Understanding TDS & TCS in Accounting: Concepts, Journal Entries & Financial Impact

In the world of accounting and taxation, TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) are two crucial mechanisms implemented by the Indian government to ensure early tax collection and income tracking. Both have direct implications on a business’s accounting treatment, compliance, and financial statements. This blog will help you understand:

- What TDS and TCS mean

- Their purpose and scope

- How to record journal entries

- The golden rules of accounting applied

- How they affect the Profit & Loss Account and Balance Sheet

What is TDS (Tax Deducted at Source)?

TDS is a mechanism where tax is deducted by the payer before making certain payments to a payee. These payments include salaries, professional fees, contractor charges, rent, interest, etc.

Purpose:

The primary objective of TDS is:

- To collect tax at the source of income.

- To minimize tax evasion.

- To ensure a steady inflow of revenue to the government.

Example:

If a company is paying ₹50,000 as professional fees and TDS applicable is 10%, the company will deduct ₹5,000 as TDS and pay ₹45,000 to the professional. The ₹5,000 is then deposited with the government.

What is TCS (Tax Collected at Source)?

TCS is tax collected by the seller from the buyer at the time of sale of specified goods such as alcohol, scrap, minerals, and more.

Purpose:

- To collect tax at the point of sale.

- To ensure the buyer declares their income properly.

- To bring high-value transactions under tax scrutiny.

Example:

If a seller sells scrap worth ₹1,00,000 with a TCS of 1%, they will collect ₹1,000 as TCS from the buyer and deposit it with the government.

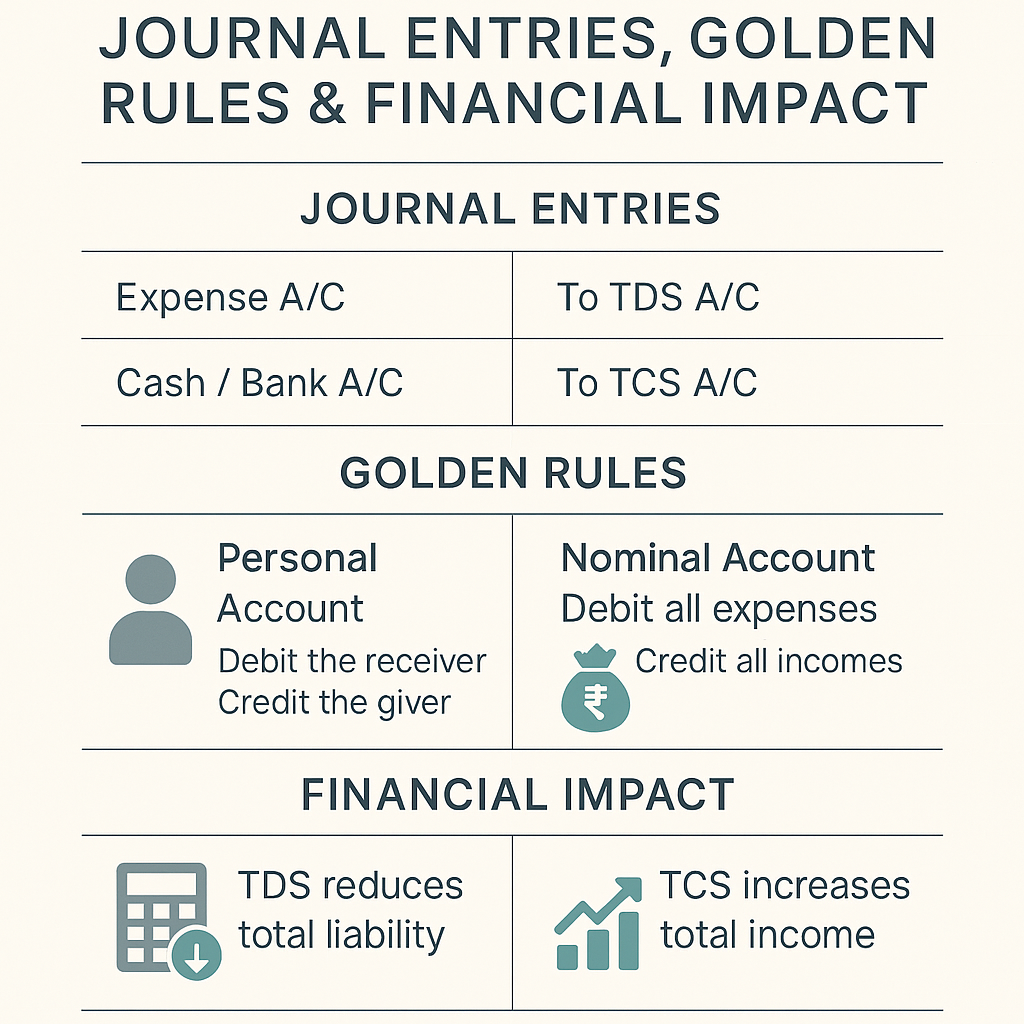

Golden Rules of Accounting: The Foundation of Journal Entries

To properly record TDS and TCS, you must understand the three golden rules of accounting:

| Account Type | Golden Rule |

| Personal A/c | Debit the receiver, Credit the giver |

| Real A/c | Debit what comes in, Credit what goes out |

| Nominal A/c | Debit all expenses/losses, Credit all incomes/gains |

Journal Entries for TDS Transactions (With Explanation)

1. Expense Booked & TDS Deducted

Expense A/c Dr. → (Nominal – Expense incurred)

To Party A/c → (Personal – Creditor)

To TDS Payable A/c → (Personal – Govt. liability)

2. Payment to Party (Net of TDS)

Party A/c Dr.

To Bank A/c

3. Remittance of TDS to Government

TDS Payable A/c Dr.

To Bank A/c

4. If Company Bears TDS

Expense A/c Dr.

TDS Payable A/c Dr.

To Party A/c

5. TDS on Salary

Salary A/c Dr.

To Employee A/c

To TDS Payable A/c

6. Net Salary Paid

Employee A/c Dr.

To Bank A/c

7. TDS on Rent

Rent A/c Dr.

To Landlord A/c

To TDS Payable A/c

8. TDS on Professional Fees

Professional Fees A/c Dr.

To Professional A/c

To TDS Payable A/c

Journal Entries for TCS Transactions (With Explanation)

1. Sale of Goods (Where TCS Applies)

Debtor A/c Dr. → (Personal – Receivable including TCS)

To Sales A/c → (Nominal – Revenue)

To TCS Payable A/c → (Personal – Liability to govt)

2. Amount Received from Customer

Bank A/c Dr.

To Debtor A/c

3. Deposit of TCS to Government

TCS Payable A/c Dr.

To Bank A/c

4. TCS Refund (Rare Case)

Bank A/c Dr.

To TCS Receivable/Income A/c

Note: Filing of TCS return does not require a journal entry as it does not impact the books directly.

Impact on Financial Statements

Profit & Loss Account (Extract)

| Particulars | Amount (₹) |

| Expenses | |

| Rent | xx |

| Professional Fees | xx |

| Salaries (Gross) | xx |

| TDS Borne by Company (if any) | xx |

| Income | |

| Sales Revenue | xx |

| TCS Collected (if recognized) | xx |

TDS is not shown as an expense or income. It is a liability until paid.

Balance Sheet (Extract)

Liabilities:

| Head | Amount (₹) |

| TDS Payable | xx |

| TCS Payable | xx |

Assets:

| Head | Amount (₹) |

| Bank Balance | xx |

| Advance to Vendors | xx |

| TCS Refund Receivable | xx |

Conclusion

Understanding the correct accounting treatment of TDS and TCS is essential not just for statutory compliance but also for accurate financial reporting. By applying the golden rules of accounting, you ensure that these transactions are recorded in the proper heads and reflect correctly in your Profit & Loss and Balance Sheet.

Keeping books accurate when it comes to TDS and TCS ensures:

- Smooth audits

- Avoidance of penalties

- Clarity of financial position