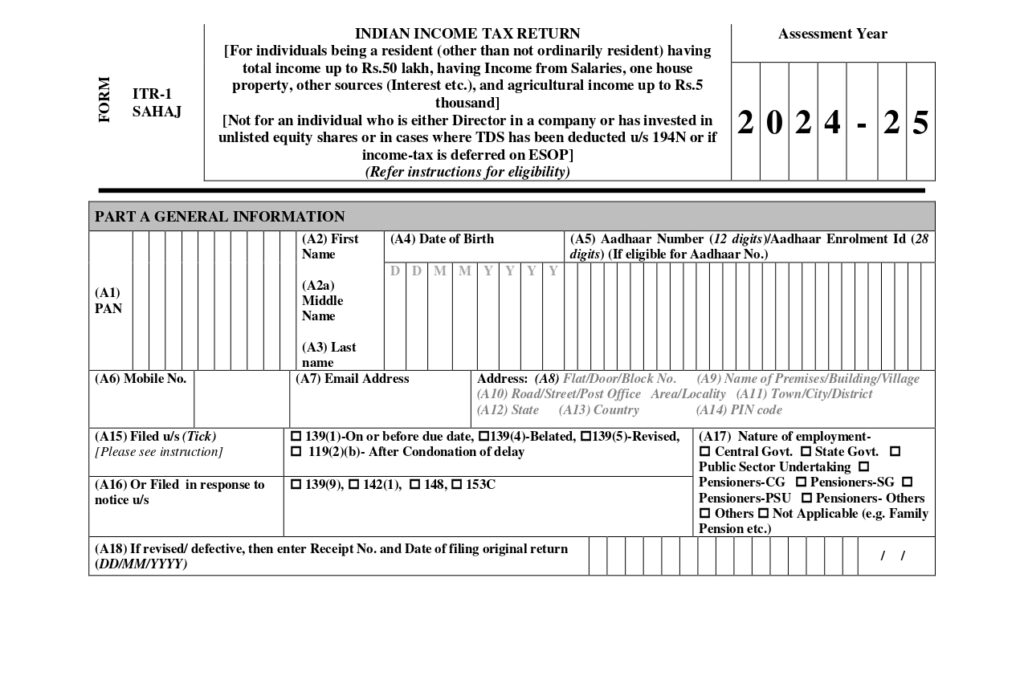

ITR-1 AY 2024-25: Eligibility, Ineligibility, and Required Details

Eligibility to File ITR-1 Sahaj AY 2024-25:

ITR-1 Sahaj is a simplified Income Tax Return form primarily meant for individual taxpayers with straightforward income sources. For the Assessment Year 2024-25 (AY 2024-25), individuals meeting the following criteria are eligible to file ITR-1 Sahaj:

(a) Resident Individuals (Other than Not Ordinarily Resident): The taxpayer should be a resident of India during the relevant financial year.

(b) Total Income Up to Rs. 50 Lakh: The total income of the individual should not exceed Rs. 50 lakh.

Income Sources:

Income from One House Property

Income from Other Sources (e.g., Interest Income)

Agricultural Income up to Rs. 5,000

Ineligibility to File ITR-1 Sahaj AY 2024-25:

Individuals falling under the following categories are not eligible to file ITR-1 Sahaj for AY 2024-25:

Total Income Exceeds Rs. 50 Lakh:

Individuals with total income exceeding Rs. 50 lakh cannot use ITR-1 Sahaj.

- Director in a Company:

Individuals who are directors in a company during the financial year.

- Invested in Unlisted Equity Shares:

Those who have invested in unlisted equity shares.

- TDS Deducted u/s 194N:

Individuals for whom tax has been deducted at source (TDS) under section 194N.

- Deferred Income Tax on ESOP:

Individuals for whom income tax is deferred on Employee Stock Ownership Plan (ESOP).

Details Required to File ITR-1 Sahaj AY 2024-25:

ITR-1 Sahaj for AY 2024-25 is divided into several parts. Here are the key details required in each part:

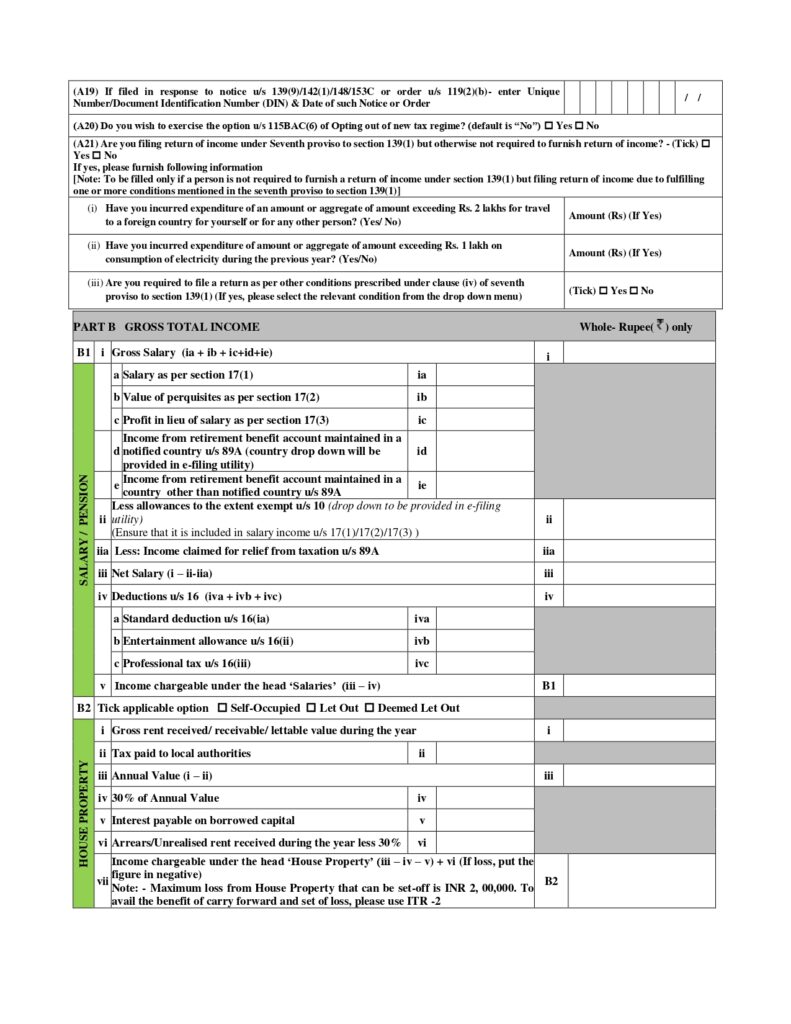

Part A – General Information:

- PAN

- Name (First, Middle, Last)

- Date of Birth

- Aadhaar Number (if eligible)

- Contact Details (Mobile No., Email)

- Address Details

- Filing Status (Original, Revised, Belated, etc.)

- Nature of Employment

How to read Notice under section 139(9), 142(1), 148, 153C

ITR Filing Sections 139(1), 139(4), 139(5), and 119(2)(b)

Part B – Gross Total Income:

- Gross Salary Details

- House Property Details (Self-Occupied, Let Out, Deemed Let Out)

- Income from Other Sources (Interest, etc.)

- Deductions under Section 16

- Gross Total Income Calculation

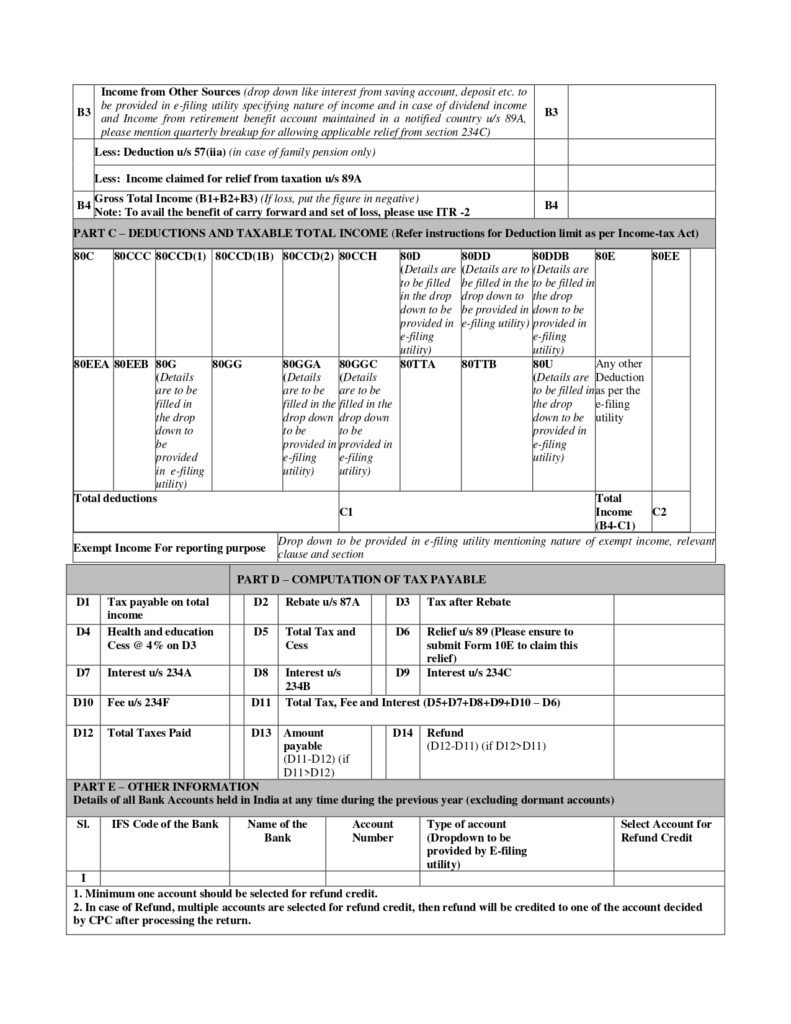

Part C – Deductions and Taxable Total Income:

Deductions under Section 80C to 80U

- Calculation of Taxable Total Income

Benefits of Home Loans in India

Part D – Computation of Tax Payable:

- Tax Calculation

- Rebates under Sections 87A

- Relief under Sections 89

- Health and Education Cess

- Total Tax and Cess Calculation

Explanation of Sections 234A, 234B, and 234C

Explanation of Sections 234F and 234E

Part E – Other Information:

- Details of Bank Accounts

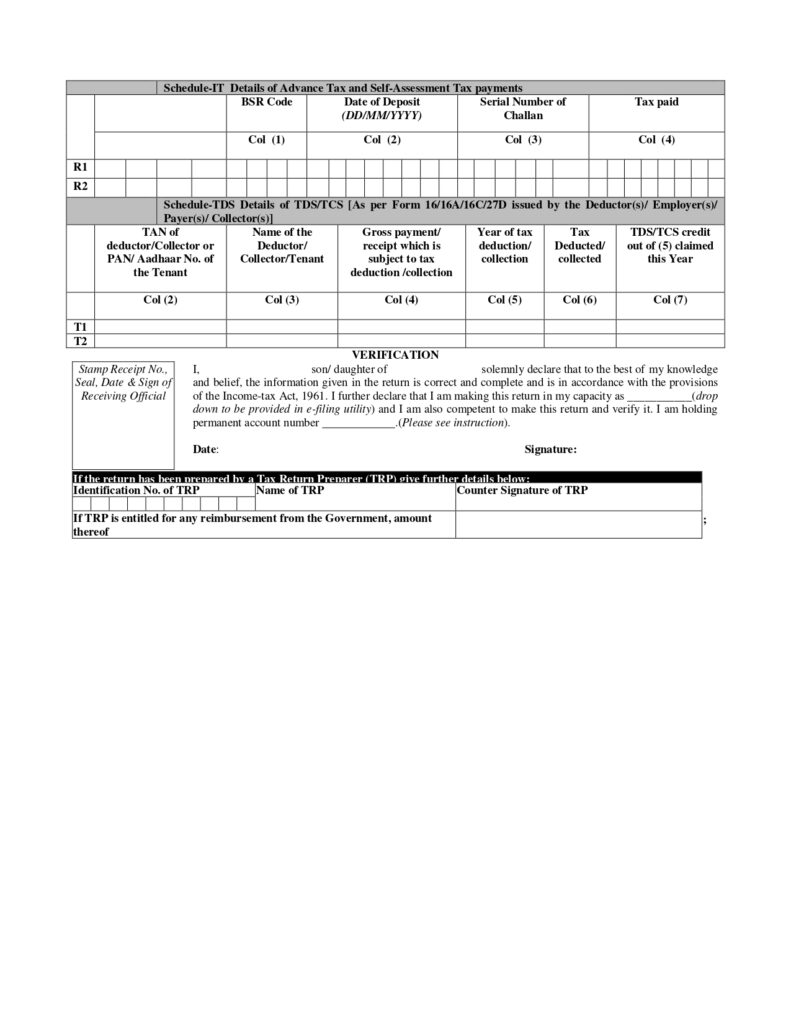

- Schedule-IT (Advance Tax and Self-Assessment Tax)

- Schedule-TDS (Details of TDS/TCS)

- Verification

Verification:

- Declaration of Correctness

- Verification by the taxpayer

Additional Considerations:

- Option under Section 115BAC(6) – Opting out of the new tax regime

- Seventh proviso to section 139(1) – Details for those not required but filing under this proviso

- TRP Details (if applicable)

Linking Aadhaar on the Income Tax Website

Conclusion:

Filing ITR-1 Sahaj for AY 2024-25 requires careful consideration of eligibility criteria, inclusion/exclusion factors, and accurate reporting of income and deductions. Taxpayers should ensure they have all the necessary documents and details to facilitate a smooth filing process. Consulting with a tax professional can also provide valuable guidance for accurate filing and adherence to income tax regulations.