The Goods and Services Tax (GST) in India, implemented as a major indirect tax reform, emphasizes transparent tax governance through its audit provisions. This document outlines the mandatory record-keeping requirements for registered persons under Section 35 of the CGST Act and Rule 56 of the GST Act, detailing various registers for inward and outward supplies, job work, goods on approval, stock, and related party transactions. A key focus is on the GST audit process, which is compulsory for taxpayers with an annual turnover exceeding INR 2 Crores. The audit, conducted by a Practicing Cost Accountant (CMA) or Chartered Accountant (CA), culminates in the submission of FORM GSTR-9C, a reconciliation statement that aligns audited annual accounts with GST annual returns (GSTR-9), identifies discrepancies, and recommends any additional tax liability.

Main Themes and Key Insights

- Mandatory Record Keeping and Audit Threshold:

- Legal Basis: “According to Section 35 of CGST Act, every registered person shall keep and maintain all records at his principal place of business.” If multiple places of business are registered, records for each must be maintained at that specific location.

- Audit Applicability: An annual audit is mandatory for “every registered person whose turnover during a financial year exceeds the prescribed limit (which is 2 Crores at present).”

- Auditor Requirement: The audit must be conducted “by a Practicing cost accountant (CMA) or a Practicing chartered accountant (CA)” and the results, along with a reconciliation statement, must be submitted in “FORM GSTR-9C.”

- Categories of Records to be Maintained:

- Activity-Specific Maintenance: Rule 56 mandates that “Accounts and Records shall be maintained separately for each activity namely manufacturing, trading and provision of services.”

- Detailed Registers: The source outlines comprehensive lists of registers required, categorized as:

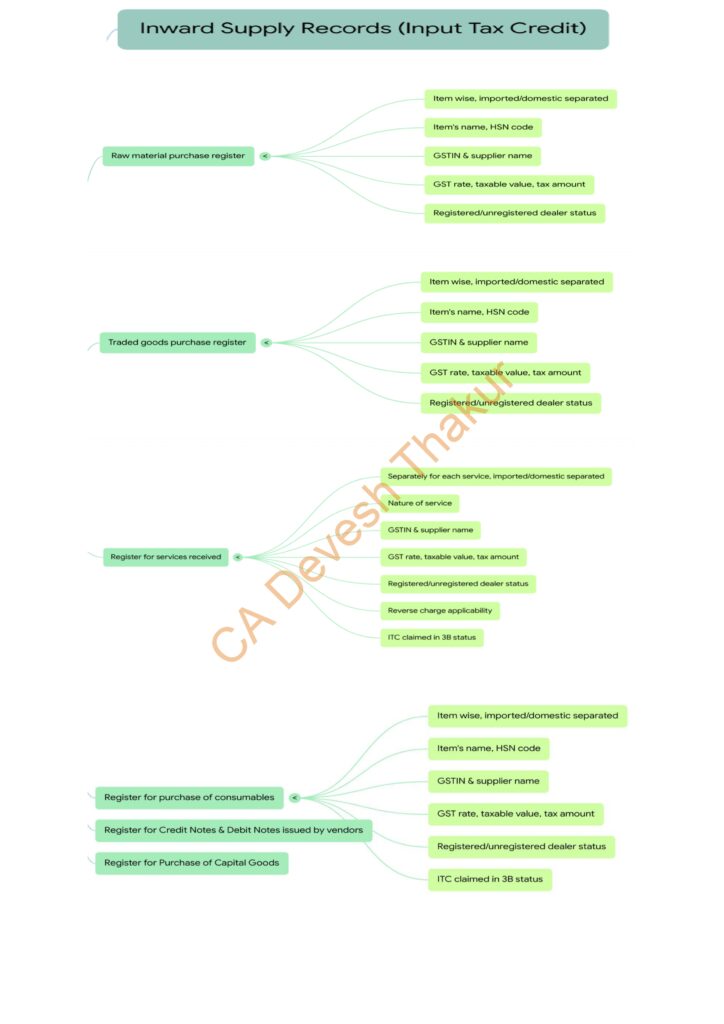

- Inward Supply Records: Includes registers for raw material purchases, traded goods purchases, services received, consumables, credit/debit notes from vendors, and capital goods purchases. These records are crucial for input tax credit (ITC) management.

- Outward Supply Records: Includes registers for tax invoices, bills of supply (for exempted goods/services), credit/debit notes issued, receipt/refund vouchers, goods sent free of cost (FOC) as sample/gift, goods sent on approval, and related party/distinct person supplies. These reflect tax liability.

- Goods Sent on Job Work Records: Delivery challan details for sending/receiving, rejection/scrap records, capital goods sent for job work, and records of dies/moulds/jigs & fixtures.

- Stock Register Records: Highly important, differentiated for manufacturers (raw material consumption, finished goods production), service providers (input goods for service provision), and traders (traded goods). Crucially, “Input Tax Credit is not available in case of raw material or inputs lost, destroyed, written off or disposed and needs to be disclosed separately and accounted for.”

- Related Party/Distinct Person Transaction Record: Separate register ensuring valuation aligns with GST rules. “Persons shall be deemed to be distinct person if having multiple registration against same PAN number.”

- Record of Returns Filed: Encompasses GSTR 3B, GSTR 1, GSTR 2A, ITC 4, and GSTR 9.

- Key Audit Procedures and Verifications:

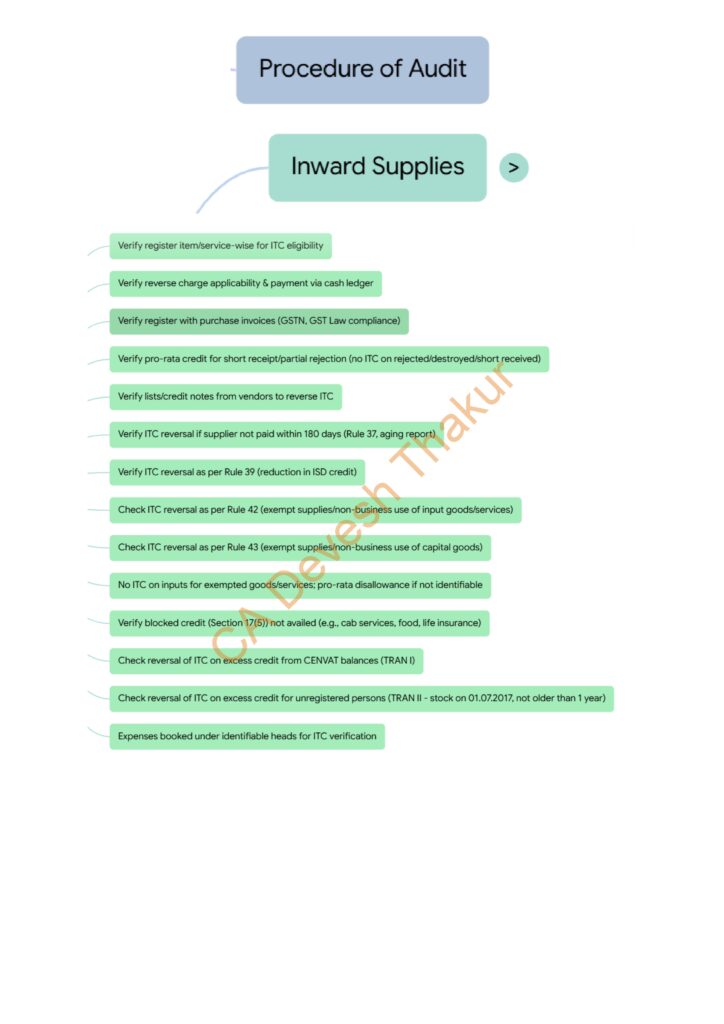

- Inward Supply Audit Focus:Verification of ITC eligibility/ineligibility.

- Checking reverse charge mechanism (RCM) applicability and payment via cash ledger.

- Matching inward supply registers with supplier invoices for GST compliance (e.g., GSTIN).

- Pro-rata credit for short receipts/rejections.

- Verification of ITC reversal based on specific rules (Rule 37 – non-payment to supplier within 180 days, Rule 39 – reduction in ISD credit, Rule 42 & 43 – inputs/capital goods for exempted/non-business purposes).

- Ensuring ITC is not availed on “blocked credit” items under Section 17(5) (e.g., cab services, food and beverages, life insurance).

- Checking CENVAT balances carried forward from the old regime (TRAN I/II) for correct ITC claims. “Expenses should preferably be booked under identifiable heads which enables easy distinction as to applicability of ITC.”

- Outward Supply Audit Focus:Correct classification using HSN/SAC codes and application of GST rates.

- Verification of invoicing procedures and correct type of GST charged based on place of supply.

- Review of exempted supplies, exports, and RCM applicable supplies.

- Valuation of related party/distinct person transactions as per rules (e.g., “cost of production + 10%”).

- Verification of delivery challan details (SKD goods, FOC goods, samples, gifts, branch transfers).

- Cross-verification of outward supplies with GSTR 1 and GSTR 3B to establish tax liability.

- Job Work & Goods on Approval Audit Focus:Verification of delivery challans and regular filing of ITC-04.

- Crucially, ensuring goods sent for job work have not exceeded stipulated return times (360 days for manufacturing inputs, 3 years for capital goods). If expired, calculate “liability of GST and interest payable on the same” from the dispatch date.

- For goods on approval, ensuring acceptance or return within one year (180 days for previous regime). Identify pending challans to determine “tax liability & interest,” with the current interest rate being “18% per annum i.e. 1.5 % per month.”

- Stock Register Audit Focus:Verification of comprehensive stock registers for each traded/manufactured good, including HSN code, UOM, quantity, GST Rate, and value.

- Separate maintenance and ITC reversal verification for goods “supplied free of cost (FOC) for Sample, Gift or lost / stolen / destroyed / written off.”

- Authenticity of disclosures for lost/stolen/destroyed goods.

- Related Party/Distinct Person Transaction Audit Focus:Verification of these transactions and compliance with GST valuation rules.

- Returns Filed Audit Focus:Verification of GST liability and ITC availed in GSTR 3B.

- Matching GSTR 1 (invoice-wise) with GSTR 3B (summary) and books of accounts.

- Verification of amendments, serial numbers, and reconciliation of ITC in GSTR 3B with books and GSTR 2A.

- Confirmation that “all liability under reverse charge is paid through cash ledger.”

- GSTR-9C: The Annual Audit Form:

- Structure: “GSTR-9C is an annual Audit form and it has two major parts, Part A for reconciliation and Part B for certification of Audit report.”

- Part A Components:Pt. I Basic details of the tax payers.

- Pt. II Reconciliation of Turnover: Compares turnover declared in Audited Annual Financial Statement with GSTR-9, requiring auditors to “report reason of un-reconciled balance, inconsistencies and deviations.”

- Pt. III Reconciliation of Tax Paid: Reconciles rate-wise liability and amount payable with GSTR-9, requiring reasons for discrepancies.

- Pt. IV Reconciliation of Input Tax Credit (ITC): Reconciles ITC availed as per audited Financial Statement (for multi-GSTIN units under same PAN) and GSTR-9, reporting “any deviation and exception with respect to applicable law.”

- Pt. V Auditor’s Recommendation on Additional Liability: The auditor must “quantify the amount of tax payable if any, with respect to deviation, exception and inconsistencies with the law.”

Conclusion

The GST audit framework in India, as detailed in this source, is rigorous and comprehensive. It places significant emphasis on meticulous record-keeping, item-wise and activity-wise segregation of data, and strict adherence to ITC rules, especially concerning eligibility and reversals. The GSTR-9C form serves as a critical reconciliation tool, ensuring transparency and compliance by requiring auditors to identify and explain any discrepancies between a taxpayer’s financial statements and their GST returns, ultimately aiming for a “strong and transparent tax governance system.” Taxpayers and auditors alike must fully understand these nuances to ensure proper compliance and avoid penalties

I. Overview of GST Audit

A. Purpose and Scope

- What is GST Audit? A mechanism under Indian GST law for strong and transparent tax governance.

- Applicability: Required for taxpayers whose turnover during a financial year exceeds a prescribed limit (currently ₹2 Crores).

- Auditing Professionals: Must be conducted by a Practicing Cost Accountant (CMA) or a Practicing Chartered Accountant (CA).

- Submission: Audited annual accounts and a certified reconciliation statement (FORM GSTR-9C) must be submitted.

B. Legal Basis

- Section 35 of CGST Act: Mandates the maintenance of records at the principal place of business and specifies the audit requirement.

- Rule 56 of GST Act: Details the specific accounts and records to be maintained, requiring separate maintenance for manufacturing, trading, and provision of services.

II. Accounts and Records Maintenance

A. General Requirements

- Records must be maintained at the principal place of business.

- If multiple places of business are registered, records for each must be kept at the respective additional place.

- Separate records for manufacturing, trading, and services.

B. Inward Supply Records (Input Tax Credit)

- Raw Material Purchase Register: Item-wise, separate for imported/domestic, including item name, HSN code, GSTIN/supplier name, GST rate, taxable value, tax amount, and registered/unregistered dealer status.

- Traded Goods Purchase Register: Similar details as raw material, item-wise, imported/domestic.

- Register for Services Received: Separate for each service, imported/domestic, including nature of service, GSTIN/supplier name, GST rate, taxable value, tax amount, registered/unregistered dealer status, reverse charge applicability, and ITC claim status (3B).

- Register for Purchase of Consumables: Item-wise, imported/domestic, including item name, HSN code, GSTIN/supplier name, GST rate, taxable value, tax amount, registered/unregistered dealer status, and ITC claim status (3B).

- Register for Credit Notes and Debit Notes issued by vendors.

- Register for Purchase of Capital Goods.

C. Outward Supply Records (Tax Liability)

- Register of Tax Invoices: Serially issued for domestic and export supply, including HSN/SAC Code, item/service name, Invoice No. & date, GSTIN/recipient name, Place of supply, Type of supply, GST rate, taxable value, tax amount, reverse charge applicability, and tax liability payment status (3B).

- Register of Bills of Supply: For exempted goods/services, serially issued for domestic/export supply, including HSN/SAC Code, item/service name, Invoice No. & date, GSTIN/recipient name, Place of supply, Type of supply, Exemption status, and Total value.

- Register of Credit Notes and Debit Notes issued: Serially maintained with reference to original documents.

- Register of receipt and refund voucher: Serially issued and recorded.

- Register of goods sent free of cost (FOC) as sample or gift.

- Register of goods sent on approval basis on delivery challan.

- Register of related party/distinct person supplies.

D. Goods Sent on Job Work Records

- Delivery Challan Details for sending and receiving goods.

- Register of rejection/scrap at job worker’s end.

- Register of capital goods sent for Job Work.

- Register of Delivery Challan for sending and receiving capital goods.

- Register of Dies, Moulds, Jigs & Fixtures provided to Job worker.

- Register of rejection/scrap at job worker’s end.

E. Stock Register Records

- For Manufacturers:Periodical records of raw material consumption, consumables consumed, and production.

- Quantitative details with HSN code, GST Rate, and value.

- Stock Register Format for Raw Materials (Opening, Receipts, Consumption, Lost/Stolen/Destroyed/Written off/Disposed, Scrap/By-product/Wastage, Closing).

- Input tax credit not available for lost/destroyed/written off/disposed raw materials.

- Periodical records of input services received, showing proportionate value utilized for taxable, exempt, and FOC goods production.

- Finished Goods (production/purchase) stock register format (Opening, Manufactured, Lost/Stolen/Destroyed/Written Off/Disposed, FOC, Supplied, Closing).

- For Service Providers:Accounts showing details of services utilized and quantitative details of goods used in provision of services.

- Stock Register of input goods for provision of service (service-wise details: HSN code, GST Rate, Qty, Value; Opening, Purchase, Lost/Stolen/Destroyed, Service-wise consumption, Closing).

- No ITC available if input goods are lost, stolen, or destroyed.

- For Traders:Accounts details of each traded good (HSN Code, GST Rate, Qty, Value).

- Stock Register Format (Opening, Purchase, Lost/Stolen/Destroyed/Written Off, FOC, Sold, Closing).

- No ITC on purchase if goods are lost/stolen/destroyed/written off or supplied FOC.

F. Related Party/Distinct Person Transaction Record

- Separate register for these transactions.

- Ensure valuation methodology aligns with GST valuation rules (e.g., cost of production + 10% for related party supplies under Rule 30).

- Definition of Related Parties: Officer/director commonality, legal partners, employer/employee, 25%+ shareholding, direct/indirect control, common control/management, control over another entity, same family members.

- Definition of Distinct Person: Multiple registrations under the same PAN.

G. Record of Returns Filed

- Includes GSTR 3B, GSTR 1, GSTR 2A, ITC 4, GSTR 9.

III. Audit Procedures

A. Audit of Inward Supplies

- Verify inward supply register (item/service-wise) for ITC eligibility/ineligibility.

- Check for reverse charge applicability: verify if tax liability paid through cash ledger.

- Cross-verify register with purchase invoices (check GSTIN, GST Law compliance).

- Verify pro-rata credit for short receipt/partial rejection (ITC not available on rejected/destroyed/short received material).

- Verify credit notes received from vendors for ITC reversal.

- Verify ITC reversal for non-payment to supplier within 180 days (Rule 37) using aging reports.

- Verify ITC reversal as per Rule 39 (reduction in ISD credit).

- Verify ITC reversal as per Rule 42 (input goods/services for exempted supplies or non-business purposes).

- Verify ITC reversal as per Rule 43 (capital goods for exempted supplies or non-business purposes).

- Ensure ITC is not availed on supplies mentioned under Section 17(5) (blocked credit, e.g., cab services, food, life insurance).

- Check reversal of ITC on excess credit taken from old regime (TRAN I, TRAN II).

- Recommendation: Book expenses under identifiable heads (e.g., specific insurance types) for easy ITC eligibility verification.

B. Audit of Outward Supplies

- Verify correct classification (HSN/SAC Code) and applicable tax rate.

- Sort outward supplies by HSN/SAC code to ensure uniform GST rate application.

- Verify invoicing procedure and correct GST type charged based on place of supply.

- Review exempted goods/services, exports, reverse charge applicable supplies.

- Verify related party/distinct person transactions and their valuation as per Rule 27 to 35.

- Verify delivery challan details for SKD goods, FOC goods, samples, gifts, branch transfers.

- Verify non-returnable gate passes (testing, scrap, samples); check GST liability payment or ITC reversal.

- Cross-verify outward supplies with GSTR 1 and GSTR 3B to establish tax liability.

C. Audit of Goods Sent on Job Work

- Check delivery challans for goods sent.

- Verify regular filing of ITC-04.

- Ensure pending challans for inputs (manufacturing) do not exceed 360 days, and for capital goods, 3 years.

- If stipulated time expired (1 year for inputs, 3 years for capital goods), list pending challans (Qty, HSN code, taxable value) for GST liability and interest calculation (from delivery challan date).

D. Audit of Goods Sent on Approval Basis

- Verify supply on delivery challan.

- Ensure challans are not pending for more than one year (180 days if sent in previous regime).

- List pending challans for tax liability and interest calculation (18% p.a. or 1.5% per month from the day after tax was due).

E. Audit of Stock Register

- Verify maintenance of stock register for each traded good (HSN code, UOM, Qty, GST Rate, Value).

- Verify separate maintenance and ITC reversal for FOC, sample, gift, lost/stolen/destroyed/written off goods.

- Verify authenticity of disclosures for lost/stolen/destroyed/written off goods.

F. Audit of Related Party/Distinct Person Transactions

- Verify transactions according to valuation rules (e.g., cost of production + 10% for Rule 30).

G. Audit of Returns Filed

- Verify GST liability and ITC availed in GSTR 3B.

- Verify GSTR 1 (invoice-wise) matching with GSTR 3B (summary) and books of accounts.

- Verify all amendments in GSTR 1.

- Verify proper recording of Invoice Serial Documents Numbers and Challan Serial numbers in GSTR.

- Verify correct ITC claims in GSTR 3B, reconciliation with books and GSTR 2A, and absence of ineligible inputs.

- Verify all reverse charge liability paid through cash ledger.

IV. GSTR-9C: Annual Audit Form

A. Structure

- Part A: Reconciliation (5 basic parts).

- Part B: Certification of Audit report.

B. Part A Breakdown

- Pt. I Basic details of the tax payers.

- Pt. II Reconciliation of Turnover: Compare declared turnover in Audited Annual Financial Statement with Annual Return (GSTR9); report reasons for un-reconciled balance, inconsistencies, and deviations.

- Pt. III Reconciliation of tax paid: Reconcile rate-wise liability and amount payable with GSTR 9; report reasons for un-reconciled amounts.

- Pt. IV Reconciliation of Input Tax Credit (ITC): Reconcile ITC availed as per audited Annual Financial Statement (for multi-GSTIN units under same PAN) and GSTR 9; report deviations and exceptions.

- Pt. V Auditor’s recommendation on additional Liability: Quantify tax payable due to deviations, exceptions, and inconsistencies.

Quiz: GST Audit Fundamentals

Instructions: Answer each question in 2-3 sentences.

- What is the primary purpose of GST Audit as implemented in India, and to whom does it apply?

- According to Section 35 of the CGST Act, where must a registered person maintain their records, especially if they have multiple places of business?

- Name three specific registers or records that must be maintained as part of ‘Inward Supply Records’ under GST law.

- If a taxpayer manufactures both taxable and exempted goods, how should input tax credit on common input services or capital goods be handled during an audit?

- Under what conditions must an auditor verify the reversal of Input Tax Credit (ITC) if the supplier has not been paid?

- List two key pieces of information that should be included in a ‘Register of Tax Invoices’ for outward supplies.

- What is the stipulated time limit for goods sent on job work (inputs for manufacturing) to be returned, and what happens if this limit is exceeded?

- Define “related parties” in the context of GST records and audit, providing two examples of how entities can be considered related.

- When auditing stock registers for traders, what specific goods or scenarios require separate maintenance and verification of ITC reversal?

- What is the main objective of Part A, Point II of GSTR-9C, concerning reconciliation of turnover?

Quiz Answer Key

- The primary purpose of GST Audit is to establish a strong and transparent tax governance system in India. It applies to taxpayers whose turnover during a financial year exceeds a prescribed limit, currently ₹2 Crores.

- According to Section 35 of the CGST Act, every registered person must keep and maintain all records at their principal place of business. If there are multiple places specified in the registration certificate, accounts and records for each must be maintained at that additional place of business.

- Three specific registers to be maintained as part of Inward Supply Records are: Raw Material Purchase Register, Traded Goods Purchase Register, and Register for Services Received. Other valid answers include Register for Purchase of Consumables, Register for Credit Notes and Debit Notes issued by vendors, and Register for Purchase of Capital Goods.

- If a taxpayer manufactures both taxable and exempted goods using common input services or capital goods, the input tax credit on these should be applied on a pro-rata basis to individual products. This mechanism for pro-rata disallowance of Input Tax Credit is available under ITC rules.

- An auditor must verify the reversal of Input Tax Credit if the supplier has not been paid within 180 days from the invoice issue date, as per Rule 37. This compliance can be checked by verifying the aging report of vendors.

- Two key pieces of information for a Register of Tax Invoices are: HSN/SAC Code with item/service name of goods or services supplied, and Invoice No. and date. Other valid answers include GSTIN and name of recipient, Place of supply, Type of supply, applicable GST rate, taxable value and tax amount, status whether reverse charge is applicable, and status whether tax liability is paid though 3B or not.

- The stipulated time limit for inputs sent to a job worker for manufacturing is 1 year (360 days). If this time is exceeded, the auditor must list such pending challans for computation of GST liability and interest payable, calculated from the date the goods were initially sent.

- Persons are deemed to be related if they can influence each other’s transactions or operations. Examples include an officer/director of one business also being an officer/director of another, or if any person holds at least 25% of shares in another company directly or indirectly.

- When auditing stock registers for traders, specific goods like those supplied free of cost (FOC) for sample or gift, or those lost, stolen, destroyed, or written off, must be maintained separately. For these, the auditor must verify the reversal of Input Tax Credit on their purchase.

- The main objective of Part A, Point II of GSTR-9C is the reconciliation of turnover declared in the Audited Annual Financial Statement with the turnover declared in the Annual Return (GSTR9). The auditor must report any un-reconciled balances, inconsistencies, and deviations, along with the reasons for them.

Essay Format Questions

- Discuss the critical role of maintaining detailed and accurate ‘Stock Register Records’ for manufacturers, service providers, and traders under GST law. Explain how the audit procedures for each type of taxpayer differ concerning their stock registers and the implications of non-compliance (e.g., ITC reversal).

- Explain the concept of ‘Input Tax Credit (ITC) reversal’ under GST, detailing at least three distinct scenarios mentioned in the source material where ITC reversal is mandated. For each scenario, describe the auditor’s procedure to verify compliance.

- Analyze the significance of ‘Related Party/Distinct Person Transactions’ in GST audit. Define what constitutes related parties and distinct persons, outline the specific record-keeping requirements for such transactions, and elaborate on the valuation rules an auditor must verify.

- Compare and contrast the record-keeping and audit procedures for ‘Inward Supply Records’ versus ‘Outward Supply Records’. Highlight the specific details required in each set of records and explain how an auditor cross-verifies these records with GST returns (GSTR 1, GSTR 3B, GSTR 2A) to ensure compliance.

- Describe the structure and purpose of FORM GSTR-9C, the annual audit form under GST. Elaborate on the five basic parts of Part A (reconciliation) and the key responsibilities of the auditor in each section, particularly concerning the identification and quantification of additional tax liability.

Glossary of Key Terms

- GST Audit: A mandatory audit under India’s Goods and Services Tax (GST) law for taxpayers exceeding a prescribed turnover limit, conducted by a Practicing Cost Accountant or Chartered Accountant, aiming for transparent tax governance.

- CGST Act: Central Goods and Services Tax Act, 2017, one of the primary legislations governing GST in India, which mandates record keeping and audit requirements.

- Principal Place of Business: The primary location declared by a registered person where their main business activities are conducted and where principal GST records must be maintained.

- Turnover: The aggregate value of all taxable supplies (excluding inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both, and inter-State supplies of persons having the same Permanent Account Number, to be computed on an all-India basis.

- Practicing Cost Accountant (CMA): A professional qualified to conduct audits, particularly cost audits, and also authorized to conduct GST audits in India.

- Practicing Chartered Accountant (CA): A professional qualified to conduct financial audits and also authorized to conduct GST audits in India.

- FORM GSTR-9C: An annual reconciliation statement certified by a practicing CMA or CA, submitted by taxpayers whose aggregate turnover exceeds the prescribed limit, reconciling their audited annual financial statement with their annual return (GSTR-9).

- Rule 56 of GST Act: Specifies the detailed requirements for accounts and records to be maintained by registered persons under the GST law.

- Inward Supply: Receipt of goods or services or both, whether by purchase, acquisition, or any other means, with or without consideration.

- Input Tax Credit (ITC): The credit of GST paid on the purchase of goods and services used for making taxable supplies.

- HSN Code (Harmonized System of Nomenclature): A globally recognized product and service classification system used in GST for identifying goods.

- SAC Code (Services Accounting Code): A classification system for services under GST, similar to HSN for goods.

- GSTIN (Goods and Services Tax Identification Number): A unique 15-digit identification number allotted to every registered person under GST.

- Reverse Charge: A mechanism where the recipient of goods or services is liable to pay GST instead of the supplier, typically for specific categories of supplies.

- Cash Ledger: An electronic ledger maintained on the GST portal reflecting the amount of tax, interest, penalty, etc., paid in cash by a taxpayer. Tax liability under reverse charge can only be paid through the cash ledger.

- Pro-rata Credit: Calculation of Input Tax Credit proportionally, especially when inputs or capital goods are used for both taxable and exempted supplies.

- Credit Note: A document issued by a supplier to a recipient to reduce the value of a taxable supply or tax charged on an invoice, usually due to returns, discounts, or overcharging.

- Debit Note: A document issued by a supplier to a recipient to increase the value of a taxable supply or tax charged on an invoice, usually due to undercharging or additional charges.

- Rule 37: A rule under GST that mandates the reversal of ITC if the payment to the supplier for inward supplies is not made within 180 days from the invoice date.

- Rule 39: A rule concerning the reduction in Input Service Distributor (ISD) credit upon receipt of a credit note from an ISD distributor.

- Rule 42: A rule specifying the reversal of ITC on input goods or services purchased when they are used for making exempted supplies or for non-business purposes.

- Rule 43: A rule specifying the reversal of ITC on capital goods when they are used for making exempted supplies or for non-business purposes.

- Blocked Credit (Section 17(5)): Specific categories of input tax credit that are not allowed to be availed by a registered person, such as those related to motor vehicles, food and beverages, life insurance, etc., with certain exceptions.

- CENVAT Balances: Input tax credit balances from the previous indirect tax regime (Central Value Added Tax) that were allowed to be carried forward into the GST regime using transitional forms (TRAN I, TRAN II).

- Outward Supply: Supply of goods or services or both, whether by sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made by a person in the course or furtherance of business.

- Bills of Supply: Documents issued instead of tax invoices by registered persons supplying exempted goods or services, or by those under the composition scheme.

- Delivery Challan: A document issued for the movement of goods in specific scenarios where a tax invoice is not immediately required, such as goods sent on job work, approval, or for testing.

- Semi Knocked Down (SKD) goods: Goods that are supplied in an unassembled or partially assembled state.

- Free of Cost (FOC): Goods supplied without any charge, typically as samples or gifts.

- Job Work: Any treatment or process undertaken by a person on goods belonging to another registered person.

- ITC-04: A quarterly statement to be furnished by the principal, detailing the goods sent to and received from a job worker.

- Related Parties: Individuals or entities deemed to be connected for GST valuation purposes, including common directors, partners, employer-employee relationships, significant shareholding, common control, or family members.

- Distinct Person: A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory, for the same Permanent Account Number.

- Valuation Rules (Rule 27 to 35 of GST Rule): Rules that prescribe the method for determining the value of supply for GST purposes, especially in specific scenarios like related party transactions or non-cash consideration.

- GSTR 3B: A monthly summary return filed by taxpayers, reporting summary details of outward supplies, inward supplies liable to reverse charge, and ITC availed and reversed.

- GSTR 1: A monthly/quarterly return filed by taxpayers detailing their outward supplies (sales).

- GSTR 2A: A read-only, auto-populated statement generated for the recipient of supplies, showing the details of inward supplies as uploaded by their suppliers in their GSTR 1. It helps in reconciling ITC claims.

- GSTR 9: An annual return to be filed by all registered taxpayers under GST.

The Goods and Services Tax (GST) in India, implemented as a major indirect tax reform, emphasizes transparent tax governance through its audit provisions. This document outlines the mandatory record-keeping requirements for registered persons under Section 35 of the CGST Act and Rule 56 of the GST Act, detailing various registers for inward and outward supplies, job work, goods on approval, stock, and related party transactions. A key focus is on the GST audit process, which is compulsory for taxpayers with an annual turnover exceeding INR 2 Crores. The audit, conducted by a Practicing Cost Accountant (CMA) or Chartered Accountant (CA), culminates in the submission of FORM GSTR-9C, a reconciliation statement that aligns audited annual accounts with GST annual returns (GSTR-9), identifies discrepancies, and recommends any additional tax liability.

Main Themes and Key Insights

- Mandatory Record Keeping and Audit Threshold:

- Legal Basis: “According to Section 35 of CGST Act, every registered person shall keep and maintain all records at his principal place of business.” If multiple places of business are registered, records for each must be maintained at that specific location.

- Audit Applicability: An annual audit is mandatory for “every registered person whose turnover during a financial year exceeds the prescribed limit (which is 2 Crores at present).”

- Auditor Requirement: The audit must be conducted “by a Practicing cost accountant (CMA) or a Practicing chartered accountant (CA)” and the results, along with a reconciliation statement, must be submitted in “FORM GSTR-9C.”

- Categories of Records to be Maintained:

- Activity-Specific Maintenance: Rule 56 mandates that “Accounts and Records shall be maintained separately for each activity namely manufacturing, trading and provision of services.”

- Detailed Registers: The source outlines comprehensive lists of registers required, categorized as:

- Inward Supply Records: Includes registers for raw material purchases, traded goods purchases, services received, consumables, credit/debit notes from vendors, and capital goods purchases. These records are crucial for input tax credit (ITC) management.

- Outward Supply Records: Includes registers for tax invoices, bills of supply (for exempted goods/services), credit/debit notes issued, receipt/refund vouchers, goods sent free of cost (FOC) as sample/gift, goods sent on approval, and related party/distinct person supplies. These reflect tax liability.

- Goods Sent on Job Work Records: Delivery challan details for sending/receiving, rejection/scrap records, capital goods sent for job work, and records of dies/moulds/jigs & fixtures.

- Stock Register Records: Highly important, differentiated for manufacturers (raw material consumption, finished goods production), service providers (input goods for service provision), and traders (traded goods). Crucially, “Input Tax Credit is not available in case of raw material or inputs lost, destroyed, written off or disposed and needs to be disclosed separately and accounted for.”

- Related Party/Distinct Person Transaction Record: Separate register ensuring valuation aligns with GST rules. “Persons shall be deemed to be distinct person if having multiple registration against same PAN number.”

- Record of Returns Filed: Encompasses GSTR 3B, GSTR 1, GSTR 2A, ITC 4, and GSTR 9.

- Key Audit Procedures and Verifications:

- Inward Supply Audit Focus:Verification of ITC eligibility/ineligibility.

- Checking reverse charge mechanism (RCM) applicability and payment via cash ledger.

- Matching inward supply registers with supplier invoices for GST compliance (e.g., GSTIN).

- Pro-rata credit for short receipts/rejections.

- Verification of ITC reversal based on specific rules (Rule 37 – non-payment to supplier within 180 days, Rule 39 – reduction in ISD credit, Rule 42 & 43 – inputs/capital goods for exempted/non-business purposes).

- Ensuring ITC is not availed on “blocked credit” items under Section 17(5) (e.g., cab services, food and beverages, life insurance).

- Checking CENVAT balances carried forward from the old regime (TRAN I/II) for correct ITC claims. “Expenses should preferably be booked under identifiable heads which enables easy distinction as to applicability of ITC.”

- Outward Supply Audit Focus:Correct classification using HSN/SAC codes and application of GST rates.

- Verification of invoicing procedures and correct type of GST charged based on place of supply.

- Review of exempted supplies, exports, and RCM applicable supplies.

- Valuation of related party/distinct person transactions as per rules (e.g., “cost of production + 10%”).

- Verification of delivery challan details (SKD goods, FOC goods, samples, gifts, branch transfers).

- Cross-verification of outward supplies with GSTR 1 and GSTR 3B to establish tax liability.

- Job Work & Goods on Approval Audit Focus:Verification of delivery challans and regular filing of ITC-04.

- Crucially, ensuring goods sent for job work have not exceeded stipulated return times (360 days for manufacturing inputs, 3 years for capital goods). If expired, calculate “liability of GST and interest payable on the same” from the dispatch date.

- For goods on approval, ensuring acceptance or return within one year (180 days for previous regime). Identify pending challans to determine “tax liability & interest,” with the current interest rate being “18% per annum i.e. 1.5 % per month.”

- Stock Register Audit Focus:Verification of comprehensive stock registers for each traded/manufactured good, including HSN code, UOM, quantity, GST Rate, and value.

- Separate maintenance and ITC reversal verification for goods “supplied free of cost (FOC) for Sample, Gift or lost / stolen / destroyed / written off.”

- Authenticity of disclosures for lost/stolen/destroyed goods.

- Related Party/Distinct Person Transaction Audit Focus:Verification of these transactions and compliance with GST valuation rules.

- Returns Filed Audit Focus:Verification of GST liability and ITC availed in GSTR 3B.

- Matching GSTR 1 (invoice-wise) with GSTR 3B (summary) and books of accounts.

- Verification of amendments, serial numbers, and reconciliation of ITC in GSTR 3B with books and GSTR 2A.

- Confirmation that “all liability under reverse charge is paid through cash ledger.”

- GSTR-9C: The Annual Audit Form:

- Structure: “GSTR-9C is an annual Audit form and it has two major parts, Part A for reconciliation and Part B for certification of Audit report.”

- Part A Components:Pt. I Basic details of the tax payers.

- Pt. II Reconciliation of Turnover: Compares turnover declared in Audited Annual Financial Statement with GSTR-9, requiring auditors to “report reason of un-reconciled balance, inconsistencies and deviations.”

- Pt. III Reconciliation of Tax Paid: Reconciles rate-wise liability and amount payable with GSTR-9, requiring reasons for discrepancies.

- Pt. IV Reconciliation of Input Tax Credit (ITC): Reconciles ITC availed as per audited Financial Statement (for multi-GSTIN units under same PAN) and GSTR-9, reporting “any deviation and exception with respect to applicable law.”

- Pt. V Auditor’s Recommendation on Additional Liability: The auditor must “quantify the amount of tax payable if any, with respect to deviation, exception and inconsistencies with the law.”

Conclusion

The GST audit framework in India, as detailed in this source, is rigorous and comprehensive. It places significant emphasis on meticulous record-keeping, item-wise and activity-wise segregation of data, and strict adherence to ITC rules, especially concerning eligibility and reversals. The GSTR-9C form serves as a critical reconciliation tool, ensuring transparency and compliance by requiring auditors to identify and explain any discrepancies between a taxpayer’s financial statements and their GST returns, ultimately aiming for a “strong and transparent tax governance system.” Taxpayers and auditors alike must fully understand these nuances to ensure proper compliance and avoid penalties.

I. Overview of GST Audit

A. Purpose and Scope

- What is GST Audit? A mechanism under Indian GST law for strong and transparent tax governance.

- Applicability: Required for taxpayers whose turnover during a financial year exceeds a prescribed limit (currently ₹2 Crores).

- Auditing Professionals: Must be conducted by a Practicing Cost Accountant (CMA) or a Practicing Chartered Accountant (CA).

- Submission: Audited annual accounts and a certified reconciliation statement (FORM GSTR-9C) must be submitted.

B. Legal Basis

- Section 35 of CGST Act: Mandates the maintenance of records at the principal place of business and specifies the audit requirement.

- Rule 56 of GST Act: Details the specific accounts and records to be maintained, requiring separate maintenance for manufacturing, trading, and provision of services.

II. Accounts and Records Maintenance

A. General Requirements

- Records must be maintained at the principal place of business.

- If multiple places of business are registered, records for each must be kept at the respective additional place.

- Separate records for manufacturing, trading, and services.

B. Inward Supply Records (Input Tax Credit)

- Raw Material Purchase Register: Item-wise, separate for imported/domestic, including item name, HSN code, GSTIN/supplier name, GST rate, taxable value, tax amount, and registered/unregistered dealer status.

- Traded Goods Purchase Register: Similar details as raw material, item-wise, imported/domestic.

- Register for Services Received: Separate for each service, imported/domestic, including nature of service, GSTIN/supplier name, GST rate, taxable value, tax amount, registered/unregistered dealer status, reverse charge applicability, and ITC claim status (3B).

- Register for Purchase of Consumables: Item-wise, imported/domestic, including item name, HSN code, GSTIN/supplier name, GST rate, taxable value, tax amount, registered/unregistered dealer status, and ITC claim status (3B).

- Register for Credit Notes and Debit Notes issued by vendors.

- Register for Purchase of Capital Goods.

C. Outward Supply Records (Tax Liability)

- Register of Tax Invoices: Serially issued for domestic and export supply, including HSN/SAC Code, item/service name, Invoice No. & date, GSTIN/recipient name, Place of supply, Type of supply, GST rate, taxable value, tax amount, reverse charge applicability, and tax liability payment status (3B).

- Register of Bills of Supply: For exempted goods/services, serially issued for domestic/export supply, including HSN/SAC Code, item/service name, Invoice No. & date, GSTIN/recipient name, Place of supply, Type of supply, Exemption status, and Total value.

- Register of Credit Notes and Debit Notes issued: Serially maintained with reference to original documents.

- Register of receipt and refund voucher: Serially issued and recorded.

- Register of goods sent free of cost (FOC) as sample or gift.

- Register of goods sent on approval basis on delivery challan.

- Register of related party/distinct person supplies.

D. Goods Sent on Job Work Records

- Delivery Challan Details for sending and receiving goods.

- Register of rejection/scrap at job worker’s end.

- Register of capital goods sent for Job Work.

- Register of Delivery Challan for sending and receiving capital goods.

- Register of Dies, Moulds, Jigs & Fixtures provided to Job worker.

- Register of rejection/scrap at job worker’s end.

E. Stock Register Records

- For Manufacturers:Periodical records of raw material consumption, consumables consumed, and production.

- Quantitative details with HSN code, GST Rate, and value.

- Stock Register Format for Raw Materials (Opening, Receipts, Consumption, Lost/Stolen/Destroyed/Written off/Disposed, Scrap/By-product/Wastage, Closing).

- Input tax credit not available for lost/destroyed/written off/disposed raw materials.

- Periodical records of input services received, showing proportionate value utilized for taxable, exempt, and FOC goods production.

- Finished Goods (production/purchase) stock register format (Opening, Manufactured, Lost/Stolen/Destroyed/Written Off/Disposed, FOC, Supplied, Closing).

- For Service Providers:Accounts showing details of services utilized and quantitative details of goods used in provision of services.

- Stock Register of input goods for provision of service (service-wise details: HSN code, GST Rate, Qty, Value; Opening, Purchase, Lost/Stolen/Destroyed, Service-wise consumption, Closing).

- No ITC available if input goods are lost, stolen, or destroyed.

- For Traders:Accounts details of each traded good (HSN Code, GST Rate, Qty, Value).

- Stock Register Format (Opening, Purchase, Lost/Stolen/Destroyed/Written Off, FOC, Sold, Closing).

- No ITC on purchase if goods are lost/stolen/destroyed/written off or supplied FOC.

F. Related Party/Distinct Person Transaction Record

- Separate register for these transactions.

- Ensure valuation methodology aligns with GST valuation rules (e.g., cost of production + 10% for related party supplies under Rule 30).

- Definition of Related Parties: Officer/director commonality, legal partners, employer/employee, 25%+ shareholding, direct/indirect control, common control/management, control over another entity, same family members.

- Definition of Distinct Person: Multiple registrations under the same PAN.

G. Record of Returns Filed

- Includes GSTR 3B, GSTR 1, GSTR 2A, ITC 4, GSTR 9.

III. Audit Procedures

A. Audit of Inward Supplies

- Verify inward supply register (item/service-wise) for ITC eligibility/ineligibility.

- Check for reverse charge applicability: verify if tax liability paid through cash ledger.

- Cross-verify register with purchase invoices (check GSTIN, GST Law compliance).

- Verify pro-rata credit for short receipt/partial rejection (ITC not available on rejected/destroyed/short received material).

- Verify credit notes received from vendors for ITC reversal.

- Verify ITC reversal for non-payment to supplier within 180 days (Rule 37) using aging reports.

- Verify ITC reversal as per Rule 39 (reduction in ISD credit).

- Verify ITC reversal as per Rule 42 (input goods/services for exempted supplies or non-business purposes).

- Verify ITC reversal as per Rule 43 (capital goods for exempted supplies or non-business purposes).

- Ensure ITC is not availed on supplies mentioned under Section 17(5) (blocked credit, e.g., cab services, food, life insurance).

- Check reversal of ITC on excess credit taken from old regime (TRAN I, TRAN II).

- Recommendation: Book expenses under identifiable heads (e.g., specific insurance types) for easy ITC eligibility verification.

B. Audit of Outward Supplies

- Verify correct classification (HSN/SAC Code) and applicable tax rate.

- Sort outward supplies by HSN/SAC code to ensure uniform GST rate application.

- Verify invoicing procedure and correct GST type charged based on place of supply.

- Review exempted goods/services, exports, reverse charge applicable supplies.

- Verify related party/distinct person transactions and their valuation as per Rule 27 to 35.

- Verify delivery challan details for SKD goods, FOC goods, samples, gifts, branch transfers.

- Verify non-returnable gate passes (testing, scrap, samples); check GST liability payment or ITC reversal.

- Cross-verify outward supplies with GSTR 1 and GSTR 3B to establish tax liability.

C. Audit of Goods Sent on Job Work

- Check delivery challans for goods sent.

- Verify regular filing of ITC-04.

- Ensure pending challans for inputs (manufacturing) do not exceed 360 days, and for capital goods, 3 years.

- If stipulated time expired (1 year for inputs, 3 years for capital goods), list pending challans (Qty, HSN code, taxable value) for GST liability and interest calculation (from delivery challan date).

D. Audit of Goods Sent on Approval Basis

- Verify supply on delivery challan.

- Ensure challans are not pending for more than one year (180 days if sent in previous regime).

- List pending challans for tax liability and interest calculation (18% p.a. or 1.5% per month from the day after tax was due).

E. Audit of Stock Register

- Verify maintenance of stock register for each traded good (HSN code, UOM, Qty, GST Rate, Value).

- Verify separate maintenance and ITC reversal for FOC, sample, gift, lost/stolen/destroyed/written off goods.

- Verify authenticity of disclosures for lost/stolen/destroyed/written off goods.

F. Audit of Related Party/Distinct Person Transactions

- Verify transactions according to valuation rules (e.g., cost of production + 10% for Rule 30).

G. Audit of Returns Filed

- Verify GST liability and ITC availed in GSTR 3B.

- Verify GSTR 1 (invoice-wise) matching with GSTR 3B (summary) and books of accounts.

- Verify all amendments in GSTR 1.

- Verify proper recording of Invoice Serial Documents Numbers and Challan Serial numbers in GSTR.

- Verify correct ITC claims in GSTR 3B, reconciliation with books and GSTR 2A, and absence of ineligible inputs.

- Verify all reverse charge liability paid through cash ledger.

IV. GSTR-9C: Annual Audit Form

A. Structure

- Part A: Reconciliation (5 basic parts).

- Part B: Certification of Audit report.

B. Part A Breakdown

- Pt. I Basic details of the tax payers.

- Pt. II Reconciliation of Turnover: Compare declared turnover in Audited Annual Financial Statement with Annual Return (GSTR9); report reasons for un-reconciled balance, inconsistencies, and deviations.

- Pt. III Reconciliation of tax paid: Reconcile rate-wise liability and amount payable with GSTR 9; report reasons for un-reconciled amounts.

- Pt. IV Reconciliation of Input Tax Credit (ITC): Reconcile ITC availed as per audited Annual Financial Statement (for multi-GSTIN units under same PAN) and GSTR 9; report deviations and exceptions.

- Pt. V Auditor’s recommendation on additional Liability: Quantify tax payable due to deviations, exceptions, and inconsistencies.

Quiz: GST Audit Fundamentals

Instructions: Answer each question in 2-3 sentences.

- What is the primary purpose of GST Audit as implemented in India, and to whom does it apply?

- According to Section 35 of the CGST Act, where must a registered person maintain their records, especially if they have multiple places of business?

- Name three specific registers or records that must be maintained as part of ‘Inward Supply Records’ under GST law.

- If a taxpayer manufactures both taxable and exempted goods, how should input tax credit on common input services or capital goods be handled during an audit?

- Under what conditions must an auditor verify the reversal of Input Tax Credit (ITC) if the supplier has not been paid?

- List two key pieces of information that should be included in a ‘Register of Tax Invoices’ for outward supplies.

- What is the stipulated time limit for goods sent on job work (inputs for manufacturing) to be returned, and what happens if this limit is exceeded?

- Define “related parties” in the context of GST records and audit, providing two examples of how entities can be considered related.

- When auditing stock registers for traders, what specific goods or scenarios require separate maintenance and verification of ITC reversal?

- What is the main objective of Part A, Point II of GSTR-9C, concerning reconciliation of turnover?

Quiz Answer Key

- The primary purpose of GST Audit is to establish a strong and transparent tax governance system in India. It applies to taxpayers whose turnover during a financial year exceeds a prescribed limit, currently ₹2 Crores.

- According to Section 35 of the CGST Act, every registered person must keep and maintain all records at their principal place of business. If there are multiple places specified in the registration certificate, accounts and records for each must be maintained at that additional place of business.

- Three specific registers to be maintained as part of Inward Supply Records are: Raw Material Purchase Register, Traded Goods Purchase Register, and Register for Services Received. Other valid answers include Register for Purchase of Consumables, Register for Credit Notes and Debit Notes issued by vendors, and Register for Purchase of Capital Goods.

- If a taxpayer manufactures both taxable and exempted goods using common input services or capital goods, the input tax credit on these should be applied on a pro-rata basis to individual products. This mechanism for pro-rata disallowance of Input Tax Credit is available under ITC rules.

- An auditor must verify the reversal of Input Tax Credit if the supplier has not been paid within 180 days from the invoice issue date, as per Rule 37. This compliance can be checked by verifying the aging report of vendors.

- Two key pieces of information for a Register of Tax Invoices are: HSN/SAC Code with item/service name of goods or services supplied, and Invoice No. and date. Other valid answers include GSTIN and name of recipient, Place of supply, Type of supply, applicable GST rate, taxable value and tax amount, status whether reverse charge is applicable, and status whether tax liability is paid though 3B or not.

- The stipulated time limit for inputs sent to a job worker for manufacturing is 1 year (360 days). If this time is exceeded, the auditor must list such pending challans for computation of GST liability and interest payable, calculated from the date the goods were initially sent.

- Persons are deemed to be related if they can influence each other’s transactions or operations. Examples include an officer/director of one business also being an officer/director of another, or if any person holds at least 25% of shares in another company directly or indirectly.

- When auditing stock registers for traders, specific goods like those supplied free of cost (FOC) for sample or gift, or those lost, stolen, destroyed, or written off, must be maintained separately. For these, the auditor must verify the reversal of Input Tax Credit on their purchase.

- The main objective of Part A, Point II of GSTR-9C is the reconciliation of turnover declared in the Audited Annual Financial Statement with the turnover declared in the Annual Return (GSTR9). The auditor must report any un-reconciled balances, inconsistencies, and deviations, along with the reasons for them.

Essay Format Questions

- Discuss the critical role of maintaining detailed and accurate ‘Stock Register Records’ for manufacturers, service providers, and traders under GST law. Explain how the audit procedures for each type of taxpayer differ concerning their stock registers and the implications of non-compliance (e.g., ITC reversal).

- Explain the concept of ‘Input Tax Credit (ITC) reversal’ under GST, detailing at least three distinct scenarios mentioned in the source material where ITC reversal is mandated. For each scenario, describe the auditor’s procedure to verify compliance.

- Analyze the significance of ‘Related Party/Distinct Person Transactions’ in GST audit. Define what constitutes related parties and distinct persons, outline the specific record-keeping requirements for such transactions, and elaborate on the valuation rules an auditor must verify.

- Compare and contrast the record-keeping and audit procedures for ‘Inward Supply Records’ versus ‘Outward Supply Records’. Highlight the specific details required in each set of records and explain how an auditor cross-verifies these records with GST returns (GSTR 1, GSTR 3B, GSTR 2A) to ensure compliance.

- Describe the structure and purpose of FORM GSTR-9C, the annual audit form under GST. Elaborate on the five basic parts of Part A (reconciliation) and the key responsibilities of the auditor in each section, particularly concerning the identification and quantification of additional tax liability.

Glossary of Key Terms

- GST Audit: A mandatory audit under India’s Goods and Services Tax (GST) law for taxpayers exceeding a prescribed turnover limit, conducted by a Practicing Cost Accountant or Chartered Accountant, aiming for transparent tax governance.

- CGST Act: Central Goods and Services Tax Act, 2017, one of the primary legislations governing GST in India, which mandates record keeping and audit requirements.

- Principal Place of Business: The primary location declared by a registered person where their main business activities are conducted and where principal GST records must be maintained.

- Turnover: The aggregate value of all taxable supplies (excluding inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both, and inter-State supplies of persons having the same Permanent Account Number, to be computed on an all-India basis.

- Practicing Cost Accountant (CMA): A professional qualified to conduct audits, particularly cost audits, and also authorized to conduct GST audits in India.

- Practicing Chartered Accountant (CA): A professional qualified to conduct financial audits and also authorized to conduct GST audits in India.

- FORM GSTR-9C: An annual reconciliation statement certified by a practicing CMA or CA, submitted by taxpayers whose aggregate turnover exceeds the prescribed limit, reconciling their audited annual financial statement with their annual return (GSTR-9).

- Rule 56 of GST Act: Specifies the detailed requirements for accounts and records to be maintained by registered persons under the GST law.

- Inward Supply: Receipt of goods or services or both, whether by purchase, acquisition, or any other means, with or without consideration.

- Input Tax Credit (ITC): The credit of GST paid on the purchase of goods and services used for making taxable supplies.

- HSN Code (Harmonized System of Nomenclature): A globally recognized product and service classification system used in GST for identifying goods.

- SAC Code (Services Accounting Code): A classification system for services under GST, similar to HSN for goods.

- GSTIN (Goods and Services Tax Identification Number): A unique 15-digit identification number allotted to every registered person under GST.

- Reverse Charge: A mechanism where the recipient of goods or services is liable to pay GST instead of the supplier, typically for specific categories of supplies.

- Cash Ledger: An electronic ledger maintained on the GST portal reflecting the amount of tax, interest, penalty, etc., paid in cash by a taxpayer. Tax liability under reverse charge can only be paid through the cash ledger.

- Pro-rata Credit: Calculation of Input Tax Credit proportionally, especially when inputs or capital goods are used for both taxable and exempted supplies.

- Credit Note: A document issued by a supplier to a recipient to reduce the value of a taxable supply or tax charged on an invoice, usually due to returns, discounts, or overcharging.

- Debit Note: A document issued by a supplier to a recipient to increase the value of a taxable supply or tax charged on an invoice, usually due to undercharging or additional charges.

- Rule 37: A rule under GST that mandates the reversal of ITC if the payment to the supplier for inward supplies is not made within 180 days from the invoice date.

- Rule 39: A rule concerning the reduction in Input Service Distributor (ISD) credit upon receipt of a credit note from an ISD distributor.

- Rule 42: A rule specifying the reversal of ITC on input goods or services purchased when they are used for making exempted supplies or for non-business purposes.

- Rule 43: A rule specifying the reversal of ITC on capital goods when they are used for making exempted supplies or for non-business purposes.

- Blocked Credit (Section 17(5)): Specific categories of input tax credit that are not allowed to be availed by a registered person, such as those related to motor vehicles, food and beverages, life insurance, etc., with certain exceptions.

- CENVAT Balances: Input tax credit balances from the previous indirect tax regime (Central Value Added Tax) that were allowed to be carried forward into the GST regime using transitional forms (TRAN I, TRAN II).

- Outward Supply: Supply of goods or services or both, whether by sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made by a person in the course or furtherance of business.

- Bills of Supply: Documents issued instead of tax invoices by registered persons supplying exempted goods or services, or by those under the composition scheme.

- Delivery Challan: A document issued for the movement of goods in specific scenarios where a tax invoice is not immediately required, such as goods sent on job work, approval, or for testing.

- Semi Knocked Down (SKD) goods: Goods that are supplied in an unassembled or partially assembled state.

- Free of Cost (FOC): Goods supplied without any charge, typically as samples or gifts.

- Job Work: Any treatment or process undertaken by a person on goods belonging to another registered person.

- ITC-04: A quarterly statement to be furnished by the principal, detailing the goods sent to and received from a job worker.

- Related Parties: Individuals or entities deemed to be connected for GST valuation purposes, including common directors, partners, employer-employee relationships, significant shareholding, common control, or family members.

- Distinct Person: A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory, for the same Permanent Account Number.

- Valuation Rules (Rule 27 to 35 of GST Rule): Rules that prescribe the method for determining the value of supply for GST purposes, especially in specific scenarios like related party transactions or non-cash consideration.

- GSTR 3B: A monthly summary return filed by taxpayers, reporting summary details of outward supplies, inward supplies liable to reverse charge, and ITC availed and reversed.

- GSTR 1: A monthly/quarterly return filed by taxpayers detailing their outward supplies (sales).

- GSTR 2A: A read-only, auto-populated statement generated for the recipient of supplies, showing the details of inward supplies as uploaded by their suppliers in their GSTR 1. It helps in reconciling ITC claims.

- GSTR 9: An annual return to be filed by all registered taxpayers under GST.