Introduction: Why Sales Growth Strategies Matter in 2025

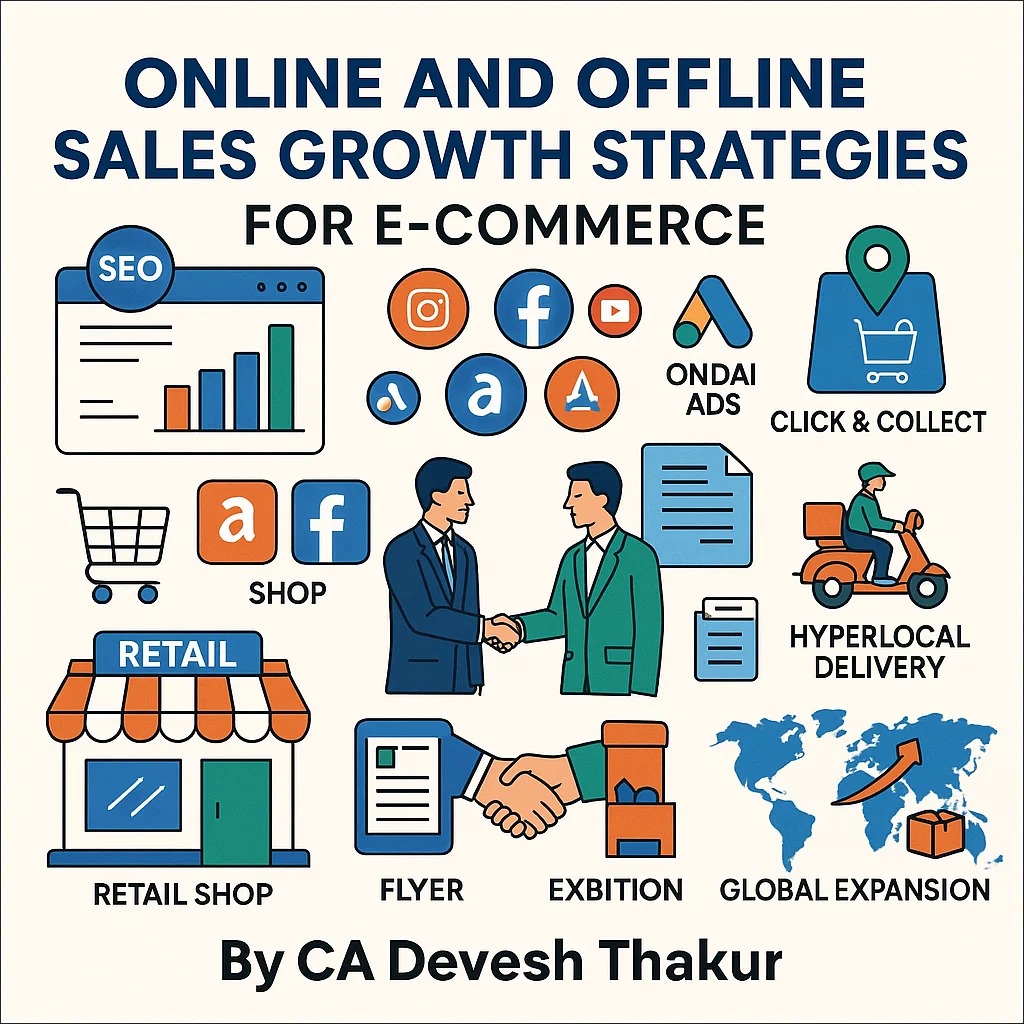

Sales are the lifeline of any business. Whether you’re running an online store, a retail shop, or a hybrid business model, growth depends on reaching more customers, converting them effectively, and retaining them for repeat purchases. In 2025, competition is fierce—customers have endless choices, so businesses must adopt smart sales growth strategies that blend online, offline, and global approaches.

This blog explores comprehensive sales strategies—from SEO and social media marketing to retail partnerships and global exports. Whether you’re a startup, SME, or established brand, these techniques will help you expand your reach, increase revenue, and build long-term success.

1. Online Sales Growth Strategies

The digital shift has made online sales critical for every business. Here’s how you can maximize your online presence:

A. Website / Online Store

Your website is your digital showroom. To succeed:

- SEO & Content Marketing

Optimize product listings, blogs, FAQs, and landing pages with keywords customers search for. Example: A skincare brand can create blogs like “Best Night Creams for Dry Skin” to attract organic traffic. - Social Media Marketing

Platforms like Instagram, Facebook, YouTube Shorts, and Pinterest are powerful for product demos, reels, and influencer collaborations. A fashion brand can showcase styling reels with trending music to attract younger audiences. - Email & WhatsApp Marketing

Personalized offers, abandoned cart reminders, and festive campaigns work wonders. Example: Sending a Diwali special coupon via WhatsApp boosts conversions. - Paid Ads

Google Ads (Search + Shopping), Meta Ads, and YouTube Ads help you reach targeted audiences instantly. - Conversion Optimization

Fast websites, easy checkouts, multiple payment options, and Cash on Delivery (COD) availability increase sales significantly.

B. Marketplaces (Amazon, Flipkart, Meesho, Myntra, etc.)

Selling on established platforms ensures visibility and trust.

- Listing Optimization: Use keyword-rich titles, professional images, and A+ content for higher conversion.

- Marketplace Ads: Sponsored listings, flash deals, and discount coupons improve rankings.

- Reviews & Ratings: Encourage happy customers to leave reviews—social proof builds trust.

- Competitive Pricing: Use dynamic pricing tools to stay ahead of competitors.

👉 Example: A home décor seller on Amazon optimized titles like “Wooden Wall Shelf – Floating, Modern Design for Living Room” and saw a 35% increase in clicks.

2. Offline Sales Growth Strategies

Despite the digital boom, offline presence builds credibility and local trust.

- Retail Partnerships: Tie up with local stores for display and sales. For example, a new food brand tying up with supermarkets.

- Pop-up Stores & Exhibitions: Short-term stalls in malls, fairs, or events help in direct customer interaction.

- B2B Sales: Supplying in bulk to wholesalers, distributors, or corporate clients boosts scale.

- Local Advertising: Flyers, newspaper inserts, radio ads, or billboards target regional customers effectively.

- Offline Sampling: Offering free samples in gyms, salons, or supermarkets creates word-of-mouth marketing.

👉 Case Study: A new beverage company distributed free samples at gyms, resulting in 40% subscription sign-ups.

3. Hybrid / Phygital Sales Channels

Today’s customers want both online convenience and offline experience. Hybrid models offer the best of both worlds.

- Click & Collect: Customers order online and pick up from offline stores. (Used widely by brands like Decathlon & Zara).

- Hyperlocal Delivery: Tie-ups with Swiggy Genie, Blinkit, or Dunzo ensure 10–30 min deliveries.

- Affiliate & Reseller Networks: Give discounts to resellers, micro-influencers, or agents.

- Franchise & Distribution Models: Expand reach without heavy infrastructure costs.

👉 Example: A bakery allows online ordering with same-day pickup, increasing repeat buyers by 50%.

4. Global Expansion

The world is your marketplace. Even small businesses can now sell globally.

- Cross-Border Selling: Platforms like Amazon Global, Etsy, eBay, and Alibaba allow exports with minimal setup.

- Export via DGFT/ICEGATE: Businesses must register IEC code and tie up with courier/3PLs for shipping.

- Niche International Ads: Target NRIs and global buyers through Facebook & Google Ads.

👉 Example: An Indian handicrafts seller expanded to Etsy USA and UK, earning 5x more revenue than domestic sales.

5. Customer Retention & Growth Hacks

Acquiring new customers is expensive; retaining them is 5x more profitable.

- Loyalty Programs: Reward points, cashback, and discounts keep customers returning.

- Referral Programs: Offer incentives for customers who bring friends.

- Subscription Models: Essentials like groceries, cosmetics, and supplements can be delivered monthly/quarterly.

- Upselling & Cross-Selling: Recommend bundles, accessories, or higher-value products.

👉 Example: A coffee brand introduced a monthly subscription pack and retained 70% of its customer base.

6. Logistics & Operations

Without strong backend support, sales cannot scale.

- Fast Delivery: Tie up with multiple courier partners like Delhivery, Shiprocket, and BlueDart for coverage.

- Inventory Management: ERP tools prevent stock-outs and overstocking.

- Packaging: Eco-friendly, attractive packaging increases repeat sales and brand loyalty.

👉 Example: A fashion brand reduced cart abandonment by 30% after offering COD + faster delivery options.

Conclusion

Growing sales in 2025 is no longer about choosing just online or offline—it’s about adopting a multi-channel, customer-first approach. Businesses that focus on online reach, offline trust, global expansion, customer loyalty, and efficient logistics will see sustainable growth.

Whether you’re a startup or an established business, these strategies will help you expand faster, serve better, and stay ahead of competition.