Introduction

If you’re involved in international trade—whether sending gifts, commercial items, or samples—the CN 23 customs declaration form is crucial for hassle-free customs clearance. This blog explores the CN 23 form in detail, explaining each section and offering practical tips to avoid delays, penalties, or seizures of your parcel.

What is CN 23 Customs Declaration Form?

The CN 23 is a mandatory customs declaration form used when exporting goods via postal or courier services, particularly when the parcel exceeds a specific value threshold (usually over €300 or its equivalent). It provides customs authorities with essential information about the contents, value, and origin of the shipment.

When is CN 23 Required?

CN 23 must be used when:

- The declared value of the parcel is above the standard threshold.

- You are sending commercial goods, samples, or returns internationally.

- Customs documentation is mandatory due to the country of destination.

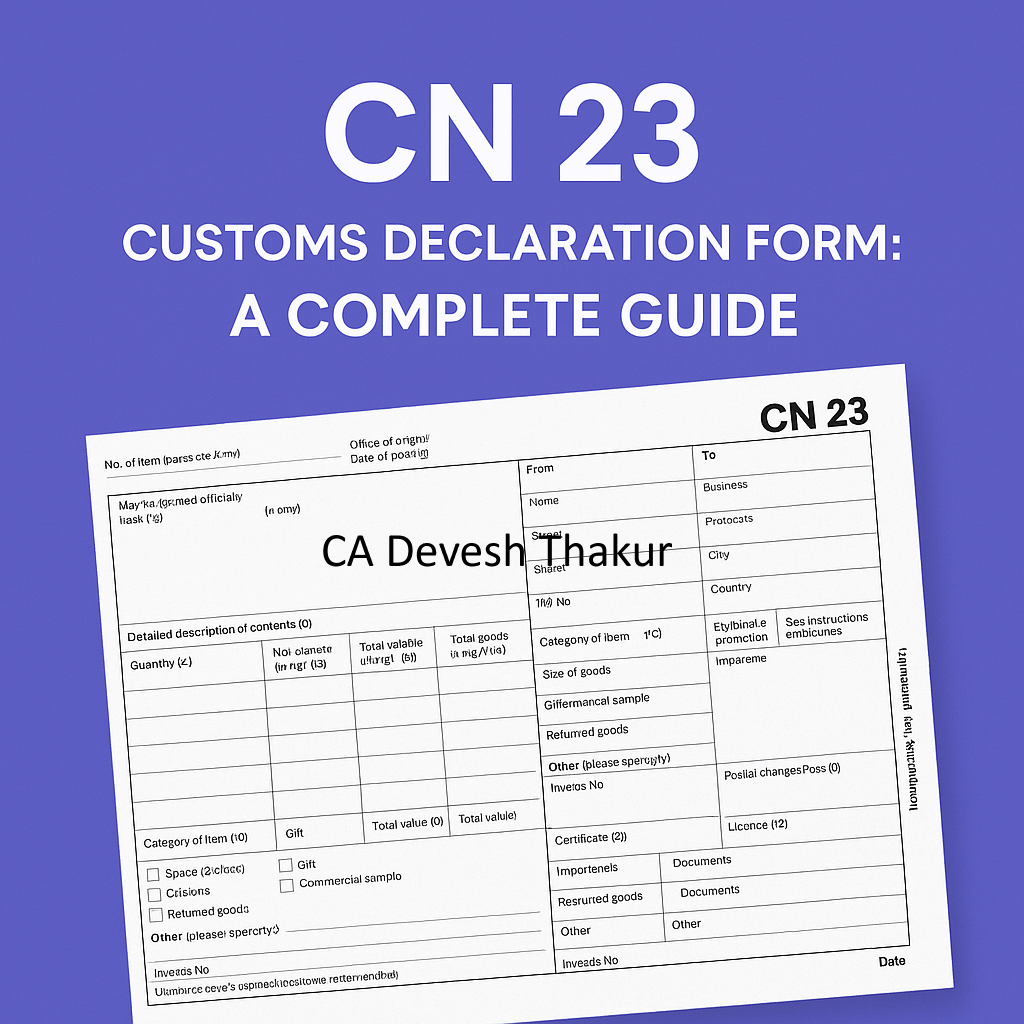

Structure of CN 23 Form

Below is a section-by-section breakdown of the CN 23 form:

1. Detailed Description of Contents (Box 1)

- Clearly specify each article (e.g., “Men’s cotton shirts”).

- Vague terms like “clothes” or “accessories” are not allowed.

2. Quantity and Unit (Box 2)

- State the quantity of each item.

- Mention the unit (e.g., pieces, meters, liters).

3. Net Weight (in kg) (Box 3)

- Weight of the item excluding packaging.

4. Total Gross Weight (Box 4)

- Total parcel weight including packaging, used for calculating postage.

5. Value of Item (Box 5)

- Enter item value per piece or unit.

- Mention the currency used (USD, INR, EUR, etc.).

6. Total Value (Box 6)

- Cumulative value of all contents.

7. HS Tariff Number (Box 7)

- 6-digit Harmonized System (HS) code for classification of goods.

- Based on the World Customs Organization’s system.

8. Country of Origin (Box 8)

- The country where the goods were produced or manufactured.

9. Postal Charges / Fees (Box 9)

- Include postage costs and any additional fees (like insurance).

10. Category of Item (Box 10)

- Tick one or more:

- Sale of goods

- Gift

- Commercial sample

- Returned goods

- Other (Specify)

11. Comments / Restrictions (Box 11)

- Mention if goods are subject to quarantine, sanitary regulations, or import restrictions.

12. Licence No. (Box 12)

- If a license is required, mention the number.

13. Certificate No. (Box 13)

- If a certificate (like origin or health certificate) is attached.

14. Invoice No. (Box 14)

- Mandatory for commercial items. Attach invoice copy.

15. Signature and Date (Box 15)

- Declaration of accuracy and liability by the sender.

Sender & Recipient Details

Make sure to clearly fill in:

- Full name and business name (if applicable)

- Street, City, Postcode, and Country

- Telephone number and email address (recommended for tracking and customs queries)

Instructions for Using CN 23

- Language: Fill in English, French, or the language accepted by the destination country.

- Visibility: Attach the form outside the parcel in a transparent adhesive pouch. If enclosed, a label should indicate the presence of customs documents.

- Documentation: Ensure all required certificates, invoices, and permits are attached.

- Accuracy: Misdeclaration can lead to fines, penalties, or seizure.

Tips for Error-Free CN 23 Submission

- Use detailed item names (avoid generic terms).

- Ensure HS codes and values are correct.

- Include commercial invoice for business shipments.

- Add importer/exporter reference numbers, where required.

- Always sign and date the form.

Importance of CN 23 in International Shipping

Properly filled CN 23 helps:

- Speed up customs clearance

- Prevent shipment delays

- Comply with international trade regulations

- Avoid disputes and penalties

Conclusion

Filling the CN 23 customs declaration form correctly is not just a formality—it is essential to ensure your package reaches its destination smoothly. Whether you’re a business exporting goods or an individual sending a gift abroad, this form bridges your shipment with international customs procedures. Pay attention to the details, attach supporting documents, and declare honestly to keep your international trade journey hassle-free.

Download CN 23 Form Template

👉 [Click Here to Download CN 23 Customs Declaration Form (PDF)]

📧 YouTube: cadeveshthakur

📸 Instagram: @cadeveshthakur