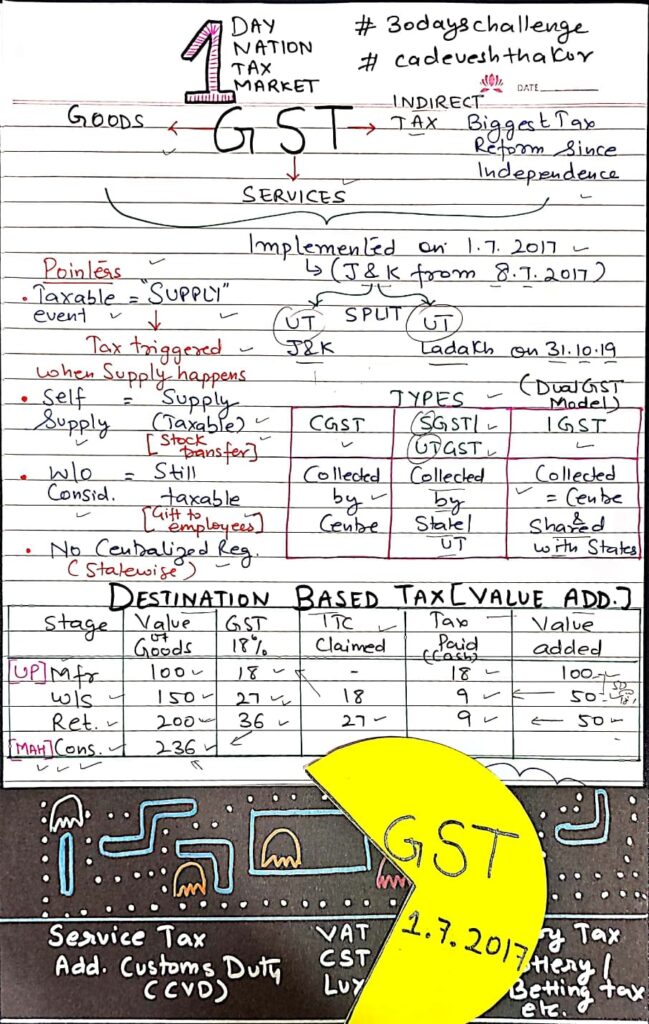

What is GST?

- GST = Goods and Services Tax

- It is an Indirect Tax (tax collected through businesses, not directly from you).

- Biggest tax reform in India after independence.

- It replaced many old taxes like VAT, Service Tax, Excise Duty, etc.

- Introduced the concept of “One Nation, One Tax, One Market.”

When was GST implemented?

- Across India: 1st July 2017

- In Jammu & Kashmir: 8th July 2017

- Later, J&K was split into two Union Territories – J&K and Ladakh on 31st Oct 2019

Important Concepts:

- Taxable Event = “Supply”

- GST is charged when goods or services are supplied, not when manufactured or sold.

- Example: Stock Transfer is also considered supply.

- Even without payment, some supplies are taxable:

- Example: Free gifts to employees.

- State-wise registration:

- Businesses must register separately in each state where they operate.

- No central (one) registration in GST.

Types of GST – Dual Model

| Type | Who Collects It? | Where It Applies? |

| CGST | Central Government | Within same state |

| SGST | State Government | Within same state |

| UTGST | Union Territory Govt | Within UTs |

| IGST | Central Govt (shared with States) | Between different states or UTs |

Destination-Based Tax (Value Addition Example)

| Stage | Value | GST (18%) | ITC Claimed | Tax Paid (Cash) | Value Added |

| Manufacturer (UP) | ₹100 | ₹18 | – | ₹18 | ₹100 |

| Wholesaler (UP) | ₹150 | ₹27 | ₹18 | ₹9 | ₹50 |

| Retailer (UP) | ₹200 | ₹36 | ₹27 | ₹9 | ₹50 |

| Final Consumer (MH) | ₹236 | – | – | – | – |

- ITC = Input Tax Credit: Tax already paid can be used to reduce tax liability.

- Tax is paid on value added at every stage.

- GST follows destination-based tax: tax goes to the state where the goods are finally consumed.

Old Taxes Replaced by GST

GST absorbed and replaced many older taxes like:

- Service Tax

- VAT (Value Added Tax)

- CST (Central Sales Tax)

- Excise Duty

- Luxury Tax

- Entertainment Tax

- Additional Customs Duty (CVD)

- Lottery & Betting Tax

Summary:

GST is a unified indirect tax

Based on supply of goods/services

Follows destination-based principle

Has 3 types: CGST, SGST/UTGST, IGST

Allows Input Tax Credit (ITC)

Removed cascading effect of multiple taxes

MCQ 1: What is the full form of ITC in GST?

A) Integrated Tax Credit

B) Input Tax Credit

C) Indirect Tax Collection

D) Internal Tax Compensation

Correct Answer: B) Input Tax Credit

Explanation:

Input Tax Credit (ITC) means reducing the tax paid on inputs (purchases) from the tax to be paid on output (sales). Businesses pay GST on purchases and can claim credit for it against GST collected on sales.

MCQ 2: Under GST, tax is applicable on which event?

A) Receipt of payment

B) Approval of invoice

C) Supply of goods or services

D) Manufacturing of goods

Correct Answer: C) Supply of goods or services

Explanation:

The taxable event in GST is “supply,” not manufacturing or payment. GST is charged at the time of supply of goods or services as per Section 12/13 of CGST Act.

MCQ 3: Which of the following is a destination-based tax?

A) VAT

B) Service Tax

C) GST

D) Excise Duty

Correct Answer: C) GST

Explanation:

GST is a destination-based tax, meaning the state where the goods/services are consumed gets the tax revenue, unlike VAT or Excise which are origin-based.

MCQ 4: In intra-state supply, GST is divided between which two authorities?

A) CGST and IGST

B) SGST and UTGST

C) CGST and SGST

D) SGST and Customs

Correct Answer: C) CGST and SGST

Explanation:

In intra-state transactions (within same state), GST is split 50-50 between the Central Government (CGST) and State Government (SGST).

MCQ 5: A manufacturer pays ₹18 GST on ₹100. A wholesaler sells the item at ₹150. How much GST does he pay after ITC?

A) ₹27

B) ₹18

C) ₹9

D) ₹0

Correct Answer: C) ₹9

Explanation:

On ₹150, 18% GST = ₹27. Since the wholesaler already has ITC of ₹18 (paid by manufacturer), he pays only the balance ₹9, which is on the value addition of ₹50.

MCQ 6: Which tax is applicable in case of inter-state supply of goods under GST?

A) CGST

B) SGST

C) UTGST

D) IGST

Correct Answer: D) IGST

Explanation:

In inter-state supply, IGST (Integrated GST) is charged. The Central Government collects IGST and later shares the appropriate portion with the destination state.

MCQ 7: Which of the following is NOT replaced by GST?

A) VAT

B) Custom Duty

C) Service Tax

D) Central Excise

Correct Answer: B) Custom Duty

Explanation:

Basic Customs Duty is still levied outside GST. Other taxes like VAT, Service Tax, and Excise have been subsumed under GST.

MCQ 8: What happens when goods are supplied free to employees?

A) No GST is applicable

B) GST is applicable

C) Only Income Tax applies

D) TDS applies but not GST

Correct Answer: B) GST is applicable

Explanation:

If goods are given free of cost, it may still be considered a supply under GST (Schedule I), especially between related persons (like employer and employee). Hence, GST applies.

MCQ 9: What is the benefit of Input Tax Credit (ITC)?

A) Tax refund from government

B) Reduction of overall tax liability

C) Payment of penalty

D) Double taxation on inputs

Correct Answer: B) Reduction of overall tax liability

Explanation:

ITC allows businesses to reduce the tax they have to pay on sales by claiming credit for the GST they paid on purchases. It helps avoid tax cascading and reduces the cost of goods.

MCQ 10: Which of the following is true about GST registration?

A) One GST number is valid across all India

B) GST is optional for all businesses

C) Each state requires separate GST registration

D) Only central government provides GST numbers

Correct Answer: C) Each state requires separate GST registration

Explanation:

GST is a state-wise registration system. If a business operates in multiple states, it needs a separate GSTIN for each state, even if it’s the same PAN.