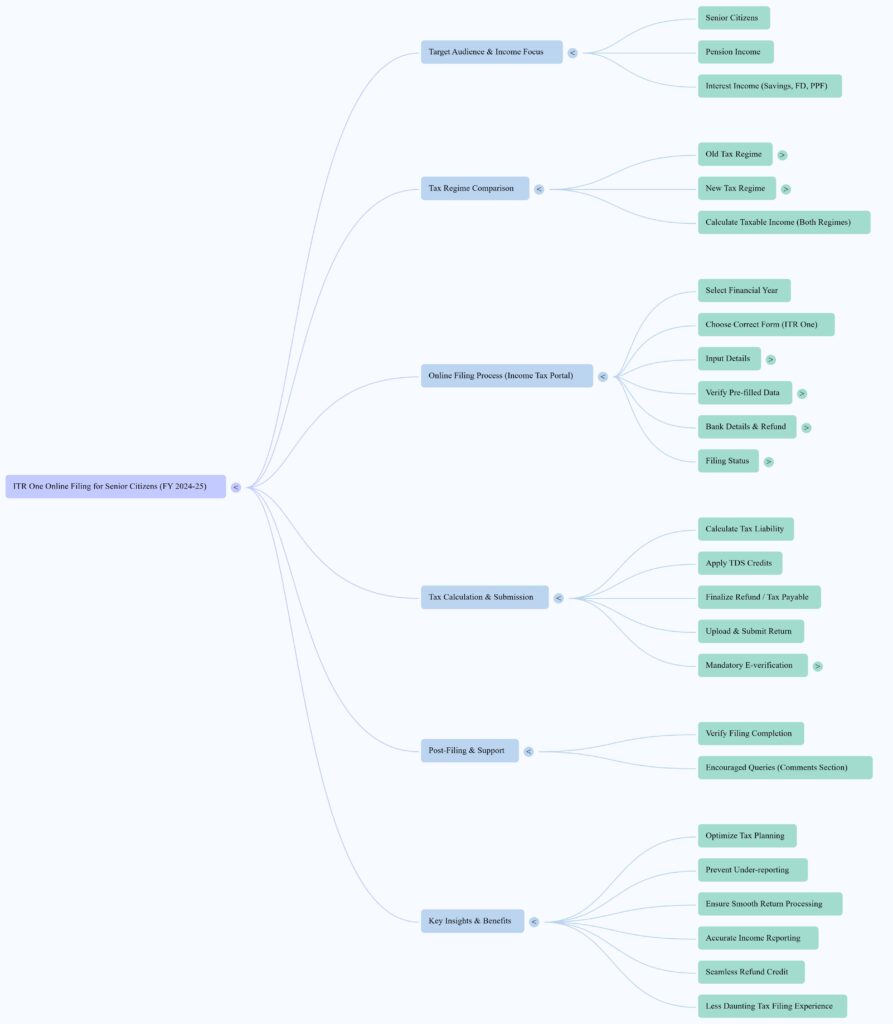

This briefing summarizes key information from the provided source, a comprehensive video guide for senior citizens on filing their Income Tax Return (ITR) One online for the financial year 2024-25. It specifically focuses on individuals with pension and interest incomes, offering practical steps and crucial tax planning insights.

1. Core Purpose and Target Audience

The video aims to provide a “comprehensive, step-by-step guide for senior citizens on how to file their Income Tax Return (ITR) One online for the financial year 2024-25, with specific focus on those earning pension and interest incomes.” It is designed to equip senior citizens with “a clear understanding and practical method to seamlessly file their income tax returns online, ensuring accuracy and maximum benefits from applicable exemptions and deductions.”

2. Key Stages of ITR Filing Covered

The tutorial systematically covers the entire online ITR filing process:

- Initial Setup & Form Selection: Guides viewers through “selecting the financial year, choosing the correct form.”

- Data Input: Demonstrates “inputting personal and income details such as pension, interest income, and deductions.”

- Verification & Correction: Emphasizes “verifying pre-filled data against Form 26AS and manually correcting discrepancies—particularly important when interest income from banks does not reflect automatically.”

- Tax Calculation & Refunds: Explains “how to calculate tax liability, apply TDS credits, and finalize the refund or tax payable amount.”

- Submission & Verification: Showcases “uploading and submitting of the return, followed by the mandatory verification process, emphasizing the various options for e-verification (Aadhaar OTP, EVC, or sending signed ITR-V via post).”

3. Critical Tax Planning Considerations: Old vs. New Tax Regimes

A significant focus of the guide is the comparison between the old and new tax regimes:

- Comparative Analysis: The video provides a “comparative analysis between old and new tax regimes focused on pension and interest incomes,” clarifying which is more beneficial based on income and deductions.

- Deduction Limitations: “The video effectively illustrates that while the new tax regime offers lower tax rates, it limits deductions such as 80C and 80TTB, which can be crucial for pensioners with investments like PPF and saving bank interest.”

- Old Regime Advantage: For senior citizens with eligible investments, “The old regime often allows more deductions resulting in potentially lower tax liability for those with eligible investments.”

- Key Deductions under Old Regime: The video highlights “Deductions under sections 80C (PPF deposits) and 80TTB (interest income exemption up to ₹50,000 for senior citizens) are significant in reducing taxable income. These are not available under the new tax regime.” Taxpayers are advised to “consider these benefits when deciding which tax regime to opt for.”

4. Importance of Data Verification and Manual Updates

The guide strongly emphasizes the need for taxpayers to verify and, if necessary, manually update their income details:

- Cross-Verification is Crucial: “Pre-filled data on the IT portal may not always reflect all sources of income, especially interest incomes from some banks and pension amounts.”

- Preventing Under-reporting: “Checking Form 26AS and ensuring all incomes are accurately reflected prevents under-reporting and potential scrutiny, ensuring smooth return processing.”

- Manual Editing: The tutorial includes “the demonstration on how to manually edit income figures that are under-reported in the pre-filled form due to missing bank reports is crucial.” This ensures “taxpayers must ensure their actual income figures are entered to avoid mismatches and issues later with the Income Tax Department.”

5. Other Essential Filing Aspects

The video covers several other practical and compliance-related aspects:

- Bank Account Validation & Refund Nomination: It details the process for “validating bank accounts through OTP and nominating an account for refunds ensures that any tax refunds are seamlessly credited.” This is particularly helpful for senior citizens who “may be filing returns online for the first time.”

- Understanding Filing Timelines & Status: The guide clarifies “different filing statuses—on-time filing under section 139(1), belated filing under 139(4), and revised returns after the original filing—which helps taxpayers comply correctly depending on when they file their returns, thus avoiding penalties.”

- Mandatory E-Verification: “Filing is not complete without verifying the return through e-verification options or sending signed forms physically.” The video addresses “technical challenges one might face (such as UIDAI server downtime) and alternative methods, reassuring taxpayers of solutions to complete the verification.”

6. Overall Value Proposition

The video is presented as a “practical, detailed tutorial that not only guides senior citizens through the filing process but also educates them on tax planning considerations with respect to regime choices, income reporting, and refund management, thereby making the tax filing experience less daunting and more financially efficient.” It also encourages “interactive queries and clarifications in the comments section.”

Income Tax Return (ITR) One Filing for Senior Citizens Study Guide

Quiz

- What is the primary focus of the ITR One tutorial for the financial year 2024-25? The tutorial’s primary focus is to provide a step-by-step guide for senior citizens on how to file their Income Tax Return (ITR) One online. It specifically targets those who earn pension and interest incomes, equipping them with the knowledge and practical methods for accurate filing.

- What key comparison is made early in the tutorial regarding tax planning? The tutorial begins by making a crucial comparison between the old tax regime and the new tax regime. It clarifies which regime is more beneficial for senior citizens based on their specific income sources (like pension and interest) and available deductions, aiming to optimize their tax planning.

- Why is it important for taxpayers to verify pre-filled data against Form 26AS? It is crucial for taxpayers to verify pre-filled data against Form 26AS because the pre-filled information on the IT portal may not always accurately reflect all sources of income, especially interest income from certain banks. Cross-verification prevents under-reporting, potential scrutiny, and ensures smooth return processing.

- Which specific deductions are highlighted as significant for senior citizens under the old tax regime? Deductions under sections 80C (for investments like PPF deposits) and 80TTB (offering an interest income exemption up to ₹50,000 for senior citizens) are highlighted as significant. These deductions are crucial for reducing taxable income and are not available under the new tax regime.

- What must senior citizens do if their interest income from banks is not automatically reflected in the pre-filled form? If interest income from banks is not automatically reflected in the pre-filled form, senior citizens must manually update and edit these income figures. The tutorial demonstrates how to accurately enter their actual income to avoid mismatches and potential issues with the Income Tax Department.

- Explain the significance of bank account validation for refund purposes. Bank account validation, often through OTP, is significant because it ensures that any tax refunds are seamlessly credited to the correct account. The tutorial details this process to help senior citizens ensure their refunds are received without complications.

- What are the different filing statuses clarified in the video? The video clarifies different filing statuses, including on-time filing under section 139(1), belated filing under section 139(4) for returns filed after the due date, and revised returns for corrections after an original filing. Understanding these statuses helps taxpayers comply correctly and avoid penalties.

- What is the final and mandatory step after uploading and submitting the return? The final and mandatory step after uploading and submitting the return is the verification process. The tutorial emphasizes various options for e-verification, such as Aadhaar OTP or EVC, or the alternative of sending a signed ITR-V via post, highlighting that filing is incomplete without this step.

- How does the new tax regime differ from the old tax regime regarding deductions like 80C and 80TTB? While the new tax regime offers lower tax rates, it significantly differs from the old tax regime by limiting or not allowing crucial deductions like those under sections 80C and 80TTB. For many senior citizens, especially pensioners with investments, the absence of these deductions can make the new regime less beneficial compared to the old.

- What kind of interaction does the tutorial encourage viewers to engage in for further clarification? The tutorial encourages viewers to leave comments for further clarifications and interactive queries. This fosters an environment where taxpayers can seek additional help and understanding beyond the scope of the video itself.

Answer Key

- The primary focus is guiding senior citizens, particularly those with pension and interest incomes, through the online filing of ITR One for FY 2024-25.

- A key comparison is made between the old tax regime and the new tax regime to determine which is more beneficial based on income and deductions.

- Verification against Form 26AS is crucial because pre-filled data may not include all income sources, especially bank interest, preventing under-reporting and potential scrutiny.

- Sections 80C (for PPF) and 80TTB (interest income exemption up to ₹50,000) are highlighted as significant deductions for senior citizens under the old tax regime.

- If interest income is not pre-filled, senior citizens must manually update and edit these figures to ensure accurate income reporting and avoid mismatches.

- Bank account validation ensures that any tax refunds are seamlessly and correctly credited to the nominated bank account.

- The video clarifies on-time filing (139(1)), belated filing (139(4)), and revised returns.

- The final mandatory step is the verification process, either through e-verification methods (Aadhaar OTP, EVC) or by sending a signed ITR-V via post.

- The new tax regime offers lower tax rates but limits or disallows deductions like 80C and 80TTB, which are available under the old tax regime.

- The tutorial encourages viewers to leave comments and engage in interactive queries for further clarifications.

Essay Format Questions

- Discuss the critical factors a senior citizen should consider when choosing between the old and new tax regimes, particularly concerning pension and interest incomes, and explain how deductions play a role in this decision.

- Explain the comprehensive process of verifying and correcting income details on the Income Tax Department’s online portal, emphasizing the role of Form 26AS and the implications of inaccurate reporting.

- Detail the various steps involved in finalizing an ITR One return, from calculating tax liability to the mandatory verification process. Include potential challenges and alternative solutions mentioned in the tutorial.

- Analyze the importance of specific deductions available to senior citizens under the old tax regime (e.g., 80C, 80TTB). How do these deductions impact the overall tax liability, and why might their absence in the new regime be significant for pensioners?

- Describe the practical benefits and challenges senior citizens might face when filing their ITR One online for the first time, as addressed by the tutorial, focusing on aspects like bank account validation, refund nomination, and e-verification.

Glossary of Key Terms

- Income Tax Return (ITR) One: A simplified one-page income tax return form for individuals having income from salary, one house property, other sources (interest, etc.), and agricultural income up to ₹5,000.

- Financial Year (FY) 2024-25: The period from April 1, 2024, to March 31, 2025, for which income is earned and assessed for taxation.

- Old Tax Regime: The traditional tax structure in India that allows taxpayers to claim various exemptions and deductions (e.g., under sections 80C, 80D, HRA) to reduce their taxable income.

- New Tax Regime: An optional, simplified tax structure introduced in India that offers lower tax rates but does not allow most deductions and exemptions available under the old regime.

- Pension Income: Regular payments received by an individual after retirement from employment.

- Interest Income: Income earned from savings bank accounts, fixed deposits (FDs), Public Provident Fund (PPF), or other investments.

- Standard Deduction: A fixed deduction amount allowed to salaried taxpayers, replacing many individual allowances and reimbursements.

- Section 80C: A section of the Income Tax Act that allows deductions for various investments and expenses, such as life insurance premiums, PPF contributions, home loan principal repayment, and tuition fees, up to a specified limit.

- Section 80TTB: A specific section for senior citizens (aged 60 years or more) that allows a deduction for interest income from savings accounts, fixed deposits, and recurring deposits up to ₹50,000.

- Form 26AS: An annual consolidated tax statement that provides details of tax deducted at source (TDS), tax collected at source (TCS), advance tax paid, and self-assessment tax payments by a taxpayer. It’s crucial for verifying pre-filled data.

- Pre-filled Data: Income and deduction details automatically populated by the Income Tax Department on the online portal based on information received from various sources (e.g., employers, banks).

- Tax Deducted at Source (TDS): A mechanism where tax is deducted at the point of income generation (e.g., salary, interest, rent) by the payer and remitted to the government.

- Tax Liability: The total amount of tax an individual or entity is legally obligated to pay to the government.

- Refund: An amount paid back to a taxpayer by the government when the tax paid (e.g., through TDS, advance tax) is more than their actual tax liability.

- Bank Details Validation: The process of verifying the authenticity and correctness of a taxpayer’s bank account details to ensure seamless credit of refunds.

- Nomination: The act of designating a specific bank account for receiving tax refunds.

- On-time Filing (Section 139(1)): Filing the income tax return by the specified due date for the relevant financial year.

- Belated Filing (Section 139(4)): Filing the income tax return after the original due date but within the extended period allowed by law, often incurring penalties.

- Revised Return: A return filed under Section 139(5) to correct any errors or omissions in an original income tax return that has already been submitted.

- e-verification: The electronic process of verifying an income tax return, making it complete. Common methods include Aadhaar OTP, Electronic Verification Code (EVC) through net banking, or sending a signed ITR-V physically.

- Aadhaar OTP: A One-Time Password sent to the mobile number registered with the Aadhaar number, used for e-verification.

- EVC (Electronic Verification Code): A 10-digit alphanumeric code generated via net banking, bank ATM, or demat account, used for e-verification.

- ITR-V: The acknowledgment form generated after filing the ITR online, which needs to be signed and sent to the Income Tax Department’s CPC in Bengaluru if e-verification is not completed.

Bottom of Form

Q1: What is the primary purpose of the provided guide for senior citizens regarding income tax filing?

The primary purpose of the guide is to provide a comprehensive, step-by-step tutorial for senior citizens on how to file their Income Tax Return (ITR) One online for the financial year 2024-25. It specifically focuses on individuals whose income primarily comes from pension and interest, aiming to make the tax filing process seamless, accurate, and financially efficient. The guide also educates them on tax planning considerations, such as choosing the optimal tax regime and managing refunds.

Q2: How does the guide help senior citizens choose between the old and new tax regimes?

The guide provides a comparative analysis of the old and new tax regimes, explaining which is more beneficial for senior citizens, especially those with pension and interest incomes. It illustrates that while the new tax regime offers lower tax rates, it limits crucial deductions like those under Section 80C and 80TTB. For many pensioners with eligible investments such as PPF and savings bank interest, the old regime often allows for more deductions, potentially resulting in a lower tax liability. This detailed comparison helps senior citizens optimize their tax planning by making an informed choice.

Q3: Why is cross-verifying pre-filled data crucial when filing ITR, especially for senior citizens?

Cross-verifying pre-filled data with Form 26AS is crucial because the information automatically populated on the Income Tax portal may not always be complete or accurate, particularly concerning interest incomes from some banks and pension amounts. Manually checking and correcting any discrepancies prevents under-reporting of income, avoids potential scrutiny from the Income Tax Department, and ensures a smooth processing of the tax return. The guide emphasizes the importance of ensuring all actual income figures are accurately reflected.

Q4: Which key deductions are highlighted as significant for senior citizens under the old tax regime, and why are they important?

Under the old tax regime, the guide highlights deductions under Section 80C (for investments like PPF deposits) and Section 80TTB (which provides an interest income exemption up to ₹50,000 for senior citizens) as significant. These deductions are crucial because they can substantially reduce taxable income. It’s important to note that these specific benefits are generally not available under the new tax regime, making them a key consideration for senior citizens when deciding which tax regime to opt for to maximize their tax benefits.

Q5: What essential steps are involved in the practical process of filing ITR One online, as demonstrated in the guide?

The practical process of filing ITR One online involves several essential steps: selecting the correct financial year and form, accurately inputting personal and income details (including pension and interest income), claiming applicable deductions (e.g., under 80C and 80TTB), and verifying pre-filled data against Form 26AS while manually correcting discrepancies. Furthermore, it covers bank details validation for refund purposes, nomination, understanding different filing statuses (on-time, belated, revised), calculating tax liability, applying TDS credits, and finally, uploading, submitting, and mandatorily verifying the return.

Q6: How does the guide address the finalization and verification of the income tax return?

The guide details how to finalize the tax return by calculating the tax liability, applying TDS credits, and determining the final refund or tax payable amount. Crucially, it emphasizes that filing is not complete without the mandatory verification process. It explains various e-verification options, such as Aadhaar OTP and EVC, or the alternative method of sending a signed ITR-V via post. The guide also addresses potential technical challenges (like UIDAI server downtime) and offers reassurance by providing alternative methods to ensure completion of verification.

Q7: What are the different filing statuses explained in the guide, and why are they relevant to taxpayers?

The guide clarifies different income tax return filing statuses, which are relevant for taxpayers to ensure compliance based on when they file. These include:

- On-time filing under Section 139(1): For returns submitted by the due date.

- Belated filing under Section 139(4): For returns submitted after the original due date but within the permissible period.

- Revised returns: For amending an original return that has already been filed. Understanding these statuses helps taxpayers comply correctly with timelines and avoid potential penalties.

Q8: Why is bank account validation and refund nomination crucial during the ITR filing process?

Bank account validation and refund nomination are crucial steps during the ITR filing process because they ensure that any tax refunds due to the taxpayer are seamlessly and correctly credited. The guide details how to validate bank accounts, often through OTP, and nominate a preferred account for receiving refunds. This process is particularly helpful for senior citizens, many of whom might be filing their returns online for the first time, ensuring that their financial benefits are received without issue.