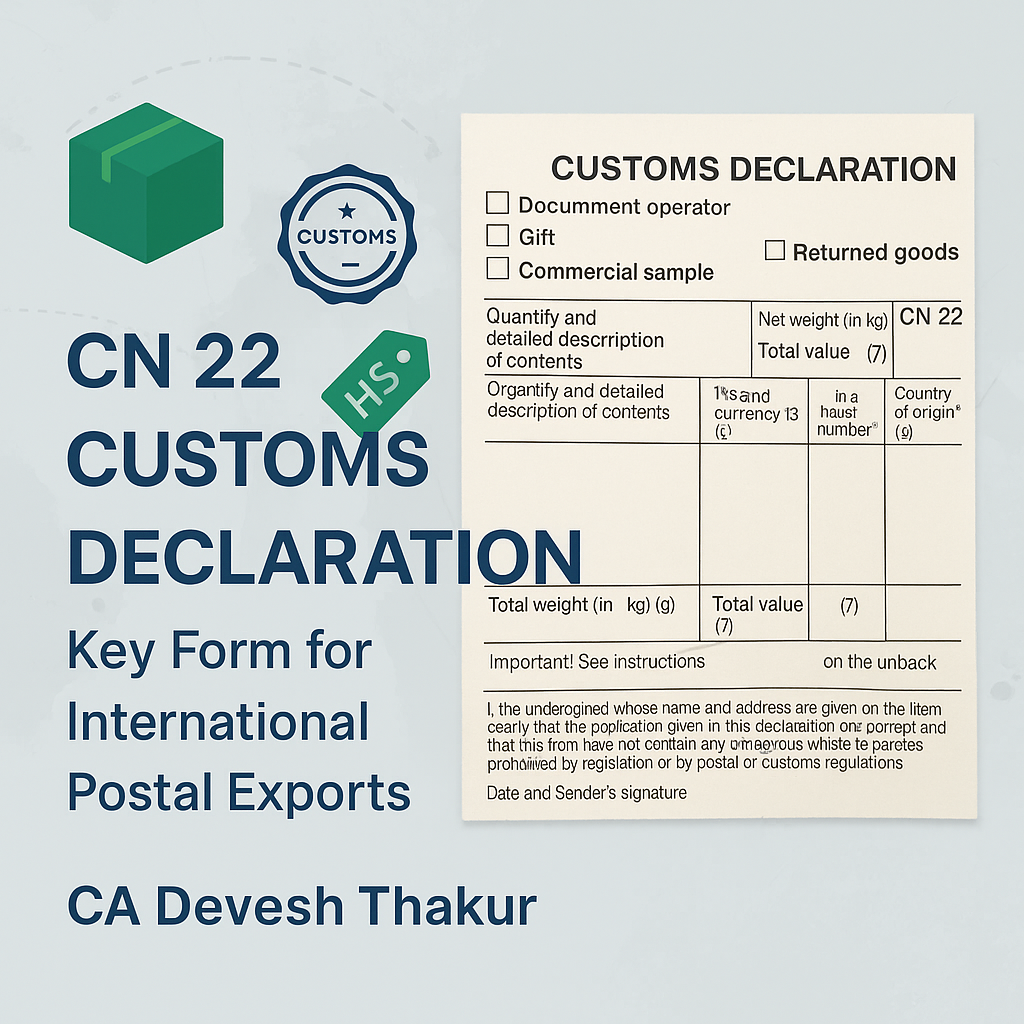

What is CN 22 and Who Needs It?

The CN 22 Customs Declaration is a mandatory document for sending goods internationally via post. It provides key information to customs authorities, ensuring smooth clearance and compliance with regulations. It’s widely used by small businesses, eCommerce sellers, and individuals for low-value shipments.

When is CN 22 Used?

You must use CN 22 if:

- The value of the item is up to 300 SDR (Special Drawing Rights).

- The item is shipped via postal services.

- The parcel contains gifts, commercial samples, documents, or returned goods.

For items above this value, the CN 23 form is required.

How to Correctly Fill CN 22 Form

To avoid delays, you must fill the CN 22 in English, French, or an accepted language of the destination country. Here’s how each field is used:

- Quantity and Detailed Description (Field 1):

- Avoid vague terms like “clothes” or “electronics.”

- Use specific descriptions such as “2 men’s cotton shirts” or “1 Bluetooth speaker.”

- Net Weight (Field 2):

- Mention the exact weight of each item in kilograms (kg).

- Value and Currency (Field 3):

- Mention the price and currency clearly, e.g., INR 500 or USD 6.

- HS Tariff Number (Field 4):

- A 6-digit code used internationally for customs classification. Look up on WCO Harmonized System or Indian Tariff Portal.

- Country of Origin (Field 5):

- Specify the country where the goods were produced, assembled, or manufactured.

- Total Weight and Value (Field 6 & 7):

- Add up total values and weight of all items in the parcel.

- Date and Sender’s Signature (Field 8):

- Confirms your declaration is truthful and complete. Sign and date the form.

Important Tips for CN 22 Users

- Always attach the CN 22 form on the outside of the parcel.

- Attach an invoice for commercial shipments.

- Select a proper reason for export – Gift, Sale, Documents, Return, etc.

- Do not leave any field blank.

- For commercial shipments, always use HS code and origin details.

Difference Between CN 22 and CN 23

| Feature | CN 22 | CN 23 |

| Value Limit | Up to 300 SDR | Above 300 SDR |

| Size | Small (74 x 105 mm) | Larger form |

| Level of Detail | Basic details | More comprehensive |

| Invoice Attachment | Recommended | Mandatory |

| Who Should Use | Small parcels, samples | High-value shipments |

Common Mistakes to Avoid

- Using vague descriptions.

- Forgetting HS codes for commercial items.

- Leaving out sender’s signature.

- Selecting “Gift” for commercial shipments.

- Not attaching invoices.

FAQs on CN 22 for Indian Exporters

Q1. Is CN 22 required for private courier services like DHL or FedEx?

A: No, they have their own commercial invoice & customs forms.

Q2. Can I use CN 22 for business samples?

A: Yes, select “Commercial Sample” and attach a zero-value invoice.

Q3. What happens if I use CN 22 incorrectly?

A: Customs may delay, reject or return your parcel.

Q4. What is 300 SDR in INR?

A: It varies. As of now, approx. ₹27,500. Always check live rates.

Conclusion

Using the CN 22 form correctly helps ensure faster customs clearance and prevents penalties or delays. Whether you’re sending small parcels, samples, or low-value goods internationally via post, understanding CN 22 is essential. When in doubt, consult with postal authorities or export professionals.

Download CN 23 Form Template

👉 [Click Here to Download CN 23 Customs Declaration Form (PDF)]

📧 YouTube: cadeveshthakur

📸 Instagram: @cadeveshthakur