Depreciation:

Definition: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It represents the decrease in the value of an asset due to wear and tear, obsolescence, or other factors.

Purpose:

- Matching Principle:

- To match the cost of the asset with the revenue it generates over its useful life.

- Asset Valuation:

- To reflect the true economic value of the asset in the books of accounts.

Deductions under Section 80C to 80U

Accumulated Depreciation:

Definition: Accumulated Depreciation is the total depreciation charged on an asset from the time it was acquired until the current date. It is a contra-asset account that reduces the book value of the asset.

Purpose:

- Book Value Adjustment:

- To adjust the original cost of the asset in the books to reflect its reduced value.

- True Asset Value:

- To provide a more accurate representation of the remaining value of the asset.

1. Straight-Line Method:

- Description: The straight-line method allocates an equal amount of depreciation over the useful life of an asset.

- Formula:

- Depreciation per year = (Cost of Asset – Residual Value) / Useful life of the asset

- Depreciation per year = (Cost of Asset – Residual Value) / Useful life of the asset

- Example:

- Suppose a company purchases machinery for ₹1,00,000 with a useful life of 5 years and no residual value.

- Annual depreciation = (₹1,00,000 – ₹0) / 5 = ₹20,000.

2. Written Down Value (WDV) Method:

- Description: Also known as the diminishing balance method, it charges a fixed percentage of depreciation on the reducing value of the asset each year.

- Formula:

- Depreciation per year = Rate of Depreciation × Book Value

- Depreciation per year = Rate of Depreciation × Book Value

- Example:

- Consider the same machinery with a 20% depreciation rate.

- Year 1 depreciation = 20% × ₹1,00,000 = ₹20,000.

- Year 2 depreciation = 20% × (₹1,00,000 – ₹20,000) = ₹16,000.

3. Double-Declining Balance (DDB) Method:

- Description: An accelerated method that doubles the straight-line rate, resulting in higher depreciation in the early years.

- Formula:

- Depreciation per year = (2 × Straight-line rate) × Book Value

- Depreciation per year = (2 × Straight-line rate) × Book Value

- Example:

- Using the same machinery, if the straight-line rate is 20%:

- Year 1 depreciation = (2 × 20%) × ₹1,00,000 = ₹40,000.

- Year 2 depreciation = (2 × 20%) × (₹1,00,000 – ₹40,000) = ₹32,000.

4. Units of Production Method:

- Description: Depreciation is based on the actual usage or production of the asset.

- Formula:

- Depreciation per unit = (Cost of Asset – Residual Value) / Total expected units of production

- Total depreciation = Depreciation per unit × Actual units produced

- Example:

- A vehicle used for delivery has a cost of ₹50,000, a residual value of ₹5,000, and an expected production of 10,000 units.

- Depreciation per unit = (₹50,000 – ₹5,000) / 10,000 = ₹4 per unit.

- If 2,000 units are produced, total depreciation = ₹4 × 2,000 = ₹8,000.

Disclaimer: The examples provided are for illustrative purposes. Actual calculations may vary based on specific scenarios.

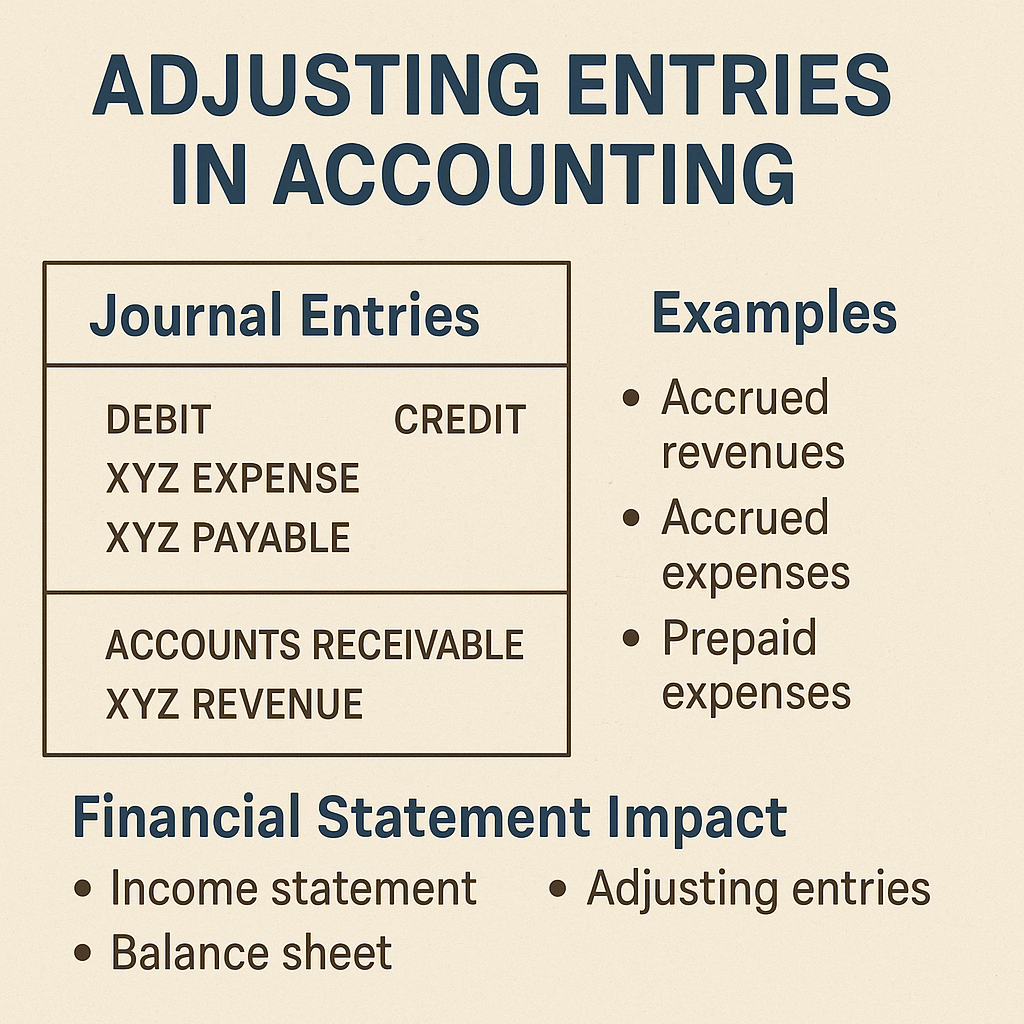

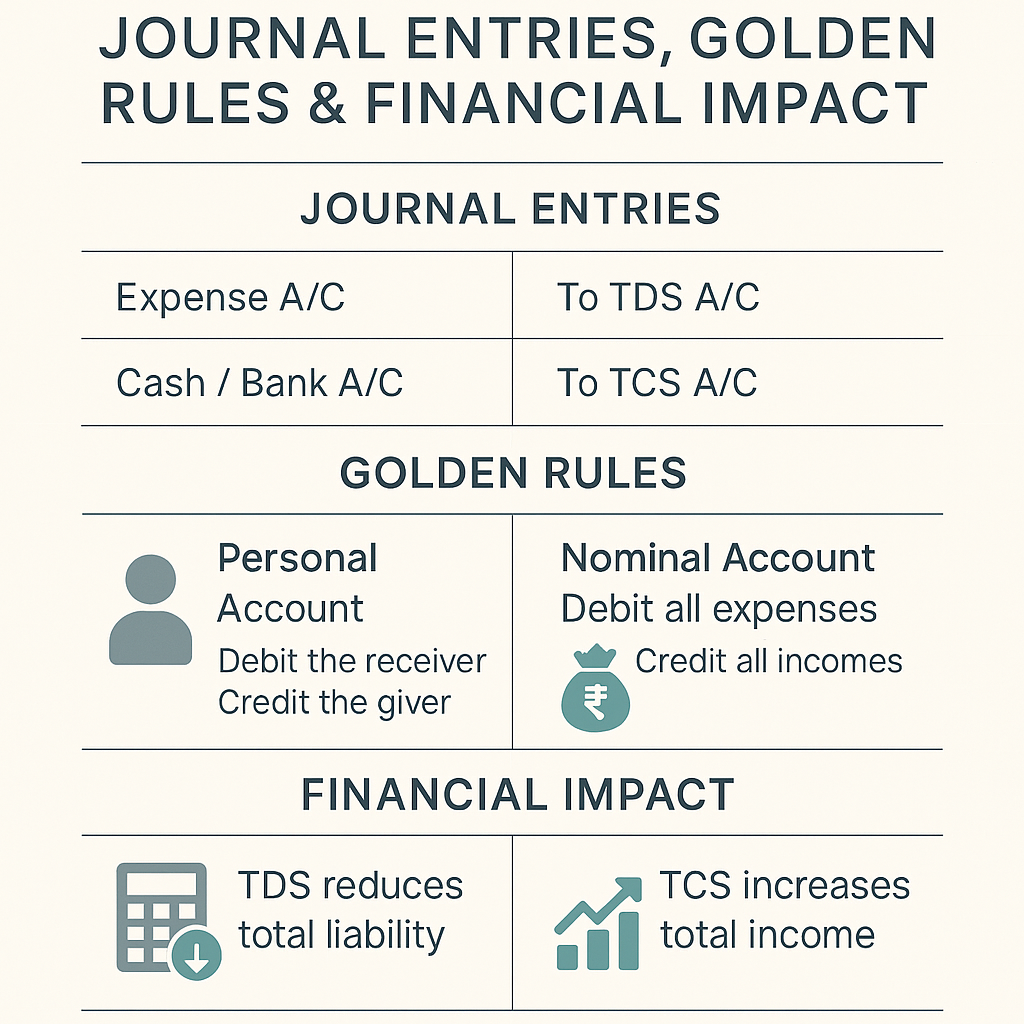

Journal Entry:

For Annual Depreciation:

- Debit: Depreciation Expense

- Credit: Accumulated Depreciation

Treatment in Books of Accounts:

- Balance Sheet:

- Accumulated Depreciation is deducted from the cost of the asset to show the net book value.

- Income Statement:

- Depreciation expense is recorded as an operating expense.

Capital Gain on Sale of Depreciable Assets

Rates of Depreciation

Important Case Laws:

- Associated Cement Companies Ltd. vs. CIT (1979):

- The Supreme Court emphasized the need for consistency in the method of depreciation.

- Emami Ltd. vs. CIT (2008):

- The Calcutta High Court clarified the treatment of abnormal loss in determining depreciation.

- CIT vs. Eicher Ltd. (1999):

- The Delhi High Court highlighted the importance of applying the correct depreciation rate.

- ACIT vs. Smt. P. D. Anitha (2019):

- The ITAT ruled on the treatment of leasehold improvements for depreciation.

- CIT vs. Tata Sons Ltd. (2006):

- The Bombay High Court discussed the concept of depreciation on goodwill.

- B. M. Malani vs. CIT (2014):

- The Gujarat High Court emphasized the need for consistency in the application of the diminishing balance method.

- A. C. K. Krishnaswami Chettiar vs. CIT (1969):

- The Madras High Court clarified the treatment of leased assets for depreciation.

- CIT vs. Parle Plastics Ltd. (1982):

- The Supreme Court discussed the concept of obsolescence as a valid ground for claiming depreciation.

- CIT vs. Kiran Kumar Jain (2013):

- The Karnataka High Court ruled on the treatment of goodwill for depreciation.

- DCIT vs. Bharat Bijlee Ltd. (2017):

- The ITAT discussed the treatment of capital work-in-progress for depreciation.

Conclusion:

Understanding depreciation and accumulated depreciation is crucial for accurate financial reporting. It ensures that the book value of assets reflects their true economic value. Compliance with the applicable methods and rates, along with consistency in treatment, is essential for financial transparency and regulatory compliance. Seeking professional advice can be beneficial for navigating the complexities of depreciation accounting.

Related Blogs: Capital Gain on Sale of Depreciable Assets