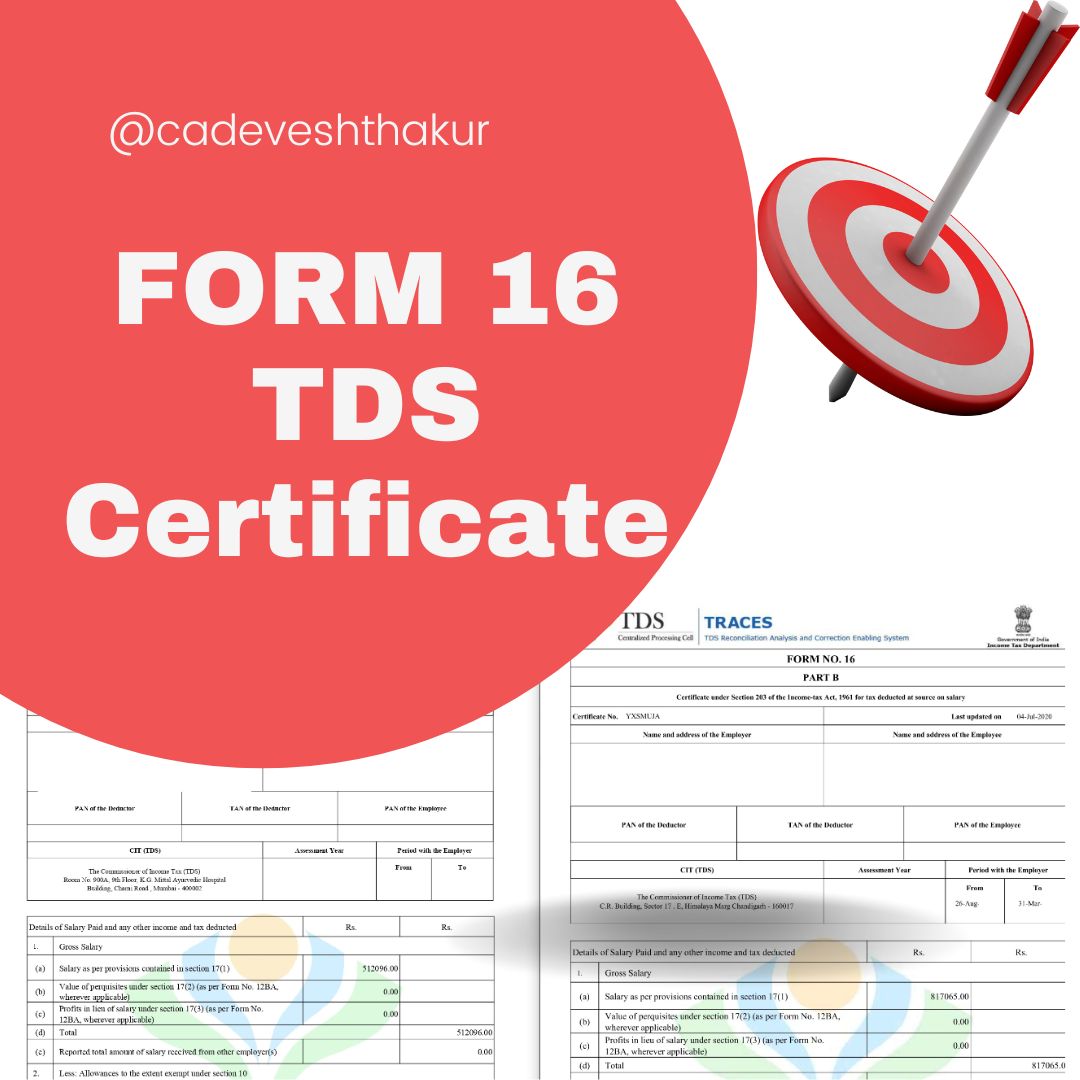

Demystifying Form 16: Your Complete Guide to Understanding the Backbone of Salary Taxation

| Form 16 |

|---|

| Description: Certificate under Section 203 of the Income Tax Act, 1961, for tax deducted at source (TDS) on salary income. |

| When to Issue: Annually, by May 31 of the following financial year. |

| To Whom to Issue: Salaried Employees. |

| Issuer: Employer. |

| Conditions for Issuance: Tax deducted at source must be deducted on salary income. |

| Implication: Provides details of TDS deducted and deposited by the employer on behalf of the employee. Used for filing income tax returns. |

| Importance: Crucial for filing income tax returns for salaried individuals. |

| Scope: Limited to salary income. |

| Other Relevant Details: Contains details of employee’s PAN, employer’s TAN, details of salary breakup, tax deducted, deposited, etc. |

Benefits of Home Loans in India

Now, let’s break down Form 16 into its components – Part A and Part B:

Part A of Form 16:

| Part A |

|---|

| Description: Contains details of tax deducted and deposited by the employer, along with other relevant details. |

| Key Components: |

| – Employer’s and employee’s details |

| – PAN and TAN details of both employer and employee |

| – Summary of tax deducted and deposited by the employer |

| – Assessment Year (AY) |

| – Period of employment with the employer |

| – Challan details |

| Illustration: |

| Let’s consider an example where an employee, Mr. X, has an annual salary of ₹6,00,000. Assuming a TDS deduction of ₹60,000 by the employer, Part A of Form 16 would include details of this TDS deduction along with other relevant information. |

| Important Case Laws: |

| – CIT vs. Vegetable Products Ltd (1973): This case established that Form 16 is prima facie evidence of the tax deducted by the employer and deposited with the government, shifting the burden of proof to the tax department. |

| – CIT vs. Larsen & Toubro Ltd (2004): In this case, it was ruled that Form 16 constitutes conclusive evidence of the tax deducted at source, providing relief to taxpayers. |

Part B of Form 16:

| Part B |

|---|

| Description: Provides a detailed breakup of salary, allowances, deductions under various sections, and tax computation. |

| Key Components: |

| – Detailed breakup of salary components such as basic salary, HRA, LTA, etc. |

| – Allowances exempt under Section 10 |

| – Deductions under various sections such as Section 80C, 80D, etc. |

| – Taxable income and tax computation |

| Illustration: |

| Continuing with the example, Part B of Form 16 for Mr. X would include a detailed breakup of his salary components, exemptions, deductions, and the computation of taxable income and tax liability. |

| Important Case Laws: |

| – CIT vs. Larsen & Toubro Ltd (2008): In this case, it was emphasized that Part B of Form 16 is essential for employees to compute their taxable income and file accurate income tax returns. |

Understanding the components of Form 16, including Part A and Part B, along with their implications and importance, is crucial for both employers and employees to ensure compliance with tax laws and regulations.