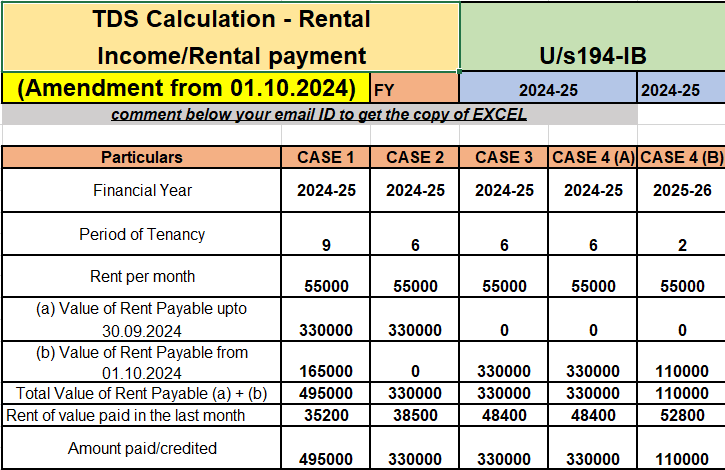

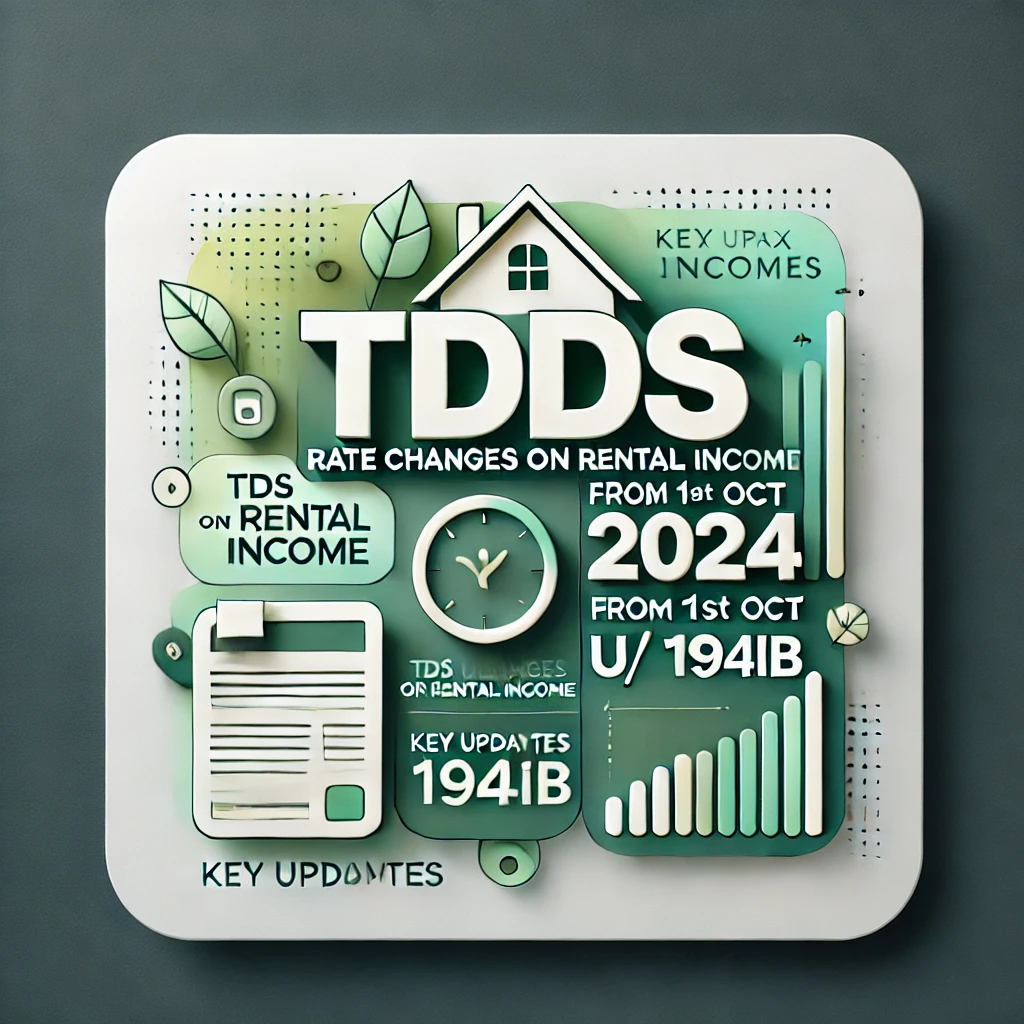

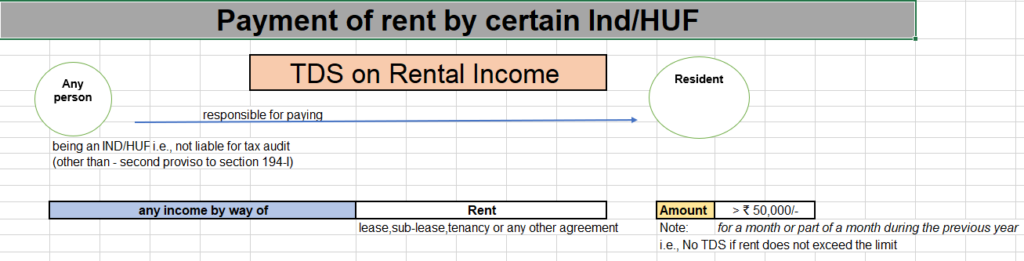

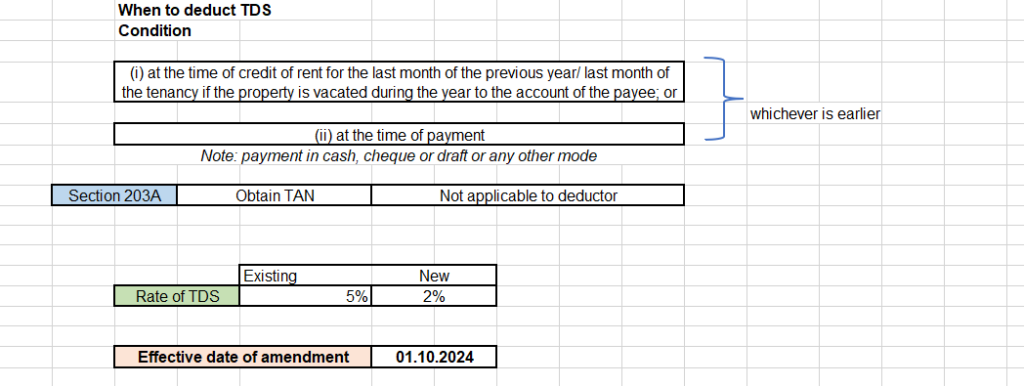

Case 1 Tenancy period 01.04.2024 to 31.12.2024 Tenant Mr. Varma Landlord Mr. Sharma (Resident) Rent p.m 55,000 Rent paid on 15th of same month

Case 2 Tenancy period 01.04.2024 to 30.09.2024 Tenant Mr. Varma Landlord Mr. Sharma (Resident) Rent p.m 55,000 Rent paid on 15th of same month

Case 3 Tenancy period 01.10.2024 to 31.03.2025 Tenant Mr. Varma Landlord Mr. Sharma (Resident) Rent p.m 55,000 Rent paid on 15th of same month

Case 4 Tenancy period 01.10.2024 to 31.05.2025 Tenant Mr. Varma Landlord Mr. Sharma (Resident) Rent p.m 55,000 Rent paid on 15th of same month Note: Two financial year covered it this. FY 2024-25 & FY 2025-26